Current Offerings

“Life begins at the end of your comfort zone.”

– Neale Donald Walsch

Marina Fund Investment

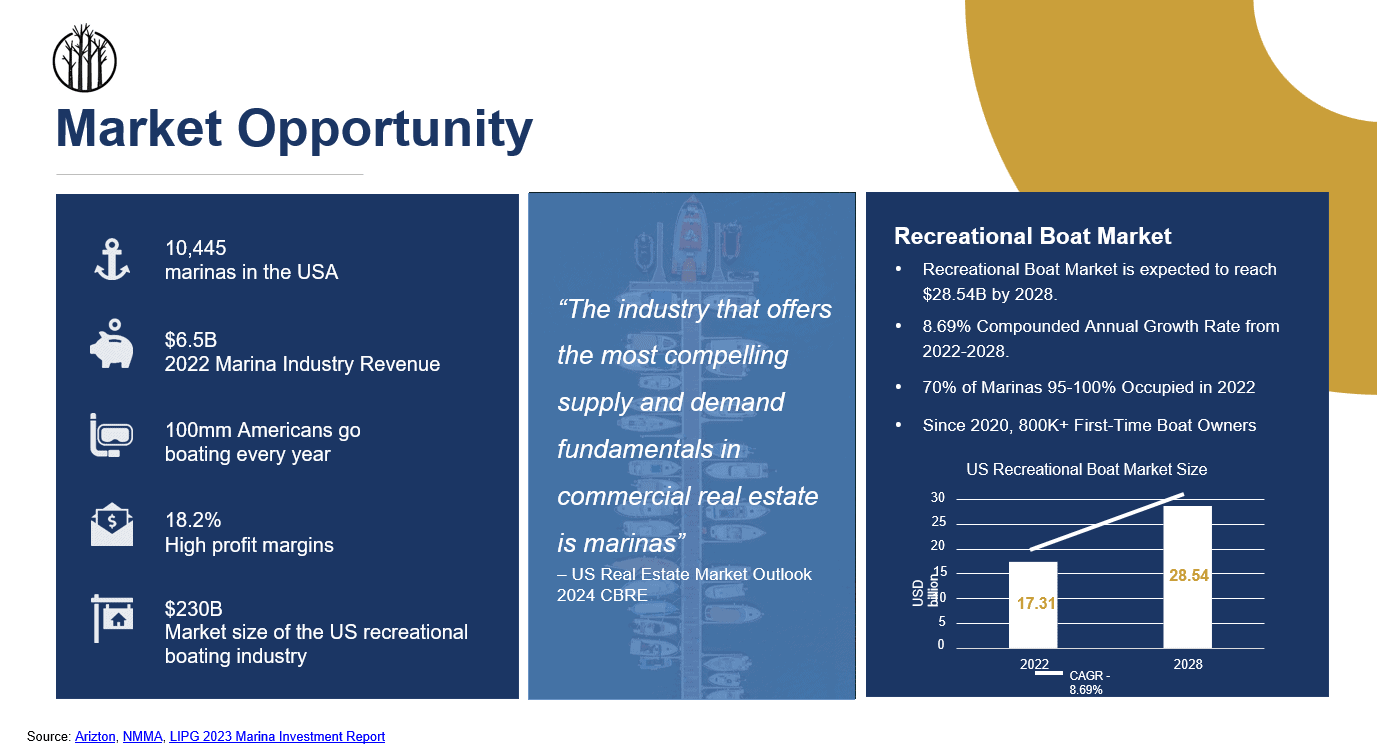

Timberview Capital is excited to present the Marina Fund Investment, a private real estate offering targeting the acquisition of cash-flowing, value-add marina properties across the U.S. This fund aims to capitalize on the growing recreational boating industry by investing in high-occupancy marinas with multiple income streams, including boat slips, fuel docks, ship stores, and short-term rentals.

9% Preferred Return

25% Target IRR

2.75x Equity Multiple

5 Years Hold Time

$50,000 Minimum Investment

Key Highlights:

-

Experienced Sponsor Team: Our partner boasts over 50 years of combined experience and more than $300 million in successfully managed investments across real estate, private equity, and oil & gas.

-

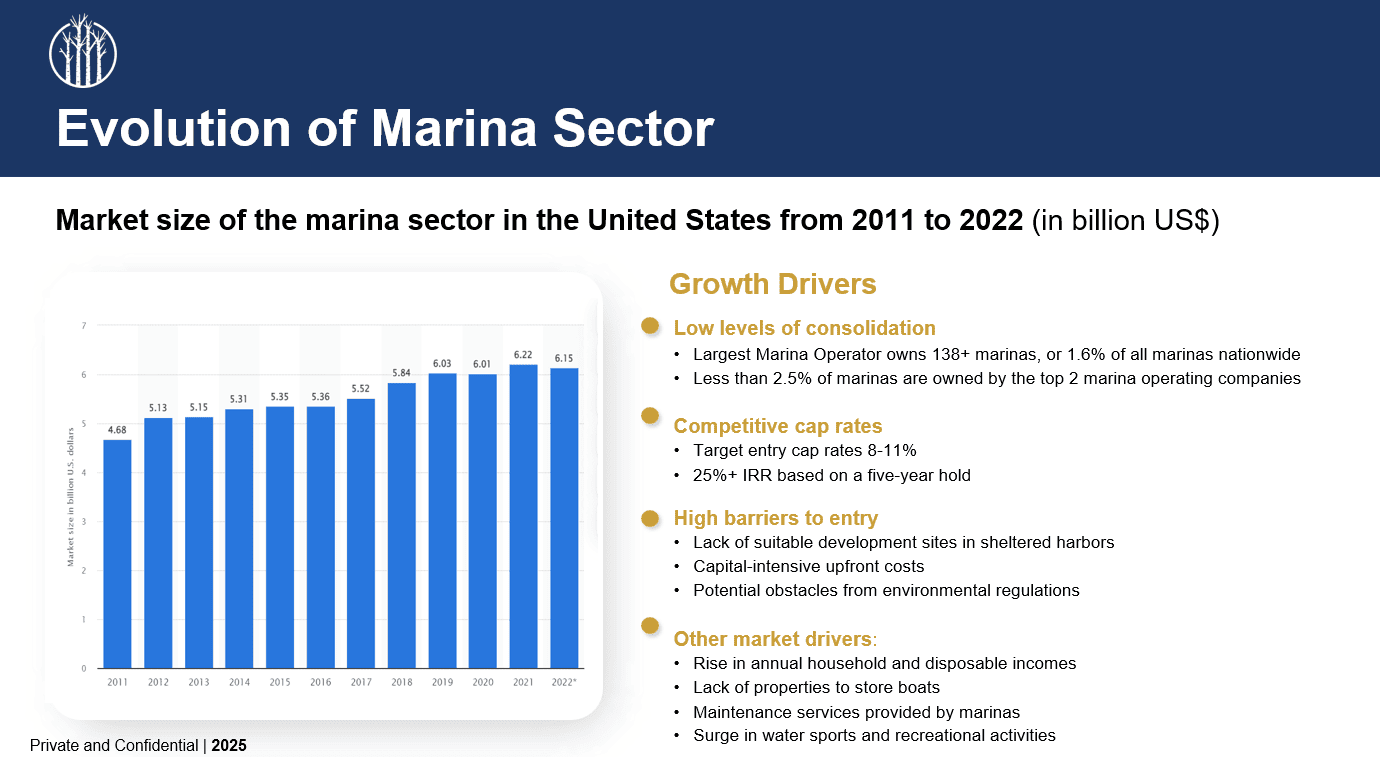

High-Demand Asset Class: The U.S. recreational boat market is projected to reach $28.5 billion by 2028, growing at an 8.69% CAGR.

-

Limited Institutional Ownership: The top 2 marina operators own less than 2.5% of the market, leaving consolidation opportunities wide open.

-

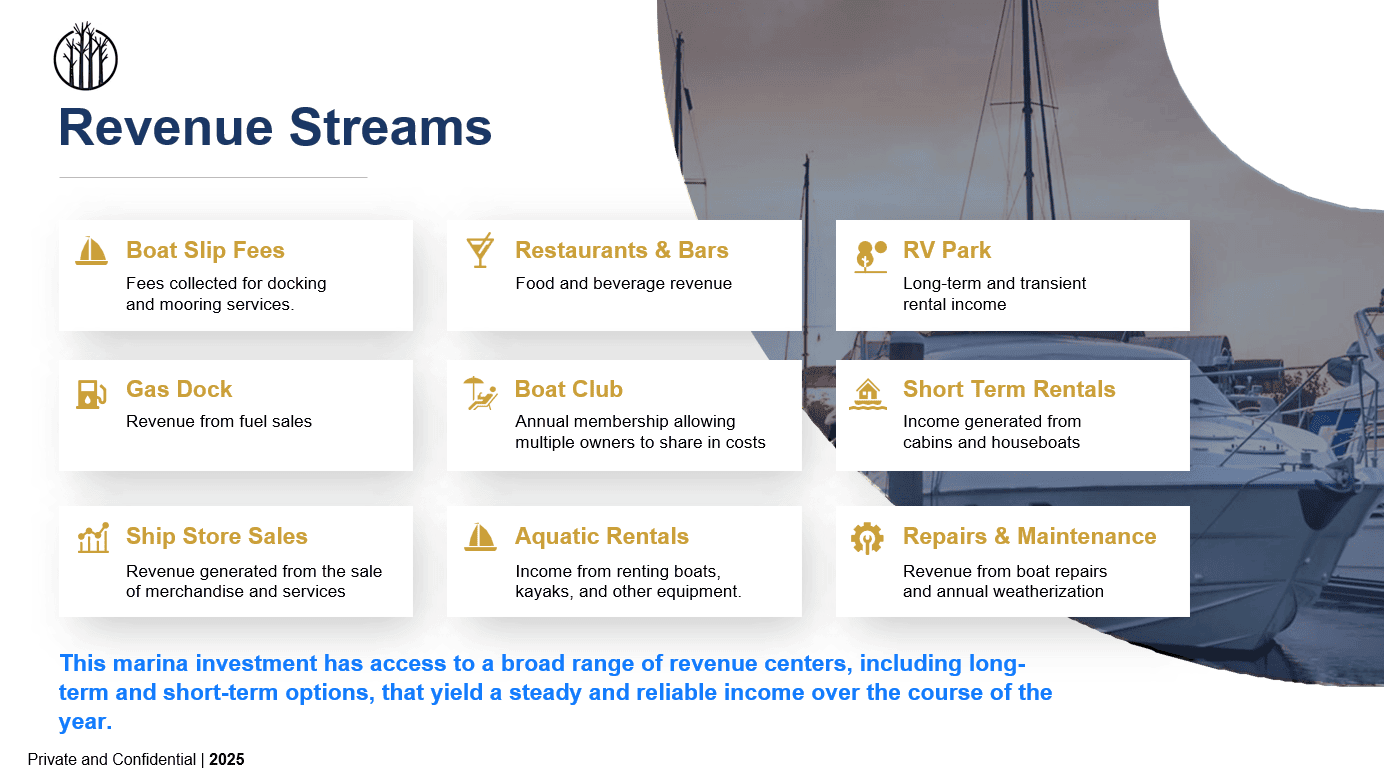

Multiple Revenue Streams: Income from boat slip fees, fuel sales, ship store merchandise, aquatic rentals, short-term lodging, restaurants & bars, boat clubs, RV parks, and maintenance services.

-

Strategic Growth Plan: Aim to build a portfolio of 5,000+ wet slips, refinance in Year 3–4, and exit or recapitalize in Year 5 at a 6–8% target cap rate.

Learn more about the Marina Fund Investment

Tax Strategy Investments

Reduce taxable income through IRS-recognized strategies that combine charitable giving with real estate partnerships. Options include land preservation, historic property easements, or a blended approach—each offering high deduction potential, long-term benefits, and built-in audit protection for accredited investors.

Featured Tax Strategies:

-

Fee Simple Donation: 5:1 deduction ratio on land conservation partnerships. Offset up to 30% of AGI.

-

Historic Preservation Easement: 2.5:1 deduction ratio while preserving iconic buildings. Offset up to 50% of AGI.

-

Combo Structure: Maximize benefits using both strategies. Includes future income and capital return potential

Up to 5x Tax Deduction per Dollar Invested

Offset up to 50% of AGI

Income + Capital Return in 5–6 Years

Audit Defense Included

$25,000 Minimum Investment

Why These Strategies:

