Learning Center

Learning Center

Timberview Capital offers resources to support and further our partners’ financial education.

“Don’t ever fear failure – be afraid of being in the same place next year that you’re at today.”

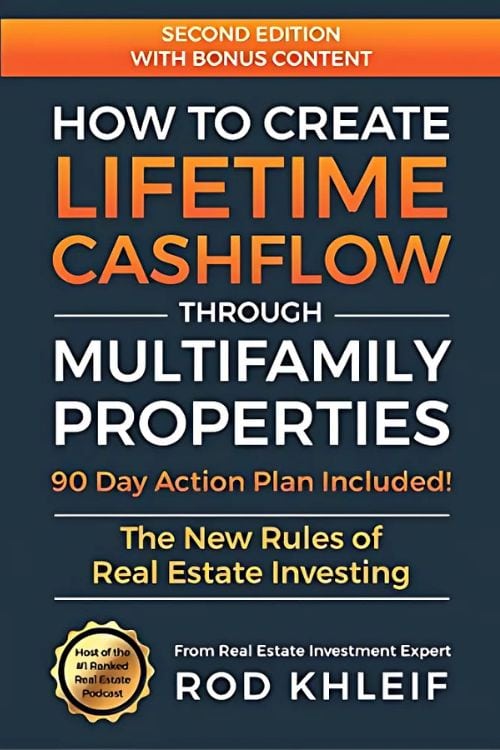

-Rod Khleif

Timberview Capital offers resources to support and further our partners’ financial education.

“Don’t ever fear failure – be afraid of being in the same place next year that you’re at today.”

-Rod Khleif

Blog

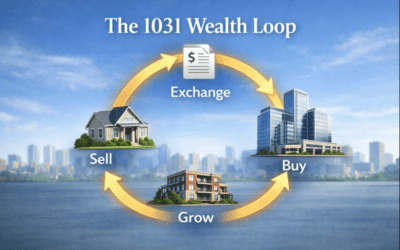

Using 1031 Exchanges to Keep Money Working Across Multiple Properties

Real estate gives investors many ways to grow wealth. One of the most powerful tools is the 1031 exchange. A 1031 exchange allows investors to sell a property and buy another one without paying capital gains tax right away. Instead of sending money to the IRS,...

The True Cost of Doing Nothing: How Inflation Destroys Cash Sitting Idle

Cash feels safe. But holding too much cash is costly. Inflation works quietly. It takes a little every day. Many investors do not see the loss because the number in their bank account does not change. The real buying power does. For investors who want to grow wealth,...

Cost Segregation Studies: What They Are and When They Matter

Real estate offers many benefits, but one of the most powerful is the tax advantage. Cost segregation is a tool that makes these tax benefits stronger and faster. Cost segregation is an IRS approved method used by investors, builders, hospitals, hotels, and major...

Blog

Using 1031 Exchanges to Keep Money Working Across Multiple Properties

Real estate gives investors many ways to grow wealth. One of the most powerful tools is the 1031 exchange. A 1031 exchange allows investors to sell a property and buy another one without paying capital gains tax right away. Instead of sending money to the IRS,...

The True Cost of Doing Nothing: How Inflation Destroys Cash Sitting Idle

Cash feels safe. But holding too much cash is costly. Inflation works quietly. It takes a little every day. Many investors do not see the loss because the number in their bank account does not change. The real buying power does. For investors who want to grow wealth,...

Cost Segregation Studies: What They Are and When They Matter

Real estate offers many benefits, but one of the most powerful is the tax advantage. Cost segregation is a tool that makes these tax benefits stronger and faster. Cost segregation is an IRS approved method used by investors, builders, hospitals, hotels, and major...

FAQs

What exactly does Timberview Capital do?

We started as a small group of physicians investing together. Our ability to find superior investment opportunities has allowed our network to grow substantially. Timberview Capital simply formalizes our process and network.

I spent most of my time doing research – researching investment opportunities. My goal is to find the best teams, with the best properties in the best geographic locations. By best teams I mean those with the ability to formulate and execute a business plan with superior returns for their investors. I’m looking for those with a significant collective experience and consistent track record of solid financial performance.

By best properties, I mean strong performing properties with substantial upside. We look for properties that can likely double our money in 2 to 5 years. The best locations will have significant population size and growth. I also look for high job growth and diversity. I like to see high median, household income and high median home price. High income tenants can pay high rents.

