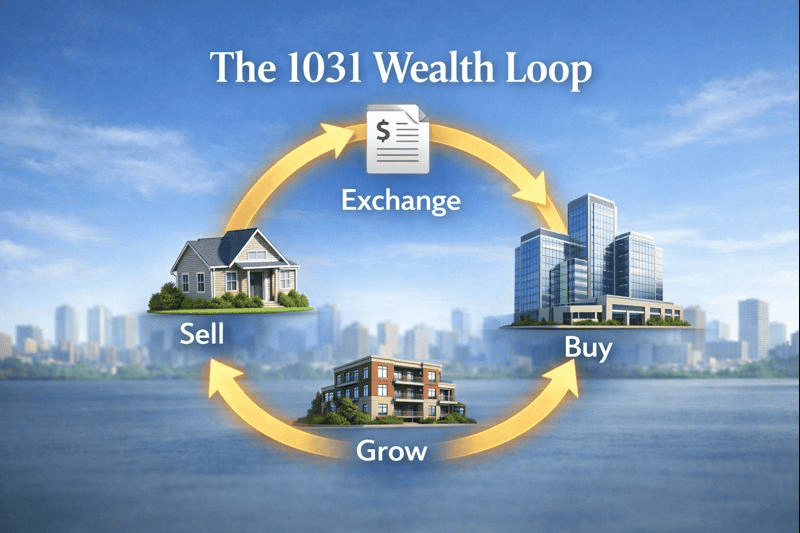

Real estate gives investors many ways to grow wealth. One of the most powerful tools is the 1031 exchange.

A 1031 exchange allows investors to sell a property and buy another one without paying capital gains tax right away. Instead of sending money to the IRS, investors keep that money working inside new properties.

This tool has helped investors build wealth for decades. It is part of the U.S. tax code and is used by individual investors, families, and large institutions.

What a 1031 Exchange Is

A 1031 exchange comes from Section 1031 of the Internal Revenue Code. It allows an investor to swap one investment property for another investment property.

The key benefit is tax deferral. When a property is sold, capital gains tax and depreciation recapture are normally due.

With a 1031 exchange, those taxes are delayed as long as the money is reinvested into a new property that meets the rules.

This means more capital stays invested and has the chance to grow.

Why Investors Use 1031 Exchanges

The main reason is simple. Taxes are a drain on net worth and slow growth.

When investors pay taxes at every sale, less money is available for the next investment. Over time, this reduces compounding.

A 1031 exchange helps investors:

- Keep more capital invested

- Buy larger or better properties

- Improve cash flow

- Diversify into new markets

- Move from active to passive ownership

- Build wealth faster over time

The IRS allows this because real estate investment supports economic activity, jobs, housing, and development.

The Five Rules That Decide Whether a 1031 Exchange Works or Fails

1031 exchanges have clear rules. Missing one rule can cancel the exchange.

Here are the main ones investors should understand.

1. Investment property only

Both the old property and the new property must be held for investment or business use. Personal homes do not qualify.

2. Like kind property

In real estate, like-kind is broad. Most investment real estate can be exchanged for other investment real estate.

3. Time limits matter

After selling the property:

- You have 45 days to identify replacement properties

- You have 180 days to close on one or more of them

These deadlines are strict.

4. A qualified intermediary is required

The investor cannot touch the sale proceeds. A third party, called a qualified intermediary, holds the funds during the exchange. This arrangement should be set up prior to the sale to ensure everything is structured correctly from the start. Engaging a qualified intermediary before the transaction allows the exchange to proceed smoothly and ensures compliance with IRS rules, protecting the tax-deferral benefits.

5. Value rules apply

To fully defer taxes, the new property should be equal to or greater in value and debt than the one sold.

A Simple Walkthrough of a 1031 Exchange in Action

Imagine an investor owns a small apartment building worth $1 million. The investor sells it and would normally owe capital gains tax and depreciation recapture.

Instead of paying those taxes, the investor uses a 1031 exchange.

The investor buys a new property. All the sale proceeds go into the new deal.

The result:

- No immediate capital gains tax

- More money stays invested

- Cash flow may increase

- The portfolio grows

This same process can repeat again and again.

How 1031 Exchanges Help Over Time

The real power of a 1031 exchange shows up over many years.

Each time an investor sells and exchanges:

- Capital grows instead of shrinking

- Properties can improve in quality

- Income can rise

- Risk can be adjusted

- Management effort can be reduced

Many investors start with small properties and use 1031 exchanges to move into larger assets over time.

Others use exchanges to shift from hands-on management to passive investments.

Using 1031 Exchanges with Passive Investing

Some investors use 1031 exchanges to move from active ownership into passive structures.

Common paths include:

- Trading a rental property for a larger property managed by a team

- Exchanging into multiple properties for diversification

- Using Delaware Statutory Trusts that qualify under 1031 rules

These options allow investors to keep tax deferral while reducing daily involvement.

Each option has different risk, income, and timeline profiles. Investors should review them carefully.

What 1031 Exchanges Do Not Do

A 1031 exchange does not remove taxes forever. It defers them.

Taxes may be due later if the property is sold without another exchange.

However, many investors continue exchanging throughout their lifetime. Heirs receive a step-up in basis under current law, which removes deferred taxes.

Tax laws can change. This is why investors plan carefully with professionals.

Common Mistakes Investors Make

Some mistakes can be costly:

- Missing the 45-day or 180-day deadline

- Touching the sale proceeds

- Buying property that does not qualify

- Not replacing enough value or debt

- Waiting too long to plan the exchange

Most problems happen because planning started after the sale. The best exchanges are planned before the property is listed.

Keeping Capital Compounding Instead of Paying It Away

A 1031 exchange is one of the strongest tools real estate investors can use to keep money working. It allows investors to sell one property and move into another without paying capital gains tax right away.

By deferring taxes, investors keep more capital invested, grow portfolios faster, and increase long-term income. Used correctly, 1031 exchanges help turn one property into many over time.

Real estate rewards patience and planning. A 1031 exchange is one way investors keep momentum on their side.

Since Trump brought back 100% bonus depreciation, this can be used in conjunction with Cost Segregation studies on newly purchased properties to offset capital gains and depreciation recapture if a new property with an appropriate amount of depreciation is purchased in the same calendar year. This can be done without a 1031 exchange.

Want to Explore 1031-Eligible Investment Opportunities?

Many passive real estate investments can accept 1031 exchange capital, including professionally managed properties and structured offerings designed for investors who want to reduce day-to-day involvement while keeping tax deferral in place.

If you would like to learn more about investment opportunities that may accept 1031 exchanges, or how this strategy could fit into your long-term plan, you can schedule a call with our team.

👉 Schedule a call with Timberview Capital to learn more

https://timberviewcapital.com/schedule/

Planning matters. The earlier a 1031 exchange is considered, the more options investors typically have.