-

Created by a legal team of former IRS litigators

-

Survived multiple audits, economic cycles, and investor use cases

-

Backed by third-party valuations, legal opinions, and ongoing compliance

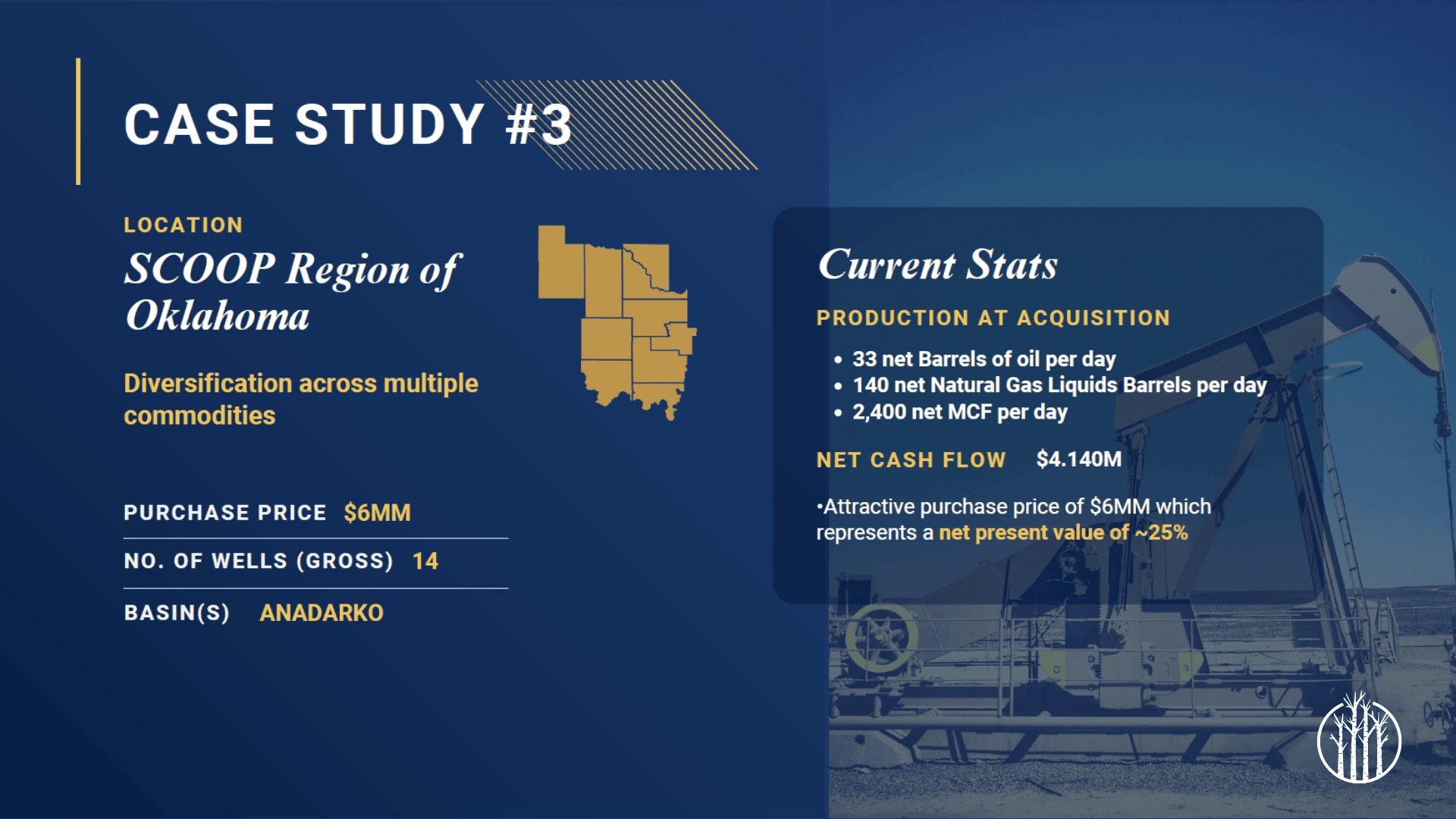

Diversified Oil and Gas

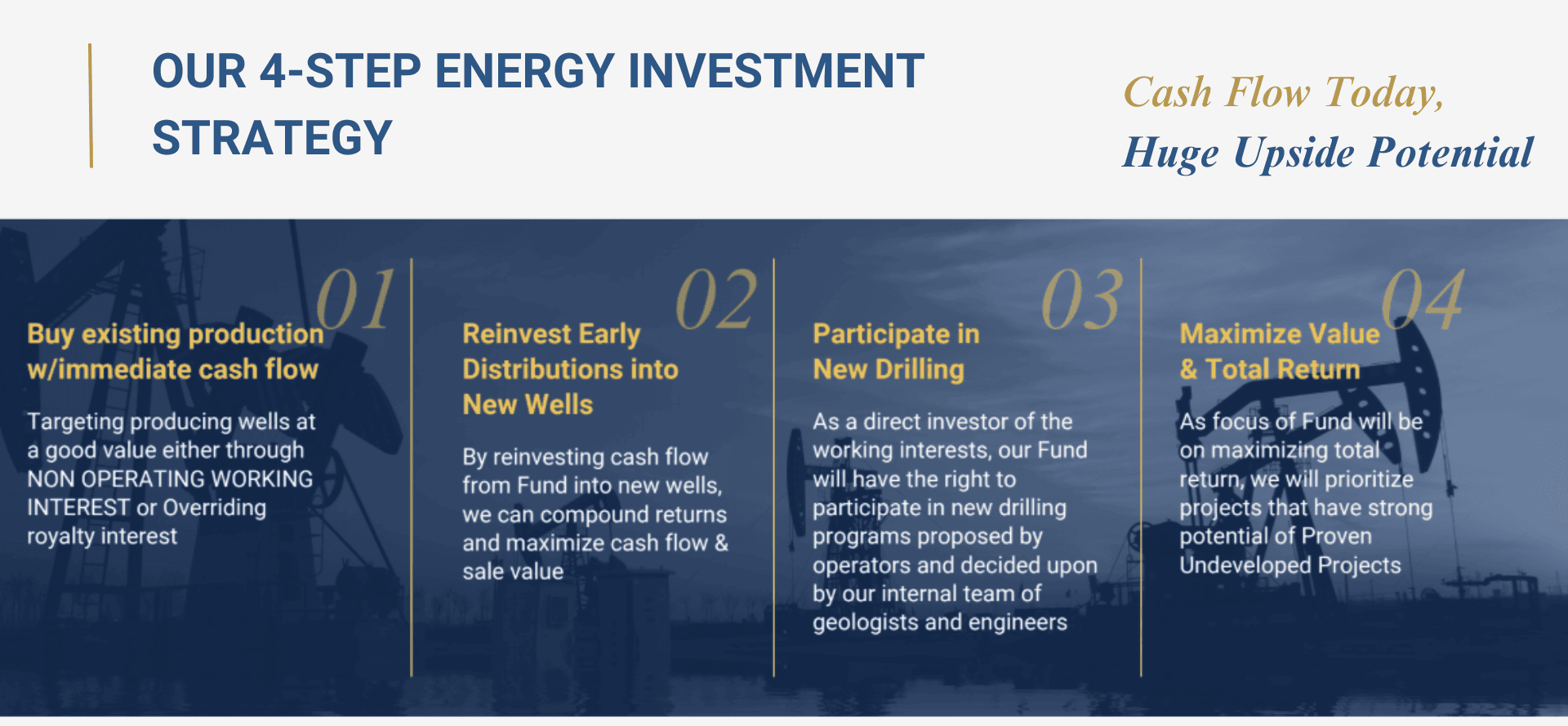

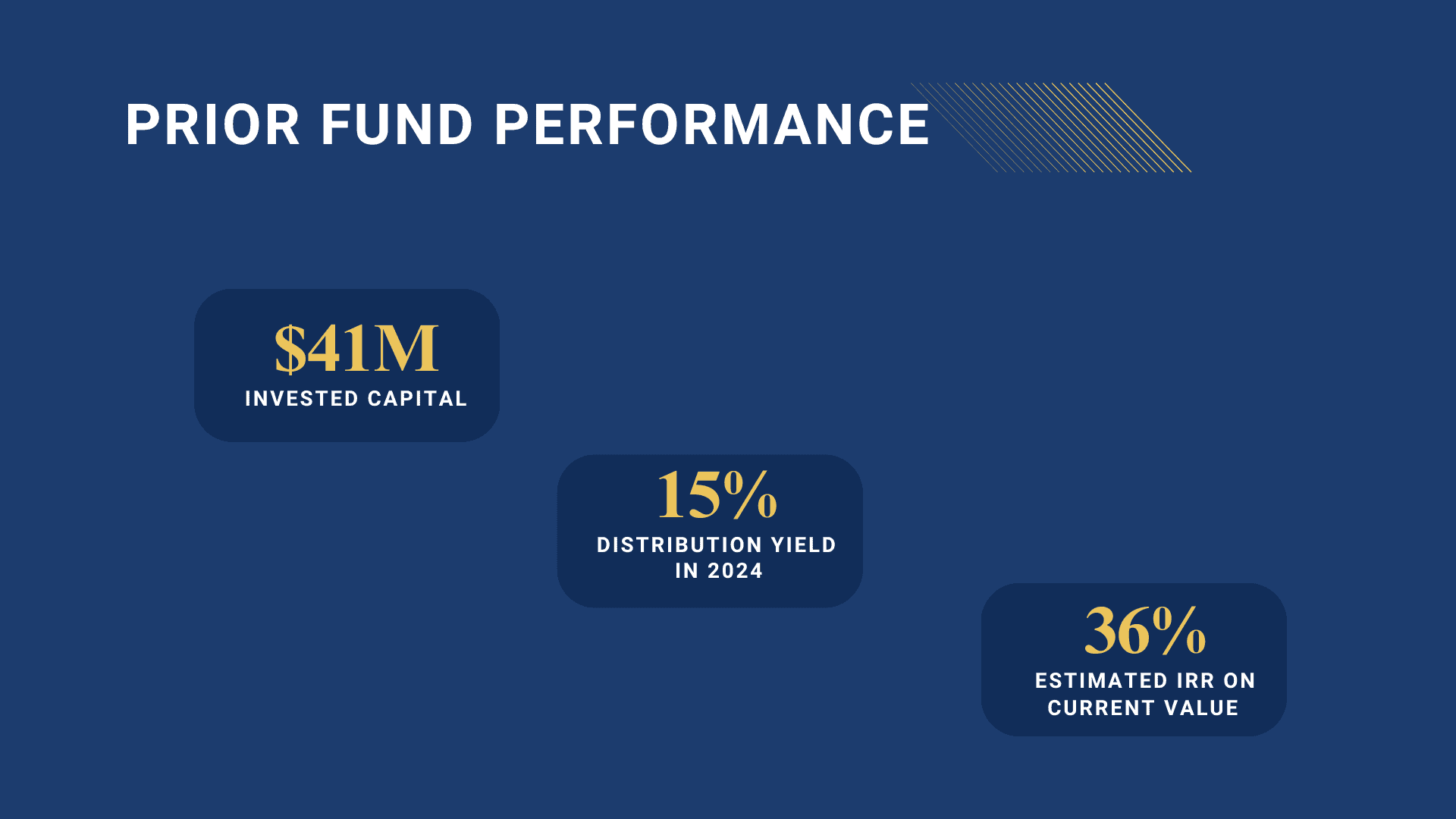

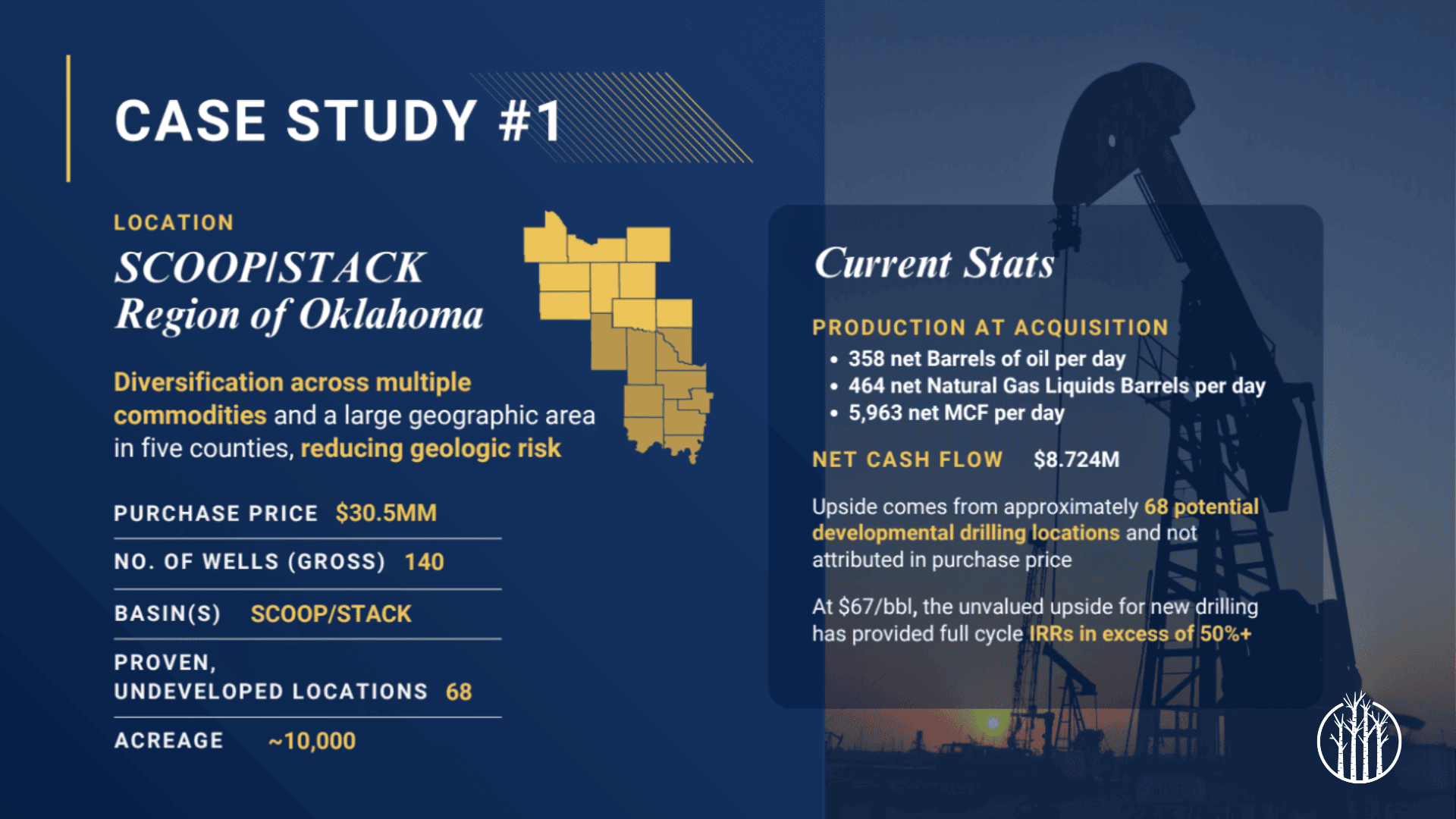

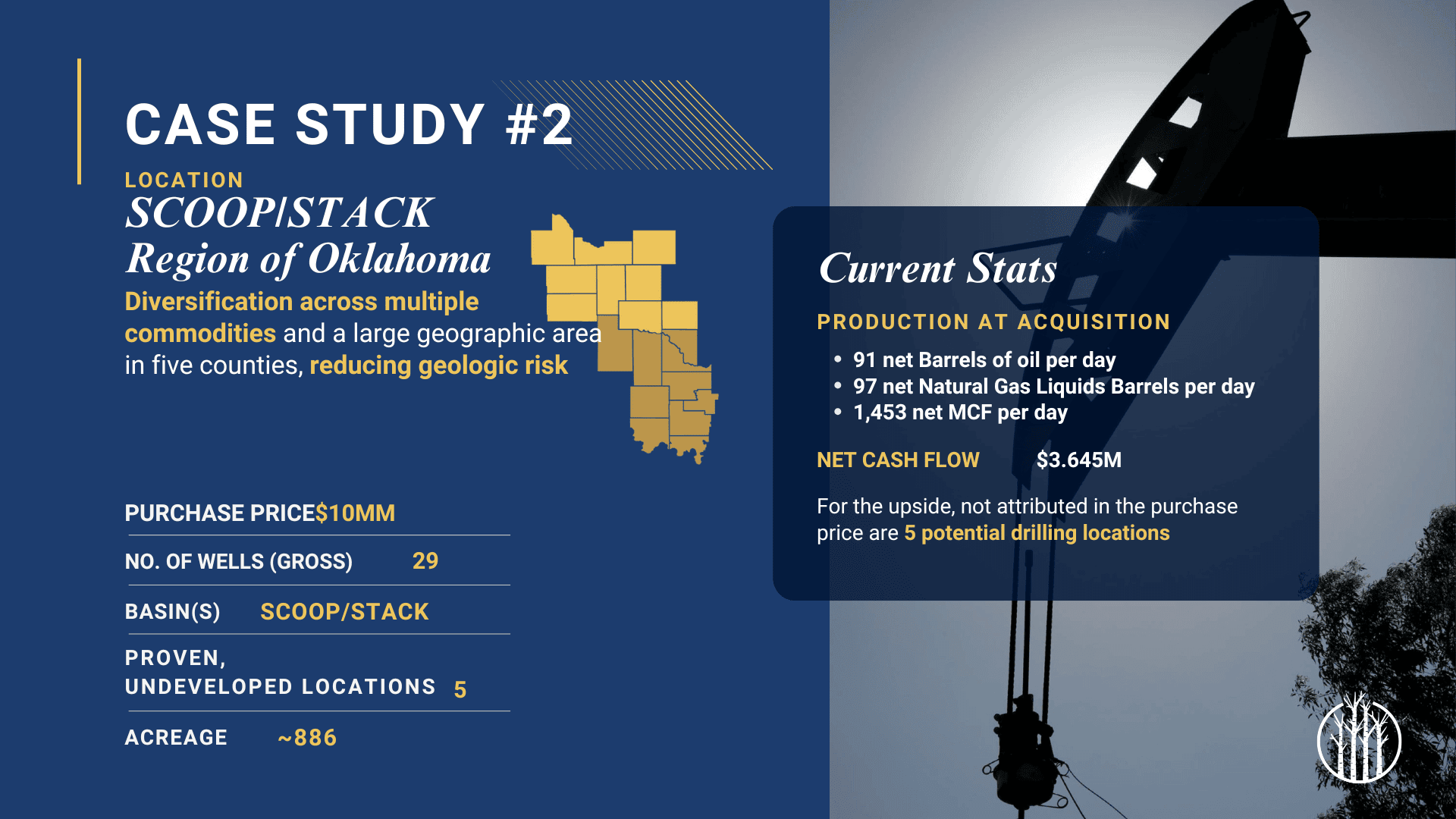

We are pleased to present a $75MM+ diversified oil & gas fund focused on investing in what we believe to be the best risk- adjusted opportunities.