When you can check all three boxes, great team-great property-great location, you probably have found a home run opportunity. Keep in mind that these are investments, so there are risks and they don’t all perform as expected. Nevertheless, if they are carefully vetted most of them will perform well.

How is working with Timberview different?

We do the research so you don’t have to. We strive to check all the boxes: a great property, in a great location, with a great team. We are not limited to our own team and resources. We seek out the best teams, with the best properties in the best areas, with the best returns across the United States. At Timberview Capital we invest alongside our partners. With our own money invested alongside yours, we make sure that every deal is fully researched to ensure maximum returns and minimum risk. We work hard to try and find the very best investment opportunities, but investors should also do their own due diligence.

What is an accredited investor?

The Securities and Exchange Commission (SEC) defines an accredited investor as either an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

OR

An individual with with a net worth greater than 1 million excluding their primary residence.

If an offering is classified as a 506C by the SEC only accredited investors are able to invest.

For a 506C investment, you will be required to prove your Accredited Investor status. There are companies that do this for a fee. I recommend asking your CPA for a letter confirming your accredited investor status.

Do I need to be an accredited investor to work with Timberview?

Some of Timberview’s deals are classified as 506(c), which require accredited investor status to participate. However, we also offer 506(b) deals, giving non-accredited investors a chance to get involved. These opportunities are not posted on our website or promoted publicly, so to access them, you’ll need to be on our 506(b) investor list.

If you’re interested, schedule a call via www.timberviewcapital.com/contact to join our investor list and stay informed about 506(b) opportunities. Timberview serves investors of all experience levels, so don’t let beginner status keep you from getting started!

How do I replace my active income with passive income?

There are a lot of ways to do this. My preference is to keep a steady flow of new investments coming into my portfolio as my previous investments go full cycle and are sold. Many of these investments are doubling my money (or more) over 1 to 5 years. This creates exponential growth and a steady flow of capital so I don’t miss new great investment opportunities. Obviously it takes a few years to reach the point that you have a steady flow of assets being sold. The longer you sit on your hands and wait, the longer it will take. I recommend that you spread your capital over several investments when possible. Be careful to choose investments that perform well by carefully vetting the team, the property and the geographic location. If you can check all 3 of these boxes, it will probably be a home run. If you don’t have the ability, time or experience to carefully vet the deals, invest along side of people who do. That’s part of the reason I formed Timberview Capital.

The year I founded Timberview Capital, I lost 3 fantastic investment opportunities because we didn’t raise enough capital to close the deals. As Rod Khleif says – multifamily is a team sport. You don’t have to be great at everything. The larger the network, the better chance we will have the capital to close deals AND the better our deal flow – it’s all about the collective experience, capital and ability that creates success for the entire network.

Individuals score points, but teams win games.

-Zig Zeigler

How do I know that I can trust the General Partner team to have my back?

Timberview invests with real estate teams whose compensation is proportional to the property performance. Therefore, these teams are extremely motivated to do everything in their power to make sure their investors have strong returns because the investors (that’s you) get paid first.

Many of the syndication investments are set up with a preferred return. For example, if you are investing into a syndication as a limited partner, and they have an 8% preferred return, the Profits that are taken out of the investment made from the property go to the limited partners. The private placement memorandum will define exactly how the money flows. In the above example, 8% per year will go to the limited partners before the general partners get any of the profit. Generally, after paying the preferred return to the limited partners, the profits will be split between the general partners who bring the deal and do all the work and the limited partners who put up the money. How the money is split will be detailed in the private placement memorandum document.

“When investing, always be certain that everyone’s interest is aligned with yours and then make sure they have skin in the game.”

-NYT best-selling author, David Osborn

“Real estate…is about the safest investment in the world.”

-Franklin D. Roosevelt

Why is multifamily better than the stock market?

Unlike the stock market where you have no control over the growth of your investment, with multifamily we can force appreciation by upgrading the property/units and raising rents. Timberview joins teams that do the work and are compensated with a portion of the profits. Increasing rent will increase net operating income resulting in a directly proportional increase in property value.

Multifamily is not valued by comparables like single family homes but rather by a multiple of net operating income. It’s simple math; the net operating income divided by the cap rate gives you the property value. Therefore, we increase the value of the property by lowering expenses and increasing rent/income. For example, if we remodel and raise rents $300 on a 150-unit property the increased property value would be roughly $300 x 12 months x 150 units divided by the cap rate (5% for this example) = $10.8 million (less vacancy).

