About Timberview Capital

“It is in the moments of decision that your destiny is shaped.”

– Tony Robbins

The 3 Pillars Of Timberview

Working Together

We believe that investing is not just about transactions, but about building relationships, trust, and mutual success. We are personally invested in the deals that we bring to our network – our approach is grounded in personalized attention and deep expertise.

Due Diligence

Many real estate investment groups raise money for their internal team, and are beholden to their decisions Timberview is different. We cherry-pick unique opportunities based on the very best teams, with the very best properties, in the very best geographic regions that we can find in today’s market.

Giving Back

In addition to helping colleagues find financial freedom, we have also found purpose by partnering with charitable organizations. Our philanthropic activities are not just a one-time or sporadic effort, but an ongoing commitment to making a lasting difference in the lives of the less fortunate.

About Us

Dr. Tyson Cobb, MD

Founder

I’m Dr. Tyson Cobb, a semi-retired orthopedic surgeon who spent over 20 years in a demanding medical career—helping patients, innovating in surgery, and juggling a fast-paced lifestyle. Despite the success, I felt the weight of long hours, high stress, and an uncertain financial future.

What started as a side investment turned into a life-changing pivot. The volatility of the markets pushed me to explore commercial real estate, and that’s where I found real momentum.

-

Triple-net leases gave my net worth a noticeable boost.

-

Real estate syndications transformed everything—allowing me to invest passively in larger, professionally managed deals.

-

I discovered powerful tax advantages and the ability to build wealth without sacrificing time.

In 2019, I left my surgical group after two decades—not to retire, but to design a more balanced life, where I could still give back, protect my family’s legacy, and grow financial freedom on my terms.

Achieving Financial Freedom and Legacy Wealth

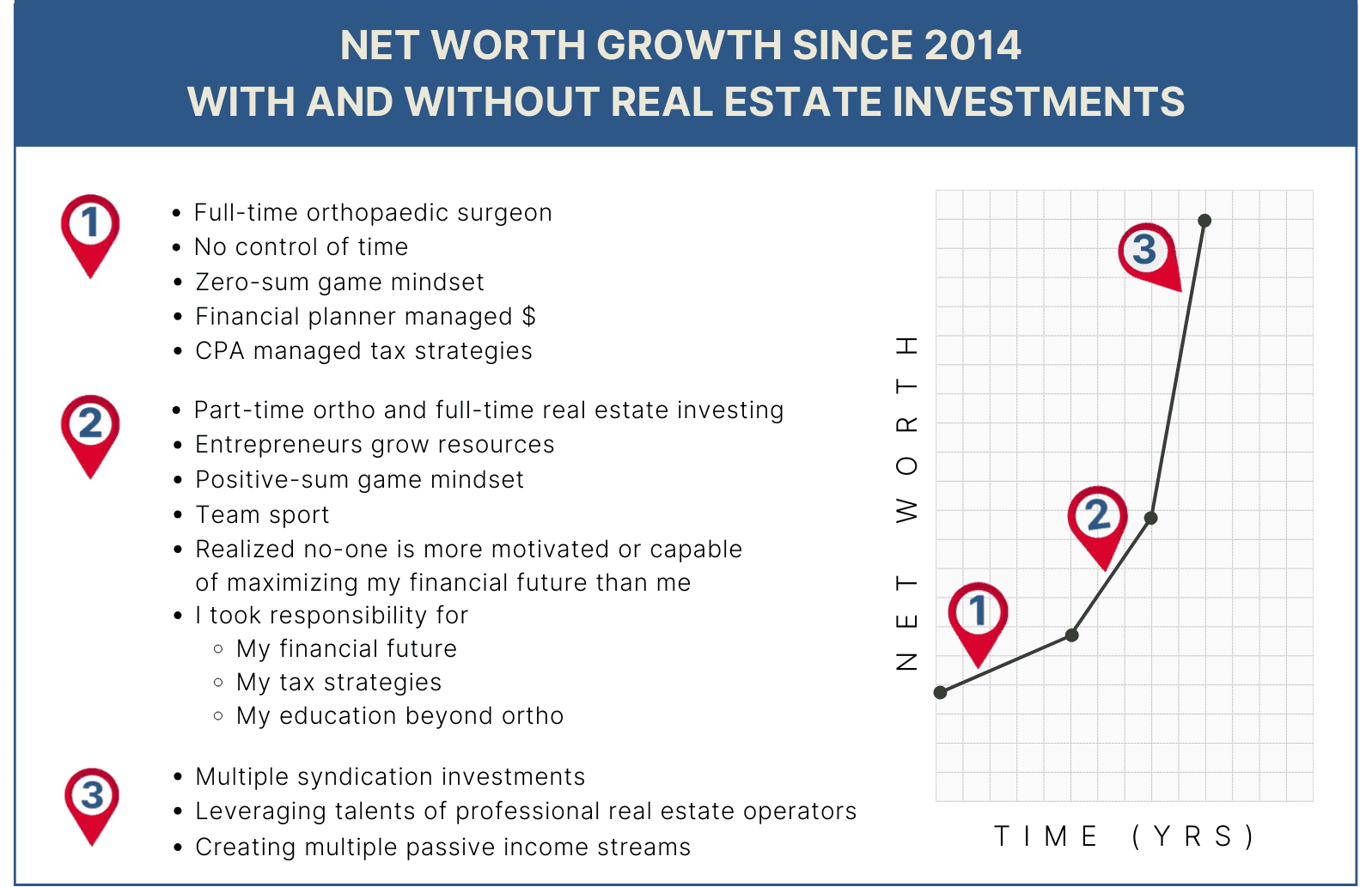

This graph shows my financial trajectory starting from 2014.