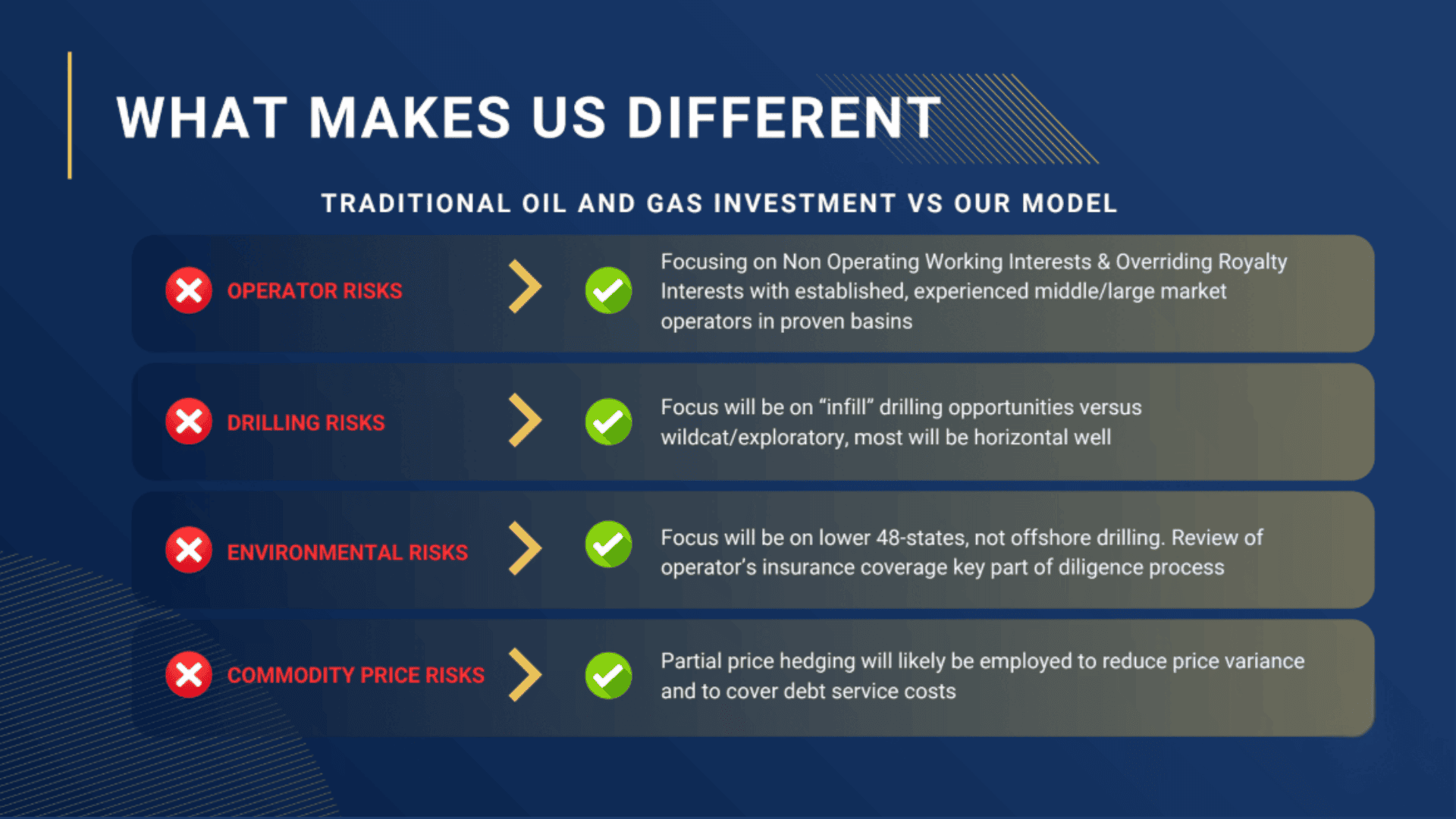

This Fund will be focusing on investing in a combination of existing producing assets for current cash flow (PDP) along with acreage for new drilling for upside value (PUD). We’ll be targeting multiple basins.

The Fund will generally be focused on investing in non-operating working interests (“NOWI”) and overriding royalty interests (“ORRI”). This reduces operational risk but gives the opportunity to participate in new drilling programs.

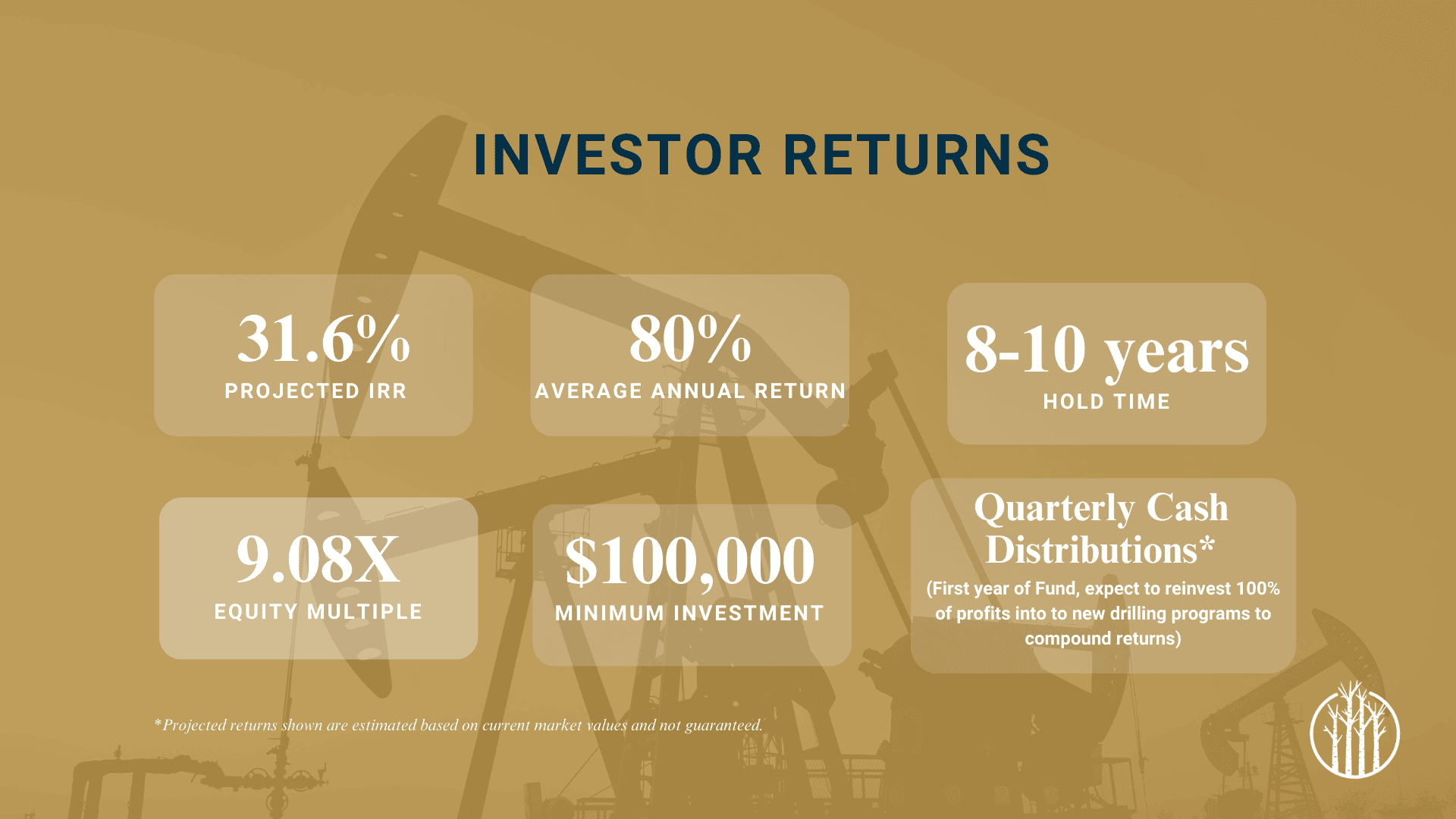

31.6% Projected IRR

9.08x Equity Multiple

80% Average Annual Return

8-10 years Hold Time

$100,000 Minimum Investment

Key Highlights:

- Exclusive Returns: We’ve negotiated better returns and a lower entry point for our network.

-

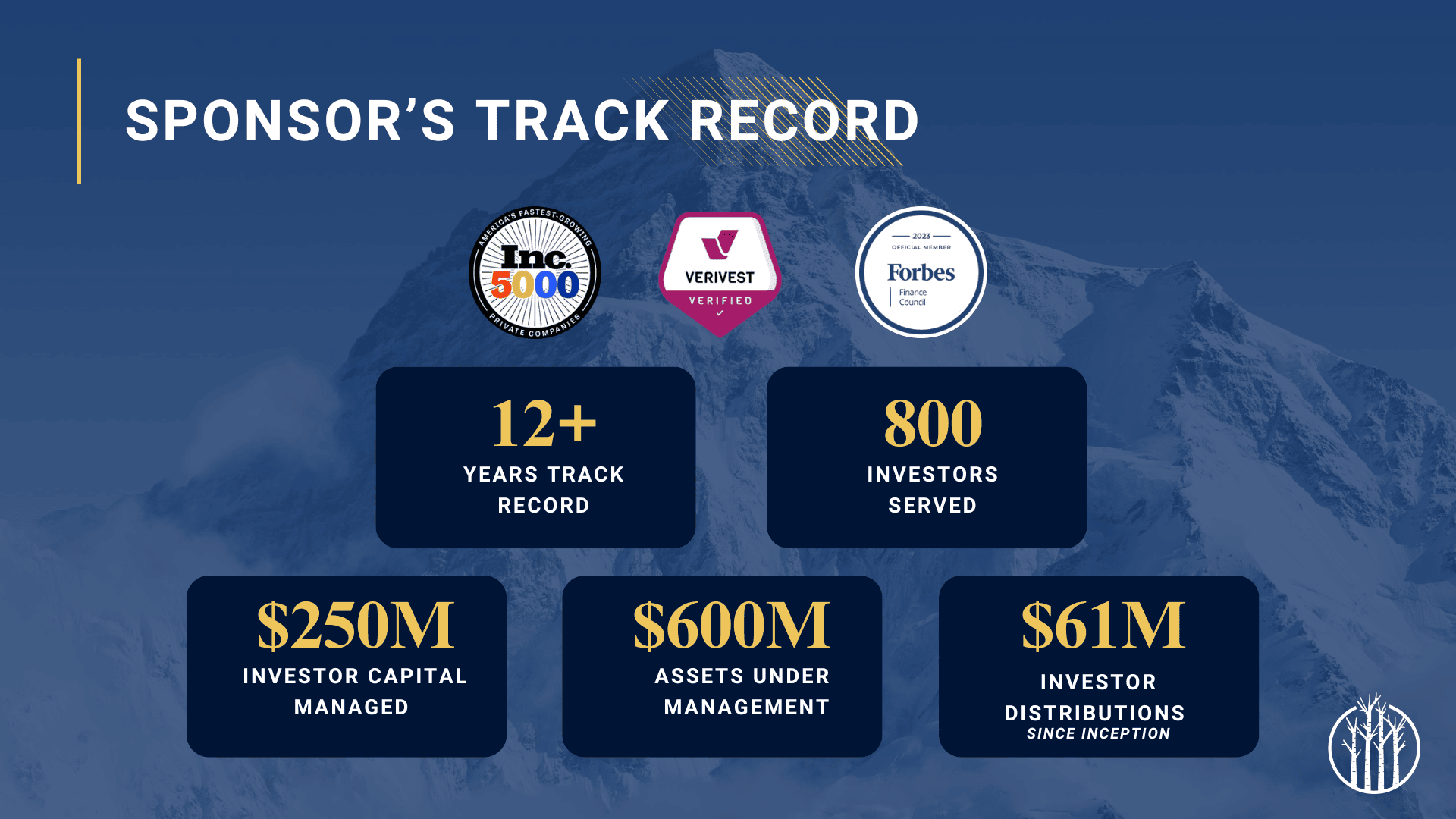

Experienced Sponsor Team: Our sponsorship team has extensive experience in operating and engineering on oil & gas assets for the last 40 years, with a 5-project track record.