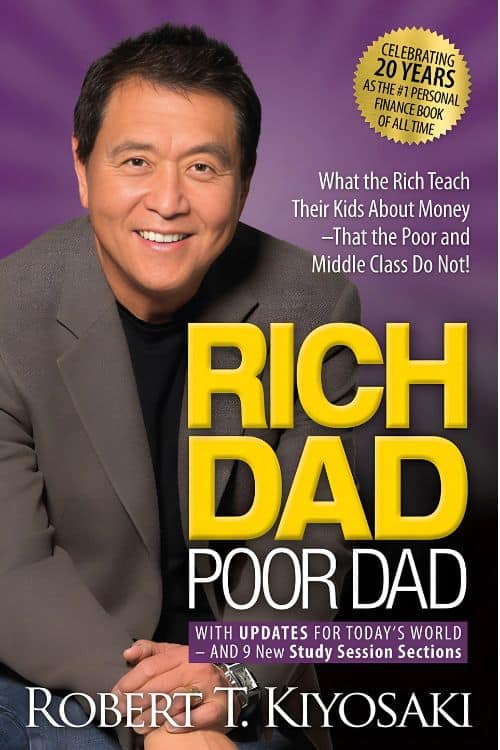

Paper assets like stocks do not grow wealth like cash flowing real assets such as apartments. According to Robert Kiyosaki, stocks and other paper assets are where the poor and middle class invest whereas the wealthy invest in cash-flowing real estate.

“Ninety percent of all millionaires become so through owning real estate.”

-Andrew Carnegie

My financial advisor has my portfolio of stocks diversified. He has even included some REITs. Do I really need real estate investments?

A diversified stock portfolio is not diversified at all – it’s all the same asset class. If the stock market crashes, it’s all going down. To truly diversify one needs to invest in various asset classes, such as real estate. Not a REIT, but rather real real estate that has an address. Real real estate is a much more stable asset class. It is much less volatile than the stock market. It also allows for much better wealth growth over time because of control and significant tax advantages.

Are there tax advantages to commercial real estate investing?

Commercial real estate kicks off significant depreciation to offset taxes. Dr. Cobb became serious about real estate investing in 2019 and has not paid significant taxes since, due to depreciation.

Through the use of cost segregation, commercial real estate can result in bonus depreciation of approximately 30-90% of your investment amount in the year of purchase. President Trump brought back 100% bonus depreciation in 2025. Many people believe this will stimulate the economy and the real estate market.

What is a 1031 exchange and how does it work?

A 1031 exchange allows investors to defer paying capital gains taxes when selling an investment property by reinvesting the proceeds into a new property of equal or greater value. This deferral can continue through multiple exchanges, allowing for the potential growth of wealth without immediate tax consequences.

Can I use a 1031 exchange for any type of property?

No, a 1031 exchange can only be used for “like-kind” properties, which generally means real estate for real estate. However, the properties don’t need to be identical—they just need to be used for investment or business purposes.

Are there any deadlines I need to meet in a 1031 exchange?

Yes, there are two critical deadlines: you must identify the replacement property (you can identify up to three) within 45 days of selling the original property, and the new property must be purchased within 180 days of the sale.

How do I get started with a 1031 exchange?

If you’re interested in using a 1031 exchange to defer taxes on the sale of investment properties, send an email to [email protected] to discuss your goals. We’ll connect you with the right people to guide you through the process and help you comply with the IRS requirements.

I’m an operator or project sponsor — can Timberview Capital help raise capital for my deal?

We work with operators and project sponsors who offer high-quality opportunities that align with our investment philosophy. If you have a strong track record and a compelling deal, we’d love to review it. Please submit your opportunity through our Sponsor Submission Form to begin the process.

Why aren’t preferred returns always paid?

A preferred return means investors receive 100% of the available cash flow until their stated return is met (for example, 8%). This gives investors priority over the sponsor when distributions are made.

However, preferred returns depend on the actual performance of the investment. If a property or project doesn’t generate enough cash flow in a given period, payments may be delayed. This doesn’t mean the preferred return is lost—it accrues and is paid out once there is sufficient cash flow. The preferred return is designed to prioritize investors, but it is not a guaranteed payment on a fixed schedule.

How can commercial real estate investments be structured for maximum tax efficiency?