Phase 1: During this time, I was working full-time as an orthopedic surgeon, investing mainly in the stock market with a little real estate on the side. The growth was slow and steady, but not enough to achieve my bigger goals.

Phase 2: As I reduced my surgical hours and began focusing more on real estate, specifically in triple-net lease properties, the slope began to increase. Real estate started to play a larger role in my portfolio.

Phase 3: When I went all-in on real estate syndications and diversified into larger deals with stronger fundamentals, my net worth increased exponentially. This final steep rise represents the shift from active income as a surgeon to passive income as a real estate investor.

This progression underscores one of the most critical lessons I’ve learned: working harder doesn’t always mean growing faster. Smart, strategic investments and tax-efficient strategies have a much more profound impact.

Lessons Learned Along the Way

Stepping away from medicine was hard. Entering real estate and other alternative investments was humbling. But I quickly learned:

- You don’t need to do it alone.

- Collaboration with experts leads to better outcomes.

- Real estate and other alternative investments isn’t just about cash flow—it’s about freedom, impact, and legacy.

Today, through Timberview Capital, I help other professionals build passive income, reduce taxes, and unlock true financial independence—without the headaches of managing real estate on their own.

Tracy Rommel

Director of Investor Relations

Building strong relationships has always been important to me. During my 17-year career at the bank, I had the privilege of working with Tyson as my private banking client for 15 of those years. I watched him transition from his group to being semi-retired and start his journey in investing. As the Timberview Capital’s investor community grew, he asked me to come take care of his investors as I have taken care of him for the past 15 years.

In June 2024, I made the exciting move to Timberview Capital, and I couldn’t be happier! I have met wonderful people and love helping them discover new ways to make their money work for them. Every individual has unique goals and is at a different stage in their career. My role is to serve as a resource for both current and potential investors. I’m here to share information about our services, answer any questions you may have, and guide you through the process.

Please feel free to call or text my cell phone number at any time. I look forward to the opportunity of working with you!

Purpose, Passion, and Giving Back

In addition to helping colleagues find financial freedom, Dr. Cobb has also found purpose in his life by financially supporting charitable organizations that support those who are less fortunate.

He serves on the boards of Wildwood Hills Ranch of Iowa and Camp Shalom. Wildwood Hills Ranch is a Christian organization which serves children at risk. They exist to transform lives and strengthen communities by providing healing, hope and God’s unconditional love to children and youth at risk. Camp Shalom is a Christian organization that provides children an environment for spiritual growth.

He also financially supports these organizations:

- A21– Against human trafficking

- Joyce Meyer Ministries – Devoted to sharing Christ

- Food for the Hungry – Fights to end poverty and hunger

- Veterans Community Project – Dedicated to ending Veteran homelessness

- Wounded Warrior Project – helps warriors recover and transition back into civilian life after serving their country

- Gideons International – Spreads the Gospel locally and globally (known for placing Bibles in hotel rooms)

- KLOVE – Christian radio network

Wildwood Hills Ranch

Wildwood Hills Ranch of Iowa is dedicated to providing at-risk youth with resources and opportunities to guide them towards a brighter future. Wildwood makes a 10-year commitment to the children in their program at no cost to their families, which includes programming such as equestrian therapy, leadership development, and more. We exist to transform lives and strengthen communities by providing healing, hope and God’s unconditional love to children and youth at-risk. Wildwood is funded solely by donations, and we are proud to play a role in their incredible work.

Tyson Cobb is a board member of Wildwood Hills Ranch.

If you feel led to help and become part of the solution, please reach out to one of the above charities (or others) and make a positive impact on someone less fortunate than yourself.

4096 Treeline Dr., Bettendorf, Iowa 52722

The testimonials, statements, and opinions presented are applicable to the individuals listed. Results will vary and may not be representative of the experience of others. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services, or any benefits in exchange for said statements. The testimonials are representative of client experience, but the exact results and experience will be unique and individual to each client. All offers and sales of any securities will be made only to Accredited Investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds or hold certain SEC approved certifications. Any securities that are offered, are offered in reliance on certain exemptions from the registration requirements of the Securities Act of 1933 (primarily Rule 506C of Regulation D and/or Section 4(a)(2) of the Act) and are not required to comply with specific disclosure requirements that apply to registrations under the Act. The SEC has not passed upon the merits of, or given its approval to any securities offered by Timberview Capital LLC, the terms of the offering, or the accuracy of completeness of any offering materials. Any securities that are offered by Timberview Capital LLC are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell any securities offered by Timberview Capital LLC. Investing in securities involves risk, and investors should be able to bear the loss of their investment. Any securities offered by Timberview Capital LLC are not subject to the protections of the Investment Company Act. Any performance data shared by Timberview Capital LLC represents past performance and past performance does not guarantee future results. Neither Timberview Capital LLC nor any of its funds are required by law to follow any standard methodology when calculating and representing performance data and the performance of any such funds may not be directly comparable to the performance of other private or registered funds.

![1[1]](https://timberviewcapital.com/wp-content/uploads/2025/06/11-3.png)

![2[1]](https://timberviewcapital.com/wp-content/uploads/2025/06/21-1.png)