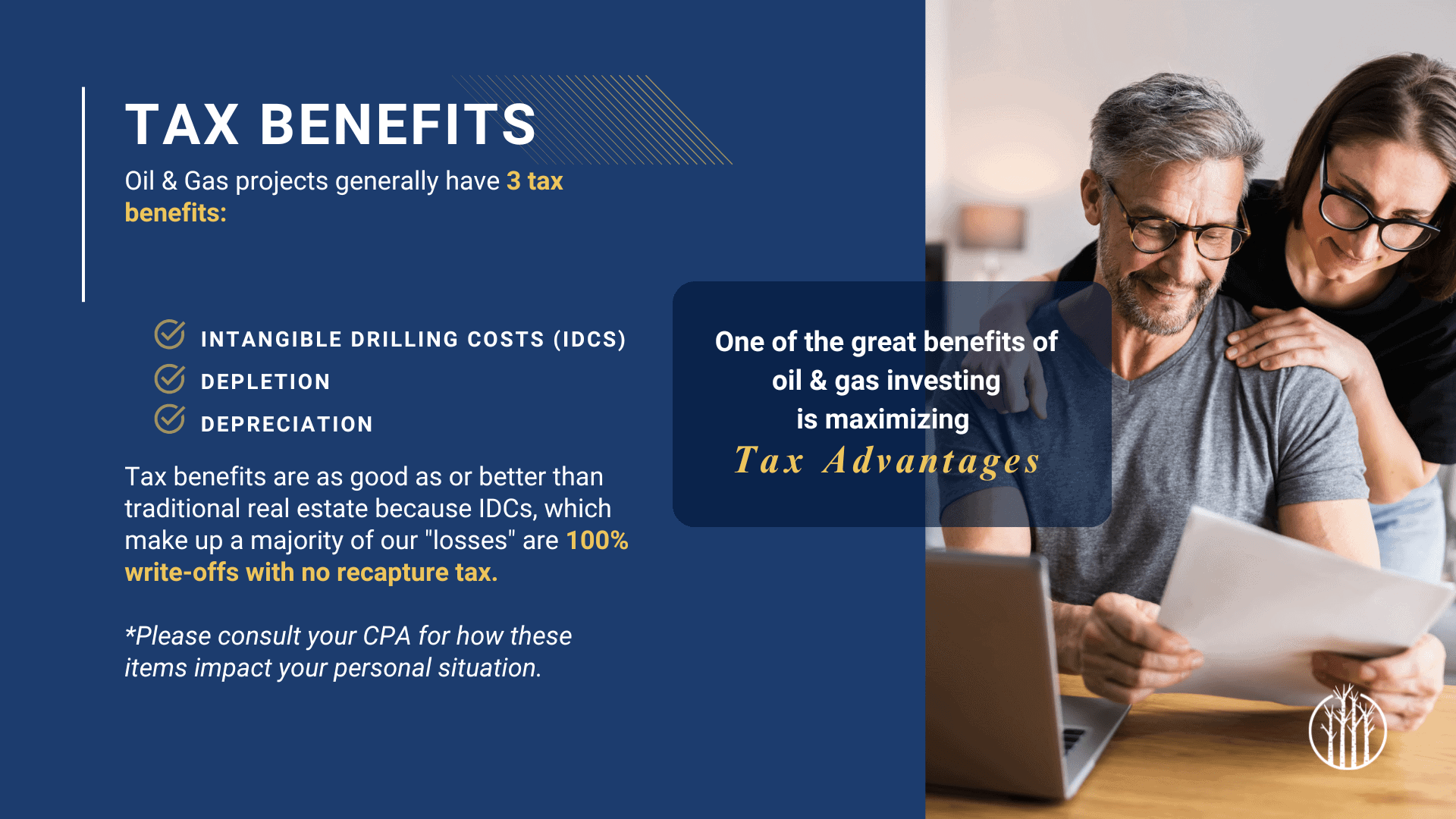

- Tax Benefits: Numerous tax benefits for our investors including: Intangible Drilling Costs, Depletion & Depreciation to offset passive income.

- Cash Flow + Total Return: Our fund strategy will combine a focus on existing producing assets at good values, with additional upside through drilling. We’re targeting a mix of distributions and reinvestment into new drilling to compound returns.

Learn more about Oil and Gas Investment

Paving Company Acquisition and Roll-up

The Paving Company Acquisition and Roll-up is a unique private equity roll-up strategy focused on acquiring and consolidating paving companies across the Southwest. It is positioned to capitalize on the $110 billion in municipal road investments fueled by the Bipartisan Infrastructure Law while addressing the retirement wave of paving company owners, which is opening acquisition opportunities at attractive valuations.

35-45% IRR

4-5x Equity Multiple

60-70%+ Average Annual Return

7-10% Average Annual Cash Flow

12% Preferred Return

$100,000 Minimum Investment

Key Highlights:

- Scalable Roll-Up Strategy – Consolidating paving companies to create operational efficiencies, increase market share, and drive higher valuations.

- Government-Backed Industry – Stable, recession-resistant demand driven by $110B in infrastructure funding and long-term municipal contracts.

- Exclusive Acquisition Advantage – Targeting businesses too small for private equity but too large for individual buyers, securing favorable deal terms.