One of the major advantages of investing in commercial real estate properties is the ability to take advantage of various tax benefits. For example, commercial real estate investors can deduct a range of expenses related to their property, including mortgage interest, property taxes, insurance, repairs, and maintenance.

In addition, commercial real estate investors can also take advantage of cost segregation, a tax planning strategy that allows them to accelerate depreciation and reduce their taxable income. Cost segregation involves separating a property’s assets into different categories based on their useful life and applying accelerated depreciation to the shorter-lived assets. This can result in significant tax savings for commercial real estate investors.

What factor does rent growth play in multifamily investments?

Rent growth is the primary fuel for adding value to the property. An investment’s returns can be maximized by choosing locations that feature substantial population and job growth.

What are some of the other advantages of commercial real estate investing?

Appreciation of commercial real estate property can be dramatic in times with significant inflation. While cash and cash equivalent investments are being depleted by inflation, the commercial real estate investor is experiencing significant growth.

Leverage can be an extreme multiplier for the real estate investor. For example, if you buy a 10-million-dollar apartment complex for 3 or 4 million down and finance the other 60-70%. Even though you didn’t pay 10 million dollars out of your pocket but rather the bank covered 60-70% of the property, you still get all of the profits and depreciation on the 10-million-dollar purchase.

Why would I want to trust a real estate syndicator? I have a long-term relationship with my financial advisor.

Syndicators of real estate are general partners that do the work and bring the deal. They get paid after the limited partners who bring the money. Syndicators are incentivized and motivated to make the limited partners money, because until the limited partners are paid, they don’t get to share any of the profit.

I’m new to real estate. How do I get started?

Spend as much time as possible looking at opportunities. The more deals you vet, the faster you will get comfortable sorting out which deals are right for you. Give us a call – we are happy to expedite your journey and extend advice on how to break through the glass ceiling that all investors have to deal with.

What if I don’t have enough money to make the minimum investment?

Some sponsors will allow investments below the minimum amount which is often between $50,000 and $100,000. Some can be $500,000 or more.

If the investment is a 506B, they are limited by SEC regulations to a maximum of 35 non-accredited investors. If you are a non-accredited investor and try to invest below the minimum and they reach the maximum number of non-accredited investors, you will almost surely get pushed out of the deal.

One option is to join with another investor, family member or friend, and pool your money and form a LLC and invest together. A group can also invest together through a Special Purpose vehicle.

What is a Roth rollover and how does it benefit investors?

A Roth rollover is the process of converting funds from a traditional IRA or 401(k) into a Roth IRA. While you pay taxes on the converted amount in the year of the rollover, future growth and withdrawals from the Roth IRA are entirely tax-free, providing substantial long-term tax benefits in retirement.

When should I consider a Roth rollover?

You should consider a Roth rollover anytime you want to save on future taxes and maximize the long-term growth of your wealth. By rolling over to a Roth IRA, your investments can grow tax-free, allowing you to enjoy tax-free withdrawals in retirement.

Are there income limits for contributing to a Roth IRA?

Yes, there are income limits for directly contributing to a Roth IRA. However, you can still convert funds from a traditional IRA to a Roth IRA regardless of your income through a Roth conversion (also known as a “backdoor” Roth).

Will I owe taxes when rolling over to a Roth IRA?

Yes, you’ll owe taxes on any pre-tax contributions and earnings in your traditional IRA or 401(k) that you convert to a Roth IRA. The advantage is that future withdrawals from the Roth IRA will be tax-free.

What is a discounted Roth rollover?

A discounted Roth rollover is a specific type of Roth rollover where you convert assets that are temporarily devalued. This allows you to pay taxes on a lower asset value during the conversion, reducing your immediate tax burden. Once the asset appreciates in the Roth account, future gains can be withdrawn tax-free.

How do tax savings of a self-directed retirement account differ from tax savings with a Roth?

A self-directed retirement account (e.g., a traditional IRA or 401(k)) allows you to defer taxes on investment gains until you withdraw the funds in retirement, at which point the withdrawals are taxed as ordinary income.

In contrast, a Roth IRA offers tax-free growth, meaning you pay taxes on contributions upfront, but your withdrawals—including gains—are entirely tax-free in retirement. Roth accounts are ideal for those expecting to be in a higher tax bracket later in life.

How do I get started with a Roth rollover?

If you’re considering a Roth rollover to optimize your retirement strategy and want to learn how it can benefit you, email [email protected]. We’ll introduce you to professionals who can help you navigate the process and determine if it’s the right move for your financial goals.

If these deals are so great, why open them to outside investors?

Timberview Capital’s investment portfolio exceeds $2 billion, a scale that would be impossible to achieve individually. By partnering with investors, we can access larger, higher-quality opportunities. This collaborative model not only strengthens our ability to secure top-tier properties but also creates a pathway for better returns for everyone involved.

Are there ways to use Real Estate Investments to offset taxes associated with Surgery Center Ownership Income?

Yes, most income from surgery center ownership is passive. Check with your CPA to confirm that your’s is set up this way. If your income from surgery center ownership is passive then the taxes associated from that income can be offset with depreciation from limited partner investments in real estate syndications.

FAQs

What exactly does Timberview Capital do?

We started as a small group of physicians investing together. Our ability to find superior investment opportunities has allowed our network to grow substantially. Timberview Capital simply formalizes our process and network.

I spent most of my time doing research – researching investment opportunities. My goal is to find the best teams, with the best properties in the best geographic locations. By best teams I mean those with the ability to formulate and execute a business plan with superior returns for their investors. I’m looking for those with a significant collective experience and consistent track record of solid financial performance.

By best properties, I mean strong performing properties with substantial upside. We look for properties that can likely double our money in 2 to 5 years. The best locations will have significant population size and growth. I also look for high job growth and diversity. I like to see high median, household income and high median home price. High income tenants can pay high rents.

When you can check all three boxes, great team-great property-great location, you probably have found a home run opportunity. Keep in mind that these are investments, so there are risks and they don’t all perform as expected. Nevertheless, if they are carefully vetted most of them will perform well.

How is working with Timberview different?

We do the research so you don’t have to. We strive to check all the boxes: a great property, in a great location, with a great team. We are not limited to our own team and resources. We seek out the best teams, with the best properties in the best areas, with the best returns across the United States. At Timberview Capital we invest alongside our partners. With our own money invested alongside yours, we make sure that every deal is fully researched to ensure maximum returns and minimum risk.

What is an accredited investor?

The Securities and Exchange Commission (SEC) defines an accredited investor as either an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

OR

An individual with with a net worth greater than 1 million excluding their primary residence.

If an offering is classified as a 506C by the SEC only accredited investors are able to invest.

For a 506C investment, you will be required to prove your Accredited Investor status. There are companies that do this for a fee. I recommend asking your CPA for a letter confirming your accredited investor status.

Do I need to be an accredited investor to work with Timberview?

Some of Timberview’s deals are classified as 506(c), which require accredited investor status to participate. However, we also offer 506(b) deals, giving non-accredited investors a chance to get involved. These opportunities are not posted on our website or promoted publicly, so to access them, you’ll need to be on our 506(b) investor list.

If you’re interested, schedule a call via www.timberviewcapital.com/contact to join our investor list and stay informed about 506(b) opportunities. Timberview serves investors of all experience levels, so don’t let beginner status keep you from getting started!

How do I replace my active income with passive income?

There are a lot of ways to do this. My preference is to keep a steady flow of new investments coming into my portfolio as my previous investments go full cycle and are sold. Most of these investments are doubling my money (or more) over 1 to 5 years. This creates exponential growth and a steady flow of capital so I don’t miss new great investment opportunities. Obviously it takes a few years to reach the point that you have a steady flow of assets being sold. The longer you sit on your hands and wait, the longer it will take. I recommend that you spread your capital over several investments when possible. Be careful to choose investments that perform well by carefully vetting the team, the property and the geographic location. If you can check all 3 of these boxes, it will probably be a home run. If you don’t have the ability, time or experience to carefully vet the deals, invest along side of people who do. That’s part of the reason I formed Timberview Capital.

The year I founded Timberview Capital, I lost 3 fantastic investment opportunities because we didn’t raise enough capital to close the deals. As Rod Khleif says – multifamily is a team sport. You don’t have to be great at everything. The larger the network, the better chance we will have the capital to close deals AND the better our deal flow – it’s all about the collective experience, capital and ability that creates success for the entire network.

Individuals score points, but teams win games.

-Zig Zeigler

How do I know that I can trust the General Partner team to have my back?

Timberview invests with real estate teams whose compensation is proportional to the property performance. Therefore, these teams are extremely motivated to do everything in their power to make sure their investors have strong returns because the investors (that’s you) get paid first.