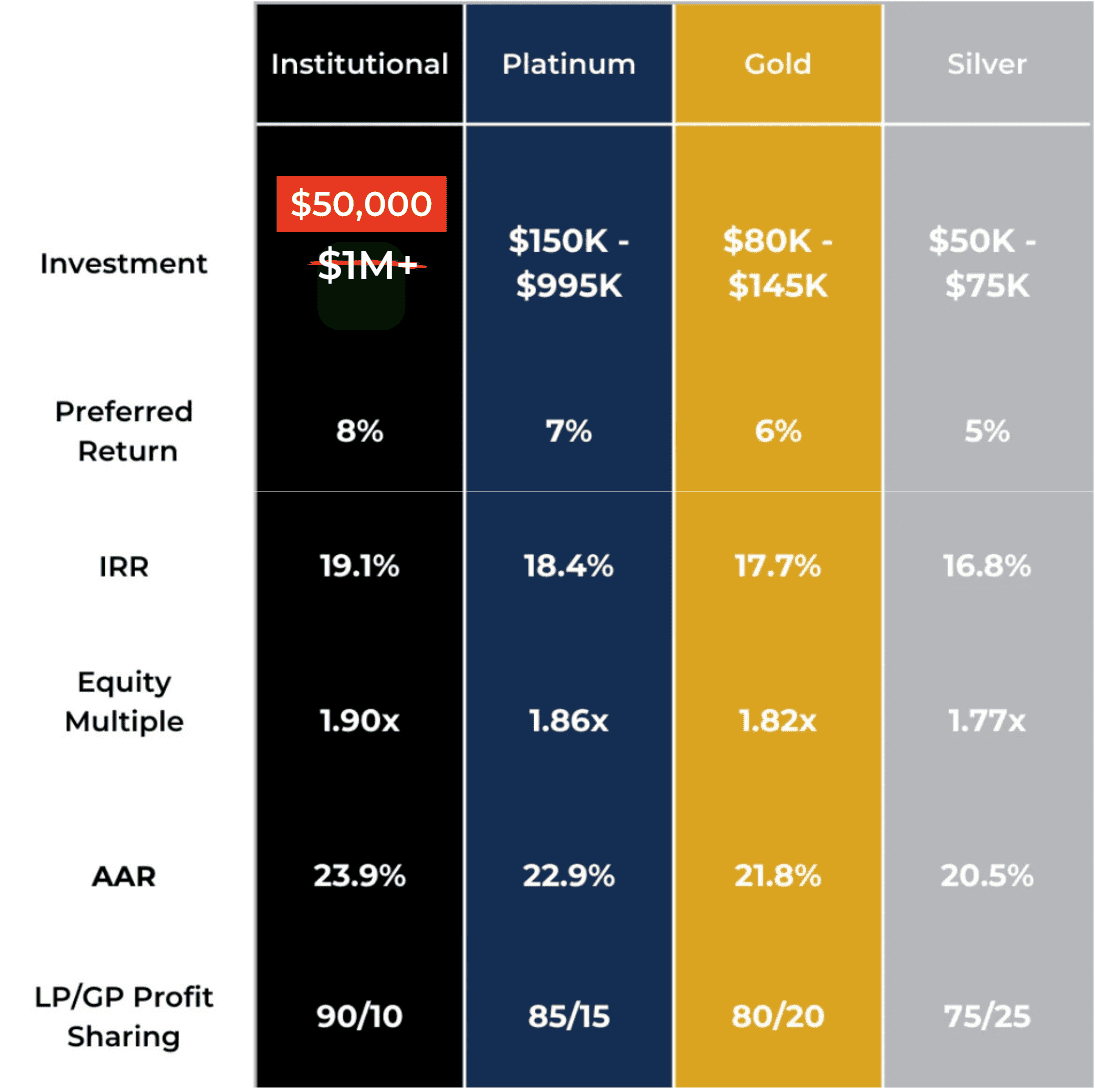

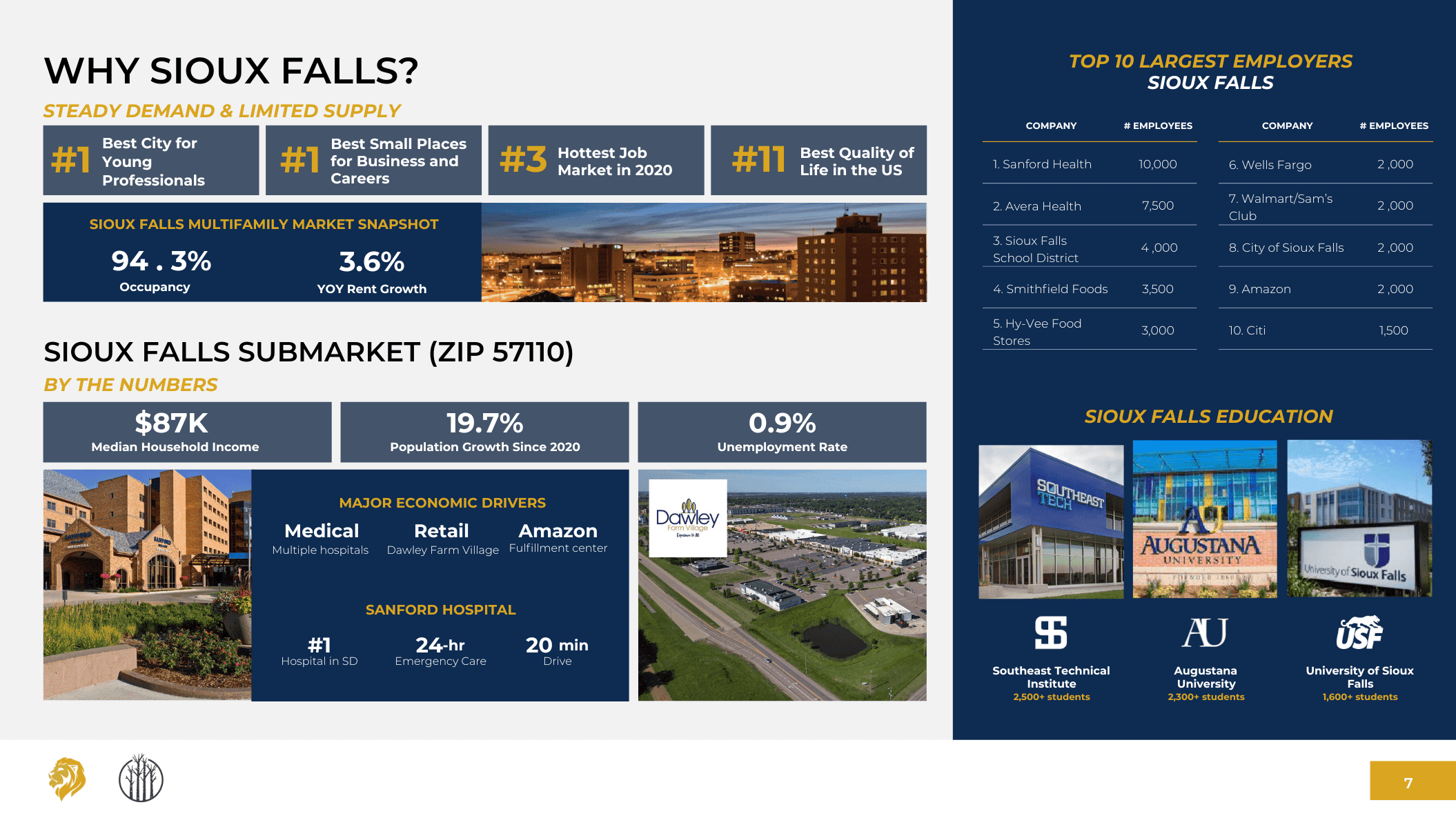

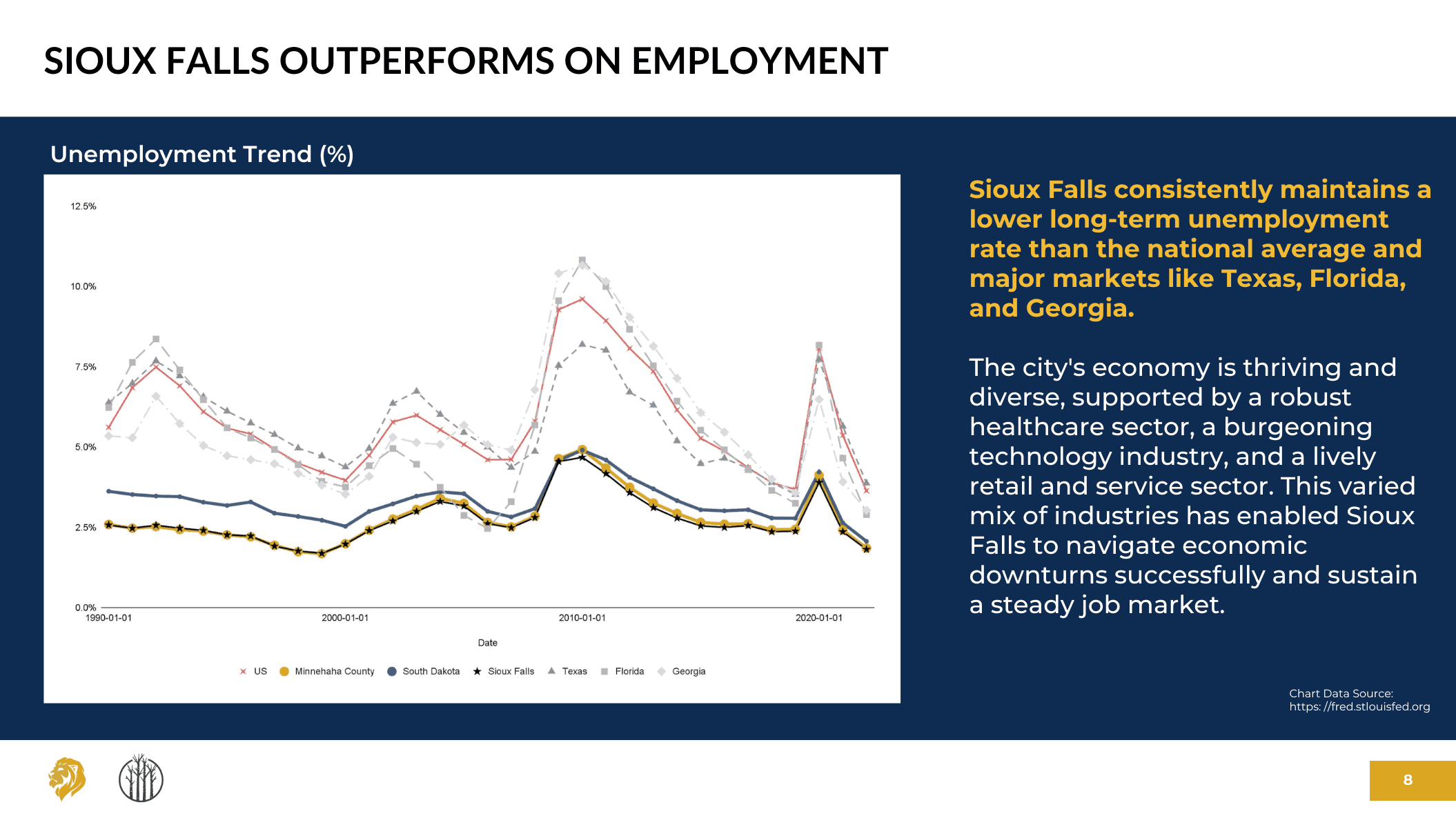

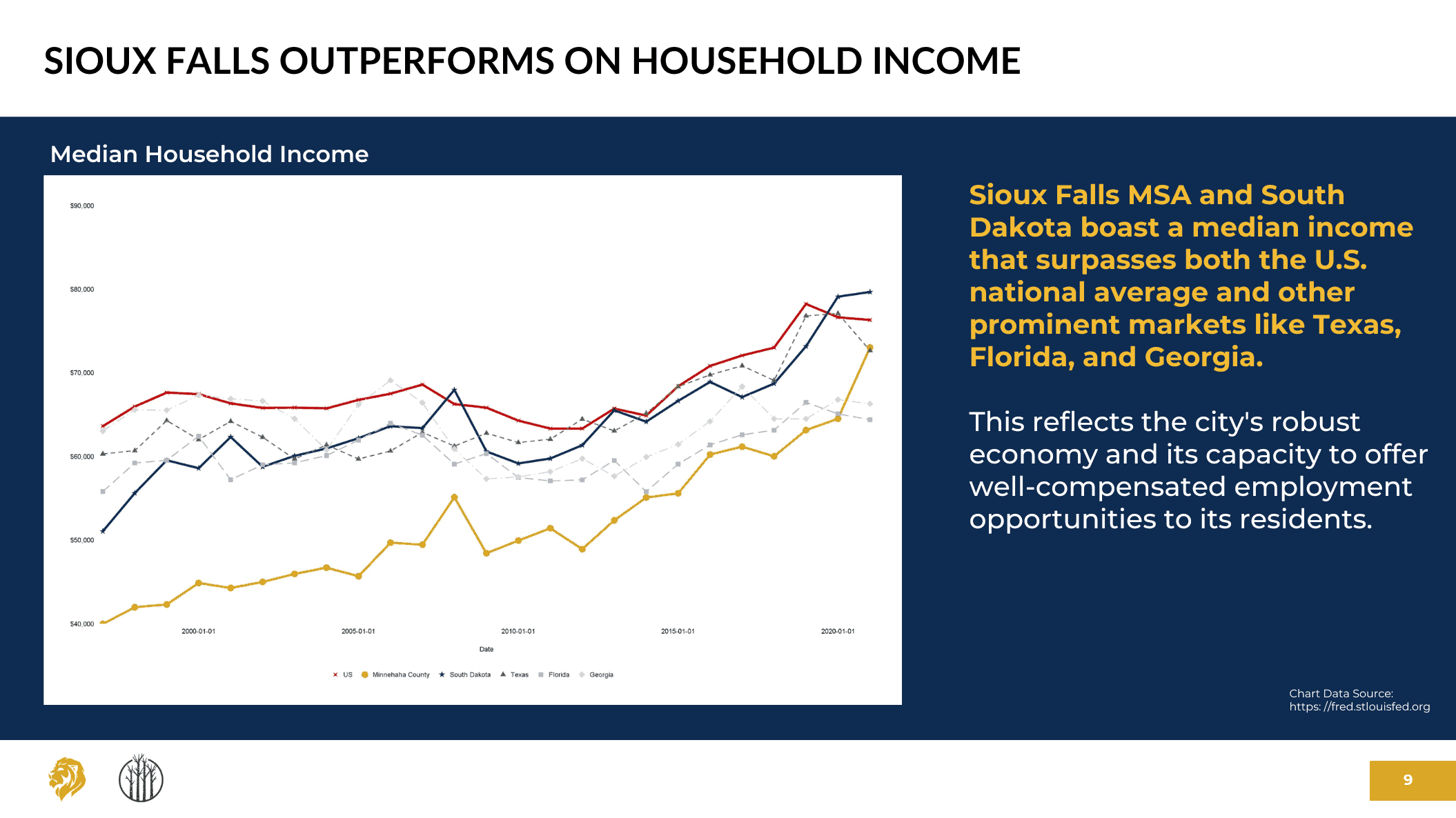

Foss Fields Phase 1

Sioux Falls, SD

19.1% IRR

8% Preferred Return

1.90x Equity Multiple on a 45-Month Holding Period

$50K Minimum Investment

Foss Fields is a 300-acre master development situated at the nexus of Sioux Falls’ next major commercial development. The master development will include residential, senior housing, multifamily, office park, retail, healthcare, and other components. Phase 1 of our Foss Fields multifamily project is targeted for 100 units.

Key Highlights:

- Institutional Returns Access – Our network gains access to superior returns at a significantly reduced minimum investment of $50,000, typically reserved for $1M+ investors.

- Proven Track Record – Sponsored by Boardwalk Wealth who have successfully operated for over a decade and have deep business, family and community ties in this market.

- Heritage Land of a Local Hero – The property will rest on the original farmhouse land of WWII flying ace Joe Foss.

- Significant Tax Benefits – Estimated $24,092 in tax benefits per $100K invested, including $4,153 in 45L energy tax credits and $19,939 from accelerated depreciation.