Many of the syndication investments are set up with a preferred return. For example, if you are investing into a syndication as a limited partner, and they have an 8% preferred return, the first 8% of the profits made from the property go to the limited partners. The private placement memorandum will define exactly how the money flows. In the above example, 8% per year will go to the limited partners before the general partners get any of the profit. Generally, after paying the preferred return to the limited partners, the profits will be split between the general partners who bring the deal and do all the work and the limited partners who put up the money. How the money is split will be detailed in the private placement memorandum document.

“When investing, always be certain that everyone’s interest is aligned with yours and then make sure they have skin in the game.”

-NYT best-selling author, David Osborn

“Real estate…is about the safest investment in the world.”

-Franklin D. Roosevelt

Why is multifamily better than the stock market?

Unlike the stock market where you have no control over the growth of your investment, with multifamily we can force appreciation by upgrading the property/units and raising rents. Timberview joins teams that do the work and are compensated with a portion of the profits. Increasing rent will increase net operating income resulting in a directly proportional increase in property value.

Multifamily is not valued by comparables like single family homes but rather by a multiple of net operating income. It’s simple math; the net operating income divided by the cap rate gives you the property value. Therefore, we increase the value of the property by lowering expenses and increasing rent/income. For example, if we remodel and raise rents $300 on a 150-unit property the increased property value would be roughly $300 x 12 months x 150 units divided by the cap rate (5% for this example) = $10.8 million.

Paper assets like stocks do not grow wealth like cash flowing real assets such as apartments. According to Robert Kiyosaki, stocks and other paper assets are where the poor and middle class invest whereas the wealthy invest in cash-flowing real estate.

Another key value of real estate investments is their inherent stability. From 1973 to 2003 to real estate values fluctuated up and down by only 4%. This is in contrast to the stock market, which fluctuated 16.8%.

“Ninety percent of all millionaires become so through owning real estate.”

-Andrew Carnegie

Isn't the housing market in trouble with the rising interest rates?

Rental growth remains stable and strong throughout the US, and very strong in places like Texas and Florida where many people are moving for better weather, great job growth and no state income tax. Multifamily rents are at all-time highs. Vacancy rates are approaching historic lows. Rent projections remain stronger than pre-pandemic numbers. This is good news for the multifamily investor. As interest rates rise many would be homeowners will become renters further increasing the demand for multifamily.

My financial advisor has my portfolio of stocks diversified. He has even included some REITs. Do I really need real estate investments?

A diversified stock portfolio is not diversified at all – it’s all the same asset class. If the stock market crashes, it’s all going down. To truly diversify one needs to invest in various asset classes, such as real estate. Not a REIT, but rather real real estate that has an address. Real real estate is a much more stable asset class. It is much less volatile than the stock market. It also allows for much better wealth growth over time because of control and significant tax advantages.

Are there tax advantages to multifamily investing?

Multifamily kicks off significant depreciation to offset taxes. Dr. Cobb became serious about real estate investing in 2019 and has not paid significant taxes since, due to depreciation.

Through the use of cost segregation, multifamily can result in bonus depreciation of approximately 50-80% of your investment amount in the year of purchase. 2022 was the last year for 100% of the depreciation generated by real estate in the year you purchase. For 2023, 80% can be used in the 1st year. In 2024, it is scheduled to drop to 60%.

What is a 1031 exchange and how does it work?

A 1031 exchange allows investors to defer paying capital gains taxes when selling an investment property by reinvesting the proceeds into a new property of equal or greater value. This deferral can continue through multiple exchanges, allowing for the potential growth of wealth without immediate tax consequences.

Can I use a 1031 exchange for any type of property?

No, a 1031 exchange can only be used for “like-kind” properties, which generally means real estate for real estate. However, the properties don’t need to be identical—they just need to be used for investment or business purposes.

Are there any deadlines I need to meet in a 1031 exchange?

Yes, there are two critical deadlines: you must identify the replacement property (you can identify up to three) within 45 days of selling the original property, and the new property must be purchased within 180 days of the sale.

How do I get started with a 1031 exchange?

If you’re interested in using a 1031 exchange to defer taxes on the sale of investment properties, send an email to [email protected] to discuss your goals. We’ll connect you with the right people to guide you through the process and help you comply with the IRS requirements.

I’m an operator or project sponsor — can Timberview Capital help raise capital for my deal?

We work with operators and project sponsors who offer high-quality opportunities that align with our investment philosophy. If you have a strong track record and a compelling deal, we’d love to review it. Please submit your opportunity through our Sponsor Submission Form to begin the process.