Learn more about Foss Fields

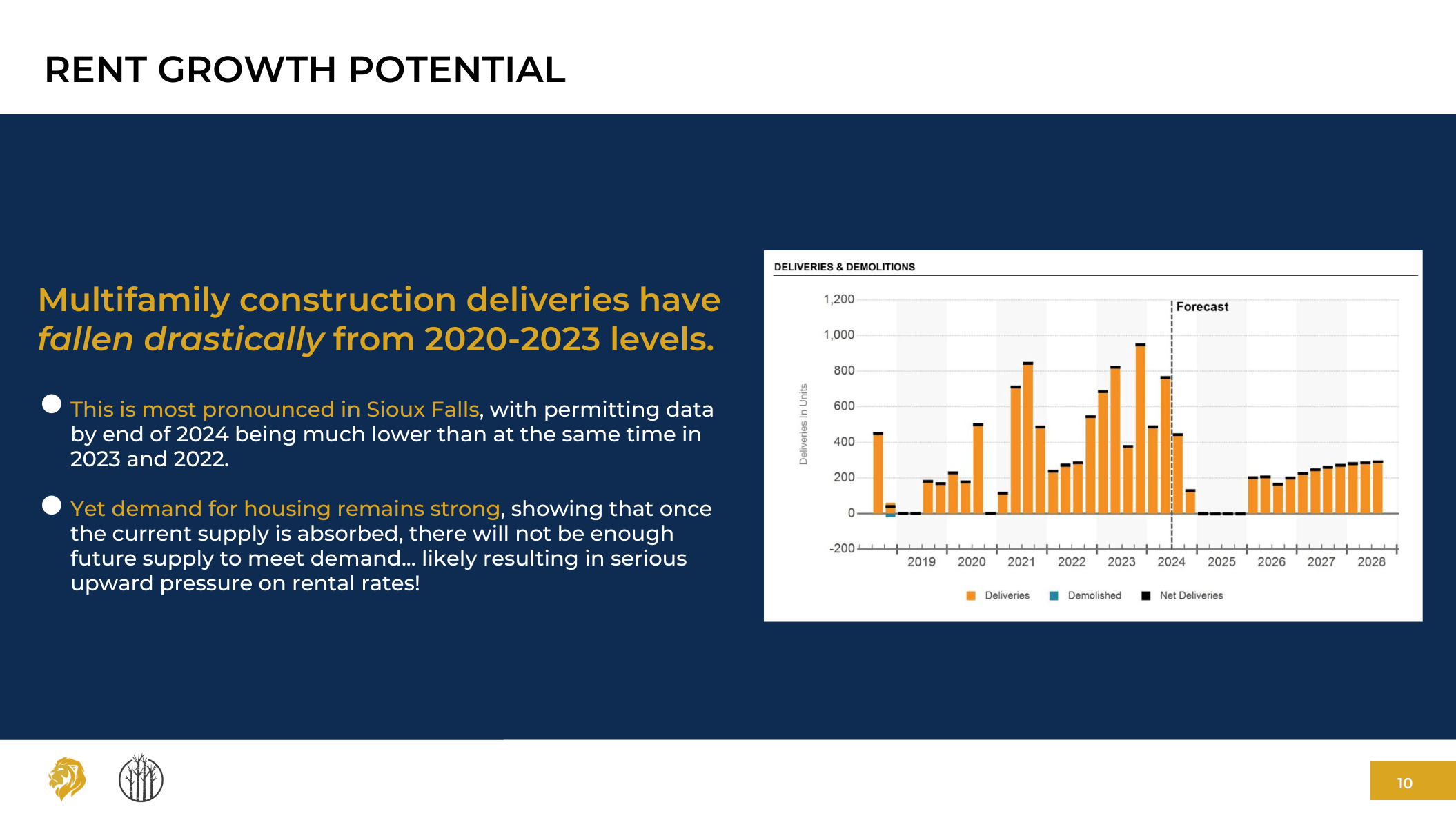

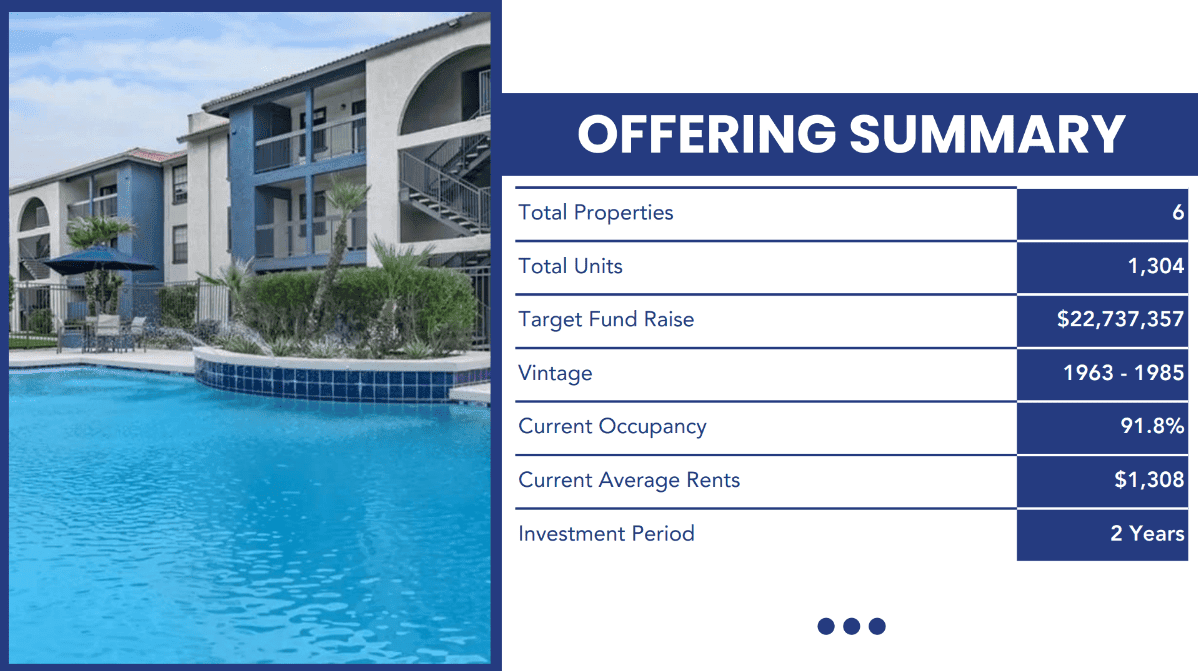

Rise

Preferred Equity Fund

BENEFITS OF PREFERRED EQUITY FUND

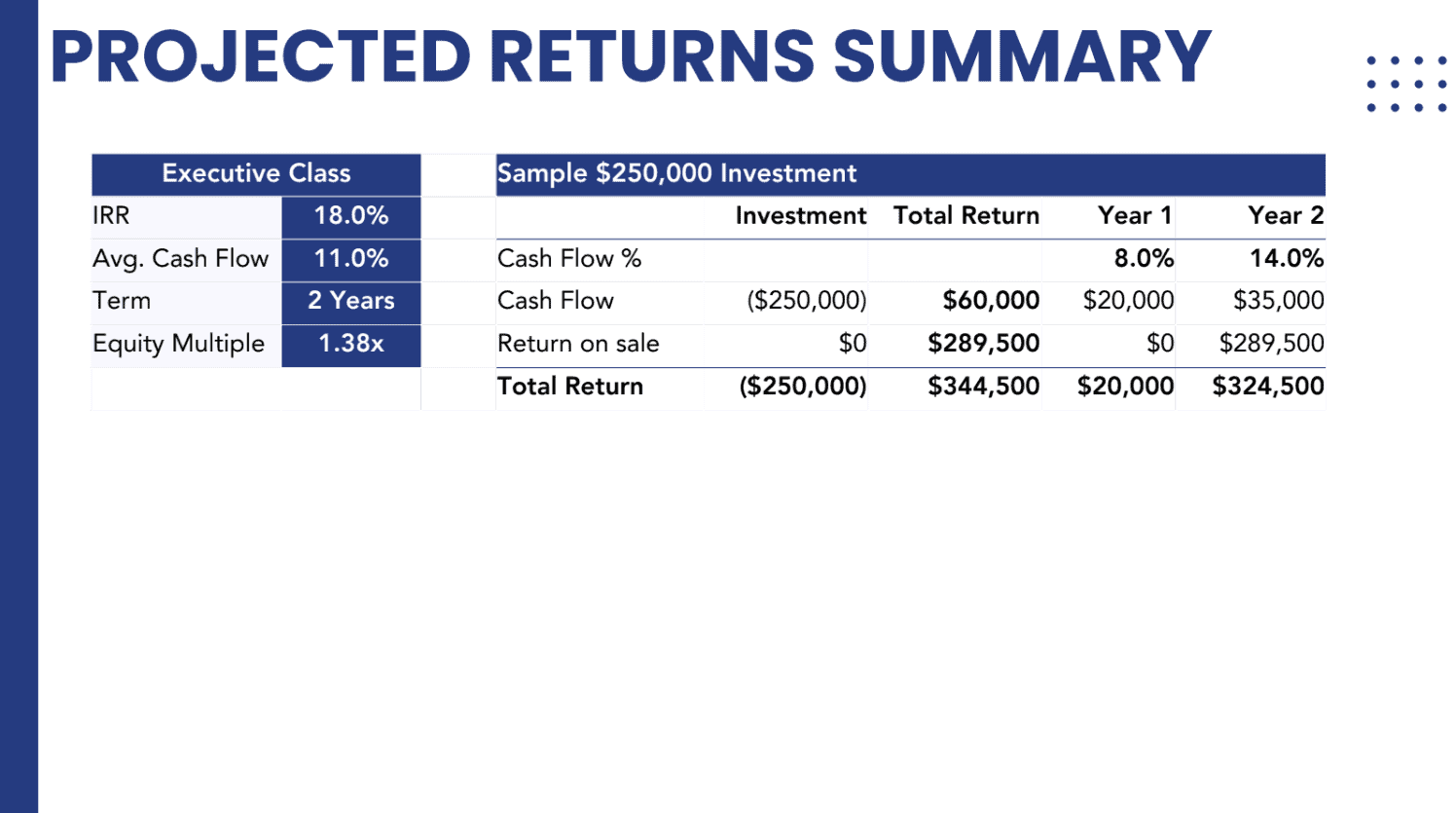

- 18% IRR

- Diversification across 1,304 units

- Quick return of capital – 2 year term

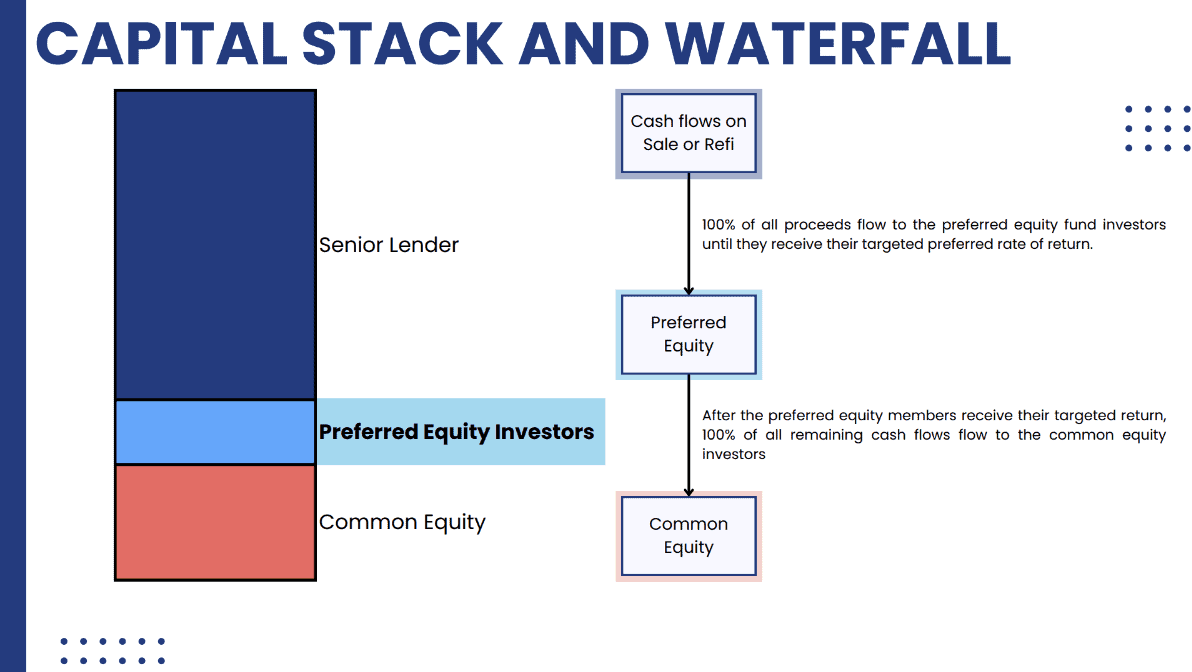

- Preferred position in the capital stack (Priority position behind senior lender)

- Low execution risk and increased probability of predictable outcome

18% IRR

18% Preferred Return

11% Average Cash Flow; 8% Year 1 Actual CoC; 14% Year 2 Actual CoC

1.38x Equity Multiple on a 2-Year Investment Period

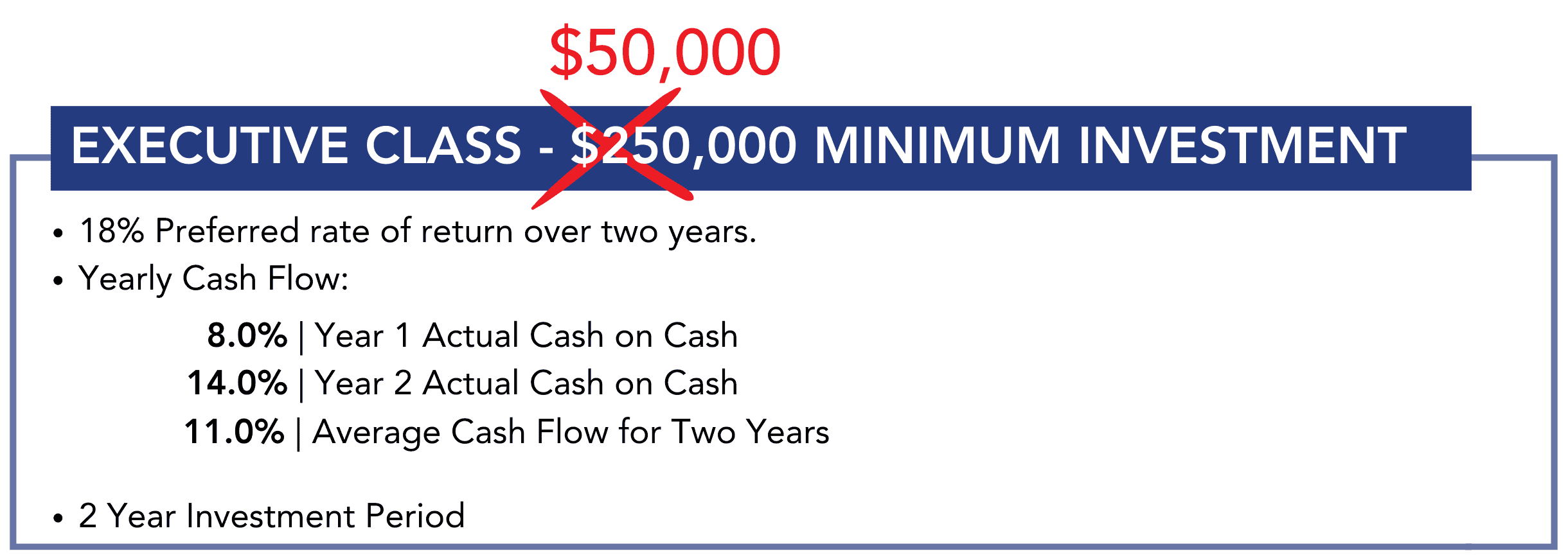

$50K Minimum Investment

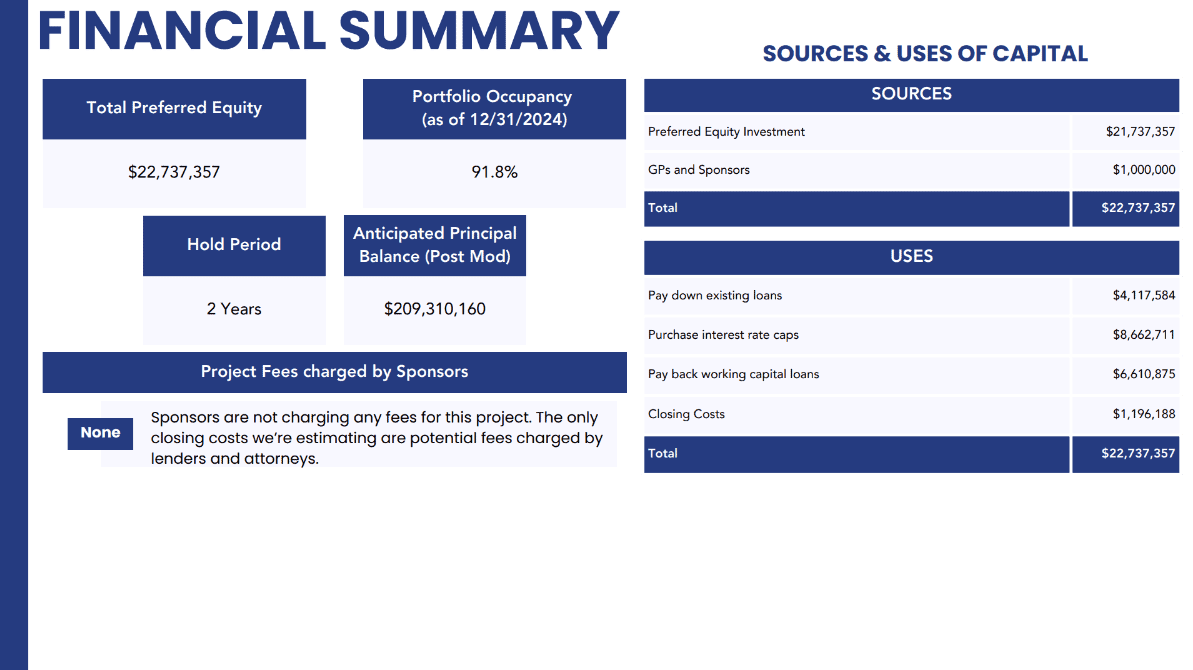

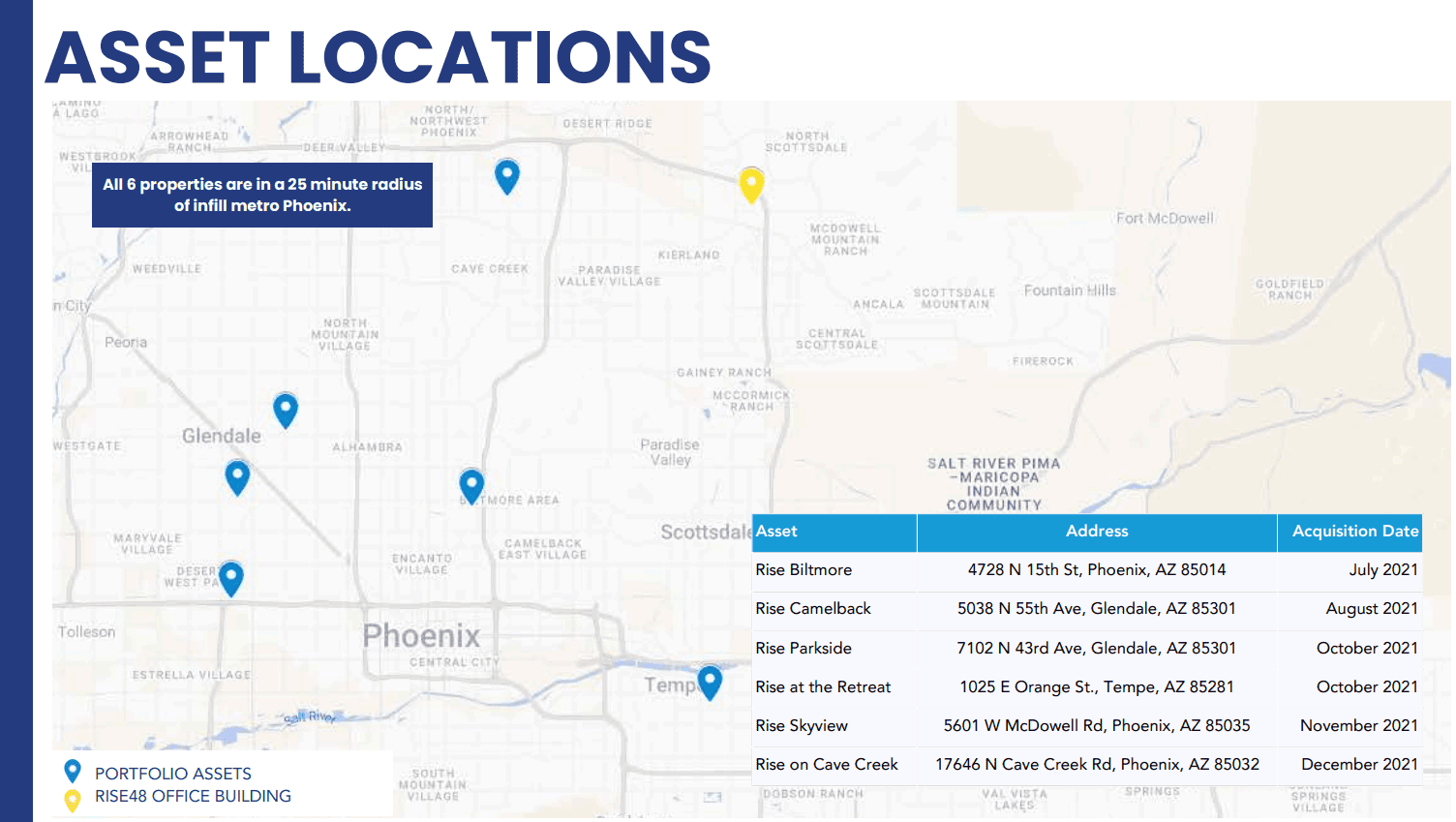

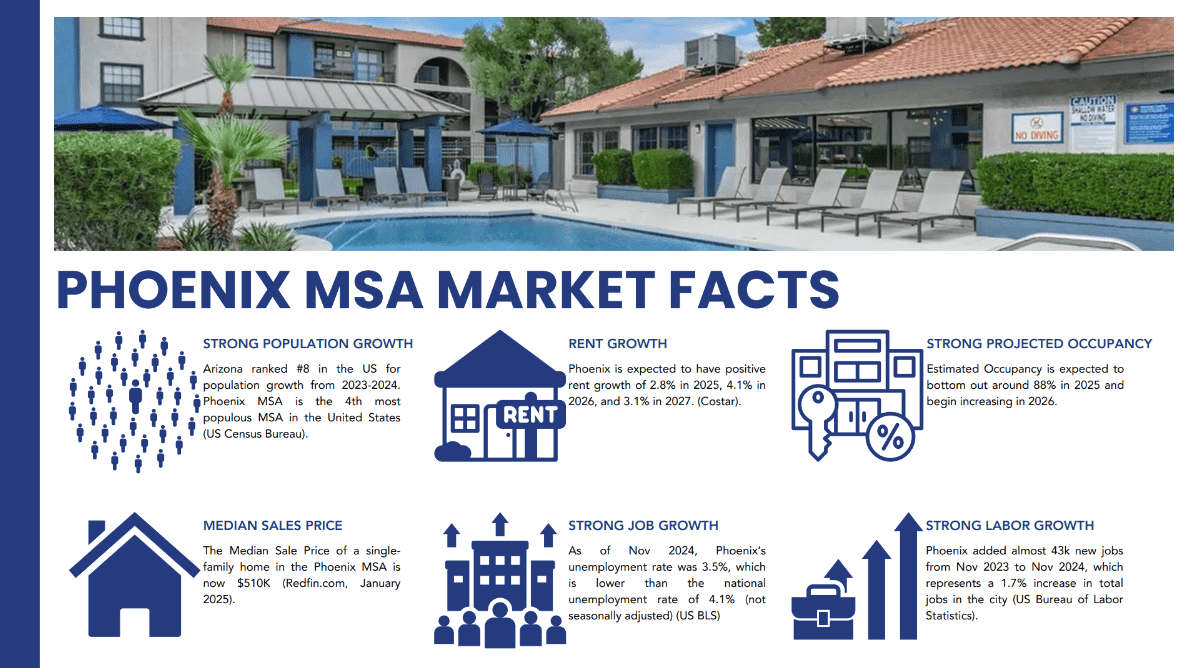

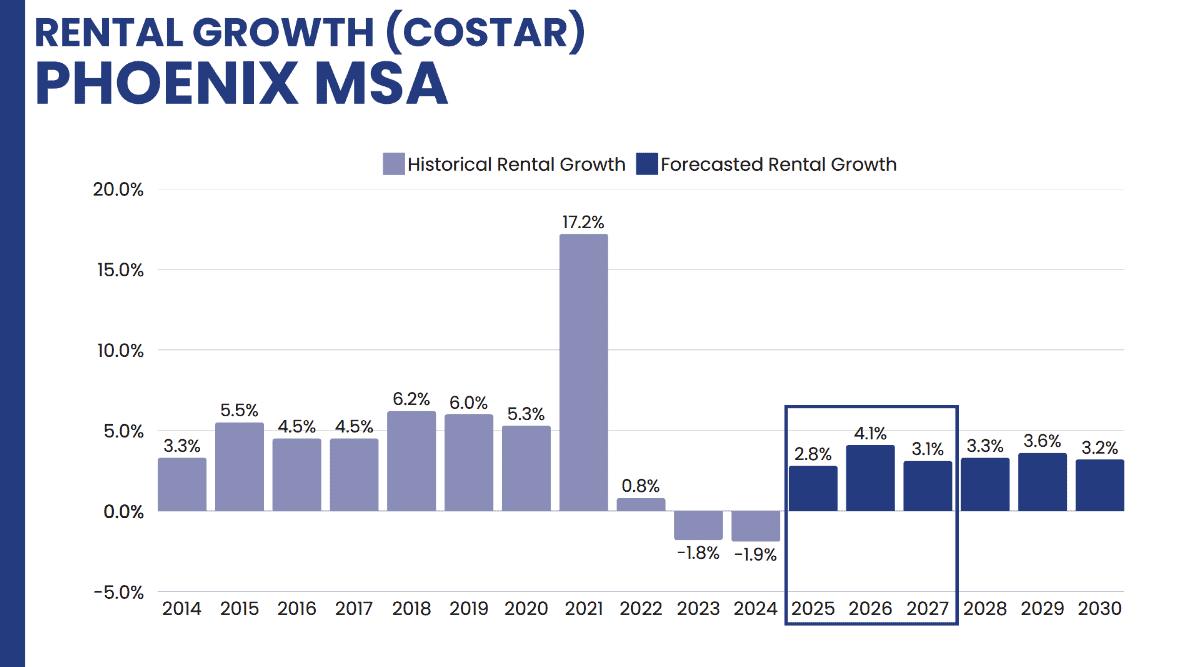

Timberview Capital is excited to present an exclusive investment opportunity: the Rise Preferred Equity Fund, a portfolio of six stabilized multifamily properties in the Phoenix MSA. This fund is strategically designed to capitalize on the current market conditions, allowing you to secure a senior position in the capital stack while benefiting from strong cash flow and a short investment horizon.

Key Highlights:

- Executive Class Access – Our network gains access to superior returns at a significantly reduced minimum investment of $50,000, typically reserved for $250K+ investors.

- Proven Track Record – Sponsored by Rise48 Equity, a leader in multifamily acquisitions and operations

- Stabilized Assets with Low Execution Risk – All six properties are performing at above-market occupancy, with strong NOI growth, and are cash-flowing immediately.

Learn more about Rise Preferred Equity Fund

Medical Office

Multiple Locations

16-20% targeted base case IRR

25-35% upside scenario IRR

2 to 3x targeted equity multiple

8% preferred return

90/10 split up to 15% IRR

70/30 split at 15% IRR

$100K Minimum Investment

Timberview Capital brings you a unique investment opportunity in medical real estate. With a focus on healthcare and dental offices, this asset class offers long-term leases and recession-resistant tenants, providing a stable foundation for consistent returns. Medical real estate is positioned to grow alongside the increasing demand for healthcare services, making it a smart addition to any diversified portfolio.

We are excited to present our current Q2-2025 investment opportunity: a portfolio of eleven medical buildings comprising 16 medical tenants featuring long-term leases. This carefully curated package offers robust financial performance.

Learn more about Medical Office

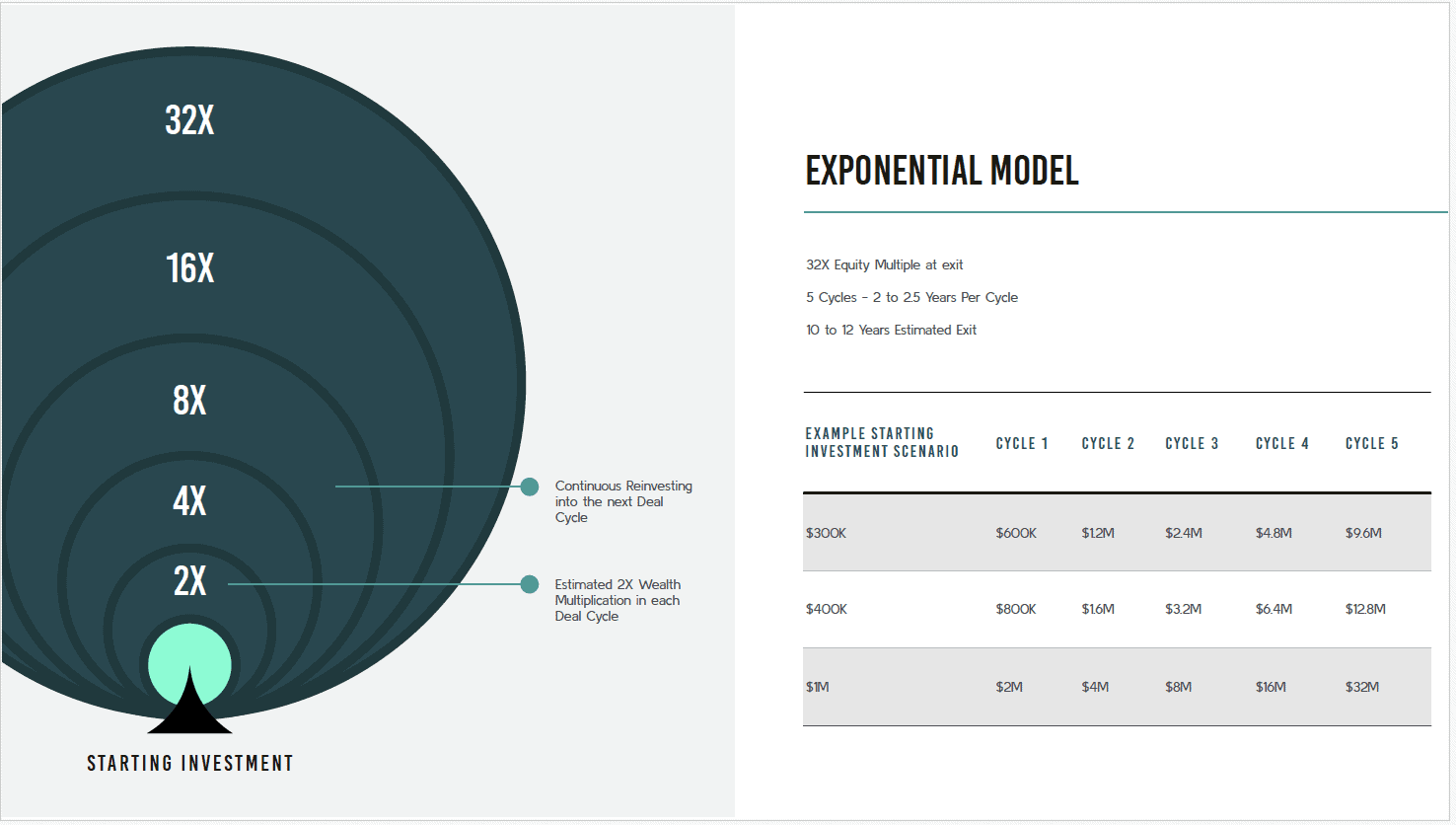

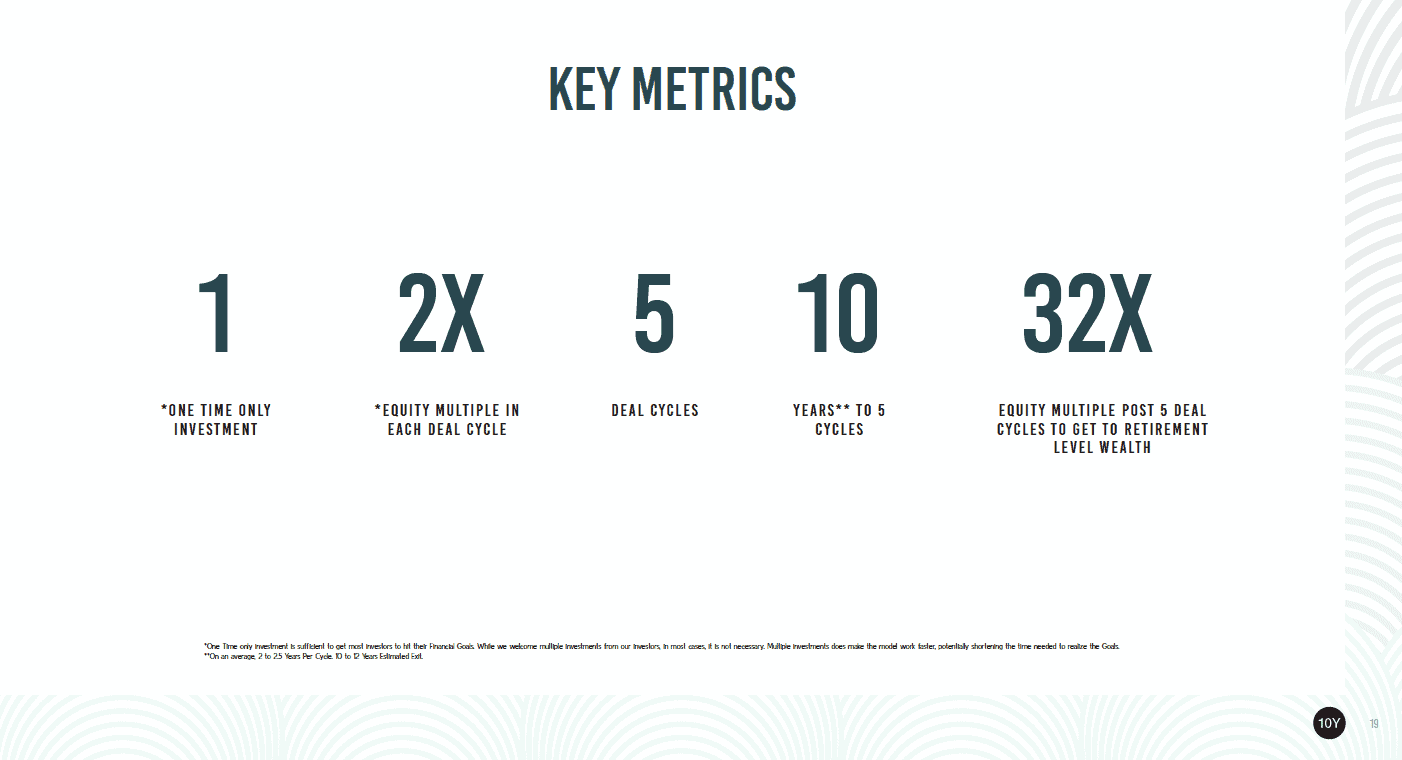

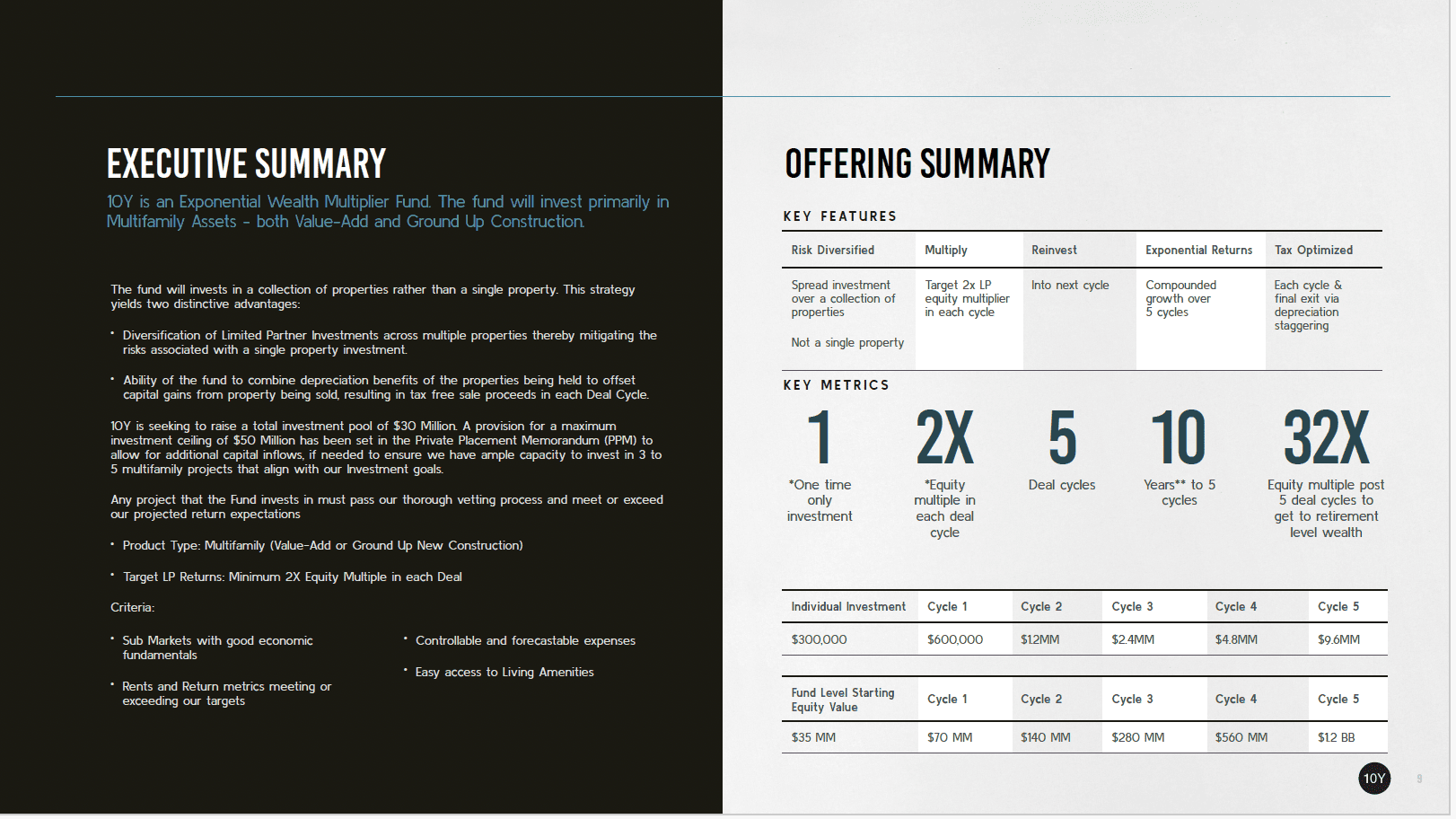

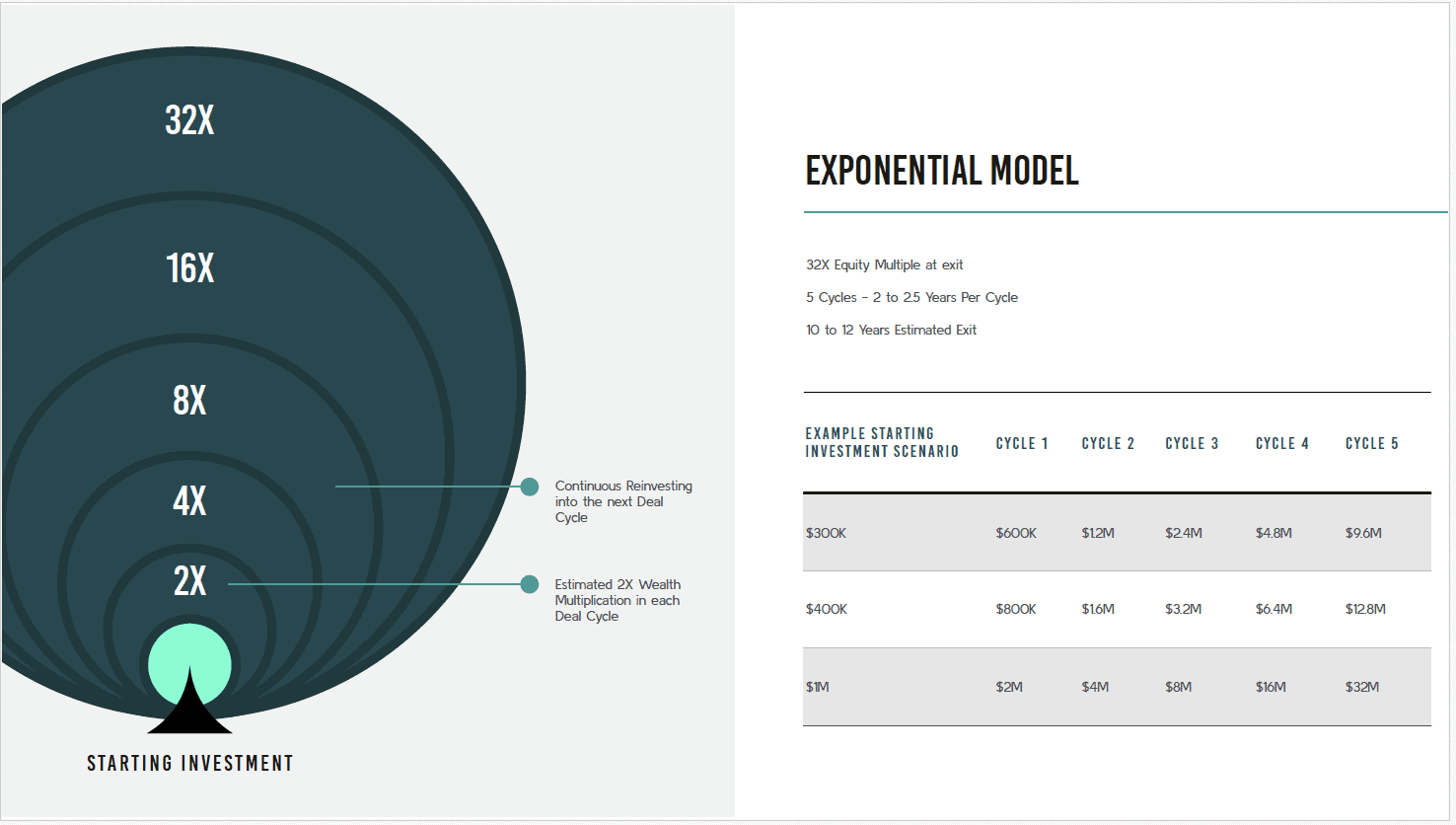

10Y Rise

Multiple Locations

Value-Add and Ground Up New Construction

2x Target Equity Multiple, 5 deal cycles

2x Multiple * 5 cycles = 32x Projected Return

$300k investment projected to yield 9.6 million in 10-12 years

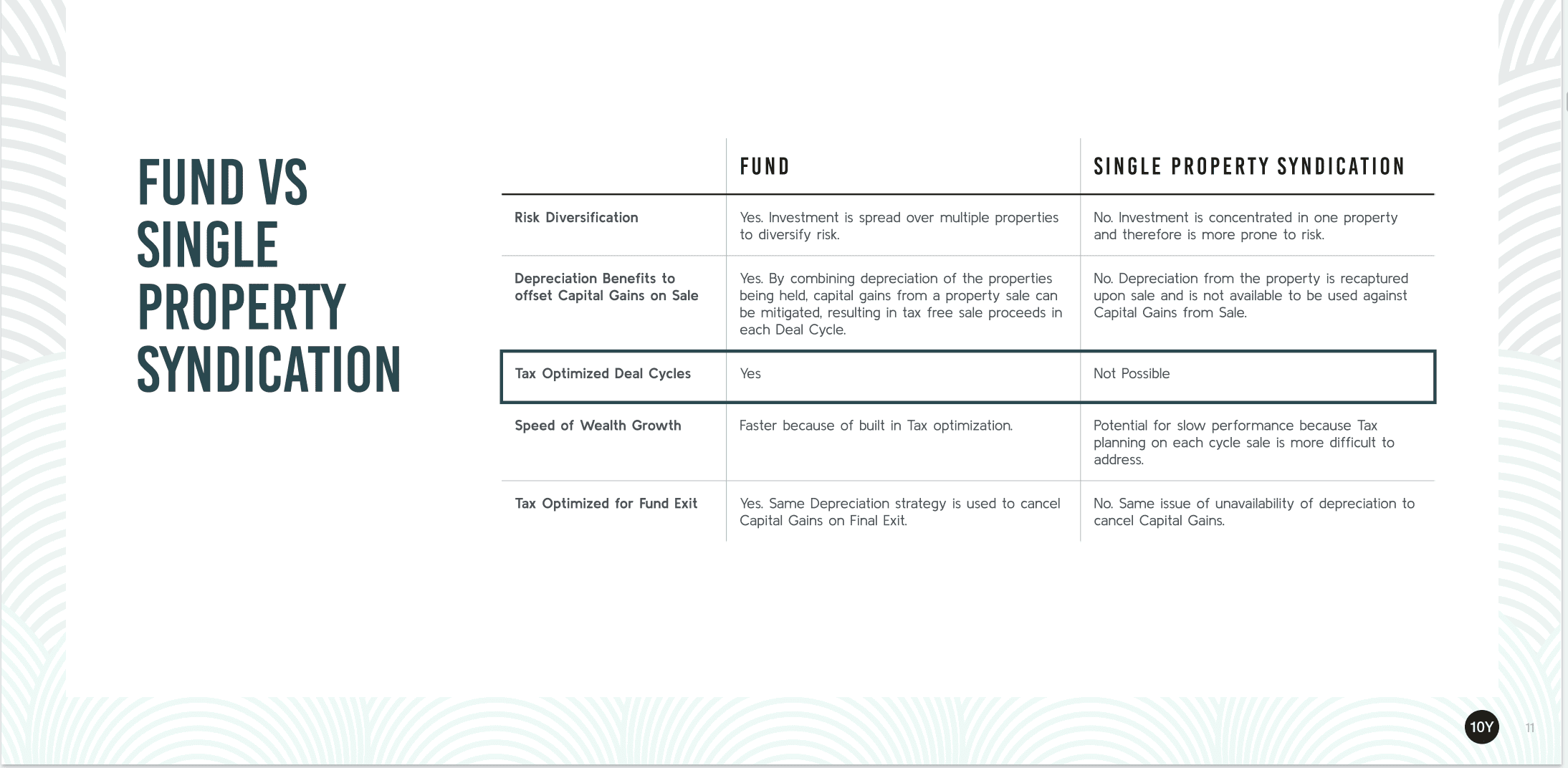

10Y is an Exponential Wealth Multiplier Fund. The fund will invest primarily in Multifamily Assets – both Value-Add and Ground Up Construction.

The fund will invest in a collection of properties rather than a single property. This strategy yields two distinctive advantages:

- Diversification of Limited Partner Investments across multiple properties, thereby mitigating the risks associated with a single property investment.

- Ability of the fund to combine depreciation benefits of the properties being held to offset capital gains from the property being sold, resulting in tax-free sale proceeds in each Deal Cycle.

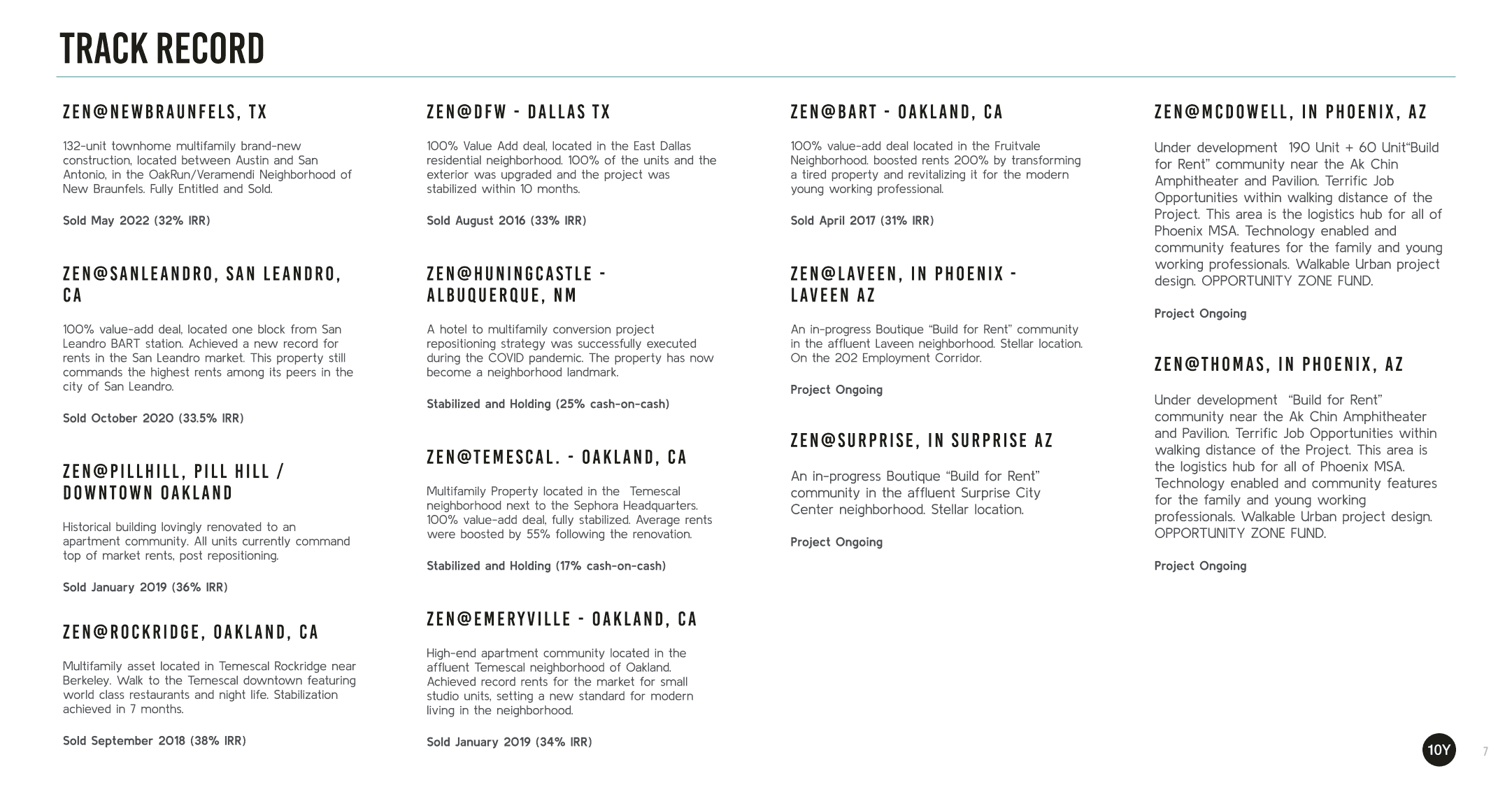

10Y is seeking to raise a total investment pool of $30 Million. Any project that the Fund invests in must pass our thorough vetting process and meet or exceed our precise return expectations.

- Product Type: Multifamily (Value-Add or Ground Up New Construction)

- Target LP Returns: Minimum 2X Equity Multiple in each Deal cycle (2yr)

- Sub Markets with good economic fundamentals

- Rents and Return metrics meeting or exceeding our targets

- Controllable and forecastable expenses

- Easy access to Living Amenities

Learn more about the 10Y Model

4096 Treeline Dr., Bettendorf, Iowa 52722

The testimonials, statements, and opinions presented are applicable to the individuals listed. Results will vary and may not be representative of the experience of others. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services, or any benefits in exchange for said statements. The testimonials are representative of client experience, but the exact results and experience will be unique and individual to each client. All offers and sales of any securities will be made only to Accredited Investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds or hold certain SEC approved certifications. Any securities that are offered, are offered in reliance on certain exemptions from the registration requirements of the Securities Act of 1933 (primarily Rule 506C of Regulation D and/or Section 4(a)(2) of the Act) and are not required to comply with specific disclosure requirements that apply to registrations under the Act. The SEC has not passed upon the merits of, or given its approval to any securities offered by Timberview Capital LLC, the terms of the offering, or the accuracy of completeness of any offering materials. Any securities that are offered by Timberview Capital LLC are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell any securities offered by Timberview Capital LLC. Investing in securities involves risk, and investors should be able to bear the loss of their investment. Any securities offered by Timberview Capital LLC are not subject to the protections of the Investment Company Act. Any performance data shared by Timberview Capital LLC represents past performance and past performance does not guarantee future results. Neither Timberview Capital LLC nor any of its funds are required by law to follow any standard methodology when calculating and representing performance data and the performance of any such funds may not be directly comparable to the performance of other private or registered funds.