How can multifamily investments be structured for maximum tax efficiency?

One of the major advantages of investing in multifamily properties is the ability to take advantage of various tax benefits. For example, multifamily investors can deduct a range of expenses related to their property, including mortgage interest, property taxes, insurance, repairs, and maintenance.

In addition, multifamily investors can also take advantage of cost segregation, a tax planning strategy that allows them to accelerate depreciation and reduce their taxable income. Cost segregation involves separating a property’s assets into different categories based on their useful life and applying accelerated depreciation to the shorter-lived assets. This can result in significant tax savings for multifamily investors.

What factor does rent growth play in multifamily investments?

Rent growth is the primary fuel for adding value to the property. An investment’s returns can be maximized by choosing locations that feature substantial population and job growth. Timberview values these traits incredibly highly when making our investment selections.

What are some of the other advantages of multifamily investing?

Appreciation of multifamily property can be dramatic in times like these with significant inflation. While cash and cash equivalent investments are being depleted by inflation, the multifamily investor is experiencing significant growth.

Leverage can be an extreme multiplier for the real estate investor. For example, if you buy a 10-million-dollar apartment complex for 3 or 4 million down and finance the other 60-70%. Even though you didn’t pay 10 million dollars out of your pocket but rather the bank covered 60-70% of the property, you still get all of the profits and depreciation on the 10-million-dollar purchase.

Why would I want to trust a real estate syndicator? I have a long-term relationship with my financial advisor.

Syndicators of real estate are general partners that do the work and bring the deal. They get paid after the limited partners who bring the money. Syndicators are incentivized and motivated to make the limited partners money, because until the limited partners are paid, they don’t get to share any of the profit.

I’m new to real estate. How do I get started?

Spend as much time as possible looking at opportunities. The more deals you vet, the faster you will get comfortable sorting out which deals are right for you. Give us a call – we are happy to expedite your journey and extend advice on how to break through the glass ceiling that all investors have to deal with.

What if I don’t have enough money to make the minimum investment?

Some sponsors will allow investments below the minimum amount which is often between $50,000 and $100,000. Some can be $500,000 or more.

If the investment is a 506B, they are limited by SEC regulations to a maximum of 35 non-accredited investors. If you are a non-accredited investor and try to invest below the minimum and they reach the maximum number of non-accredited investors, you will almost surely get pushed out of the deal.

One option is to join with another investor, family member or friend, and pool your money and form a LLC and invest together. A group can also invest together through a Special Purpose vehicle.

What is a Roth rollover and how does it benefit investors?

A Roth rollover is the process of converting funds from a traditional IRA or 401(k) into a Roth IRA. While you pay taxes on the converted amount in the year of the rollover, future growth and withdrawals from the Roth IRA are entirely tax-free, providing substantial long-term tax benefits in retirement.

When should I consider a Roth rollover?

You should consider a Roth rollover anytime you want to save on future taxes and maximize the long-term growth of your wealth. By rolling over to a Roth IRA, your investments can grow tax-free, allowing you to enjoy tax-free withdrawals in retirement, which can be especially beneficial if you expect your tax rate to increase in the future.

Are there income limits for contributing to a Roth IRA?

Yes, there are income limits for directly contributing to a Roth IRA. However, you can still convert funds from a traditional IRA to a Roth IRA regardless of your income through a Roth conversion (also known as a “backdoor” Roth).

Will I owe taxes when rolling over to a Roth IRA?

Yes, you’ll owe taxes on any pre-tax contributions and earnings in your traditional IRA or 401(k) that you convert to a Roth IRA. The advantage is that future withdrawals from the Roth IRA will be tax-free.

What is a discounted Roth rollover?

A discounted Roth rollover is a specific type of Roth rollover where you convert assets that are temporarily devalued. This allows you to pay taxes on a lower asset value during the conversion, reducing your immediate tax burden. Once the asset appreciates in the Roth account, future gains can be withdrawn tax-free.

How do tax savings of a self-directed retirement account differ from tax savings with a Roth?

A self-directed retirement account (e.g., a traditional IRA or 401(k)) allows you to defer taxes on investment gains until you withdraw the funds in retirement, at which point the withdrawals are taxed as ordinary income.

In contrast, a Roth IRA offers tax-free growth, meaning you pay taxes on contributions upfront, but your withdrawals—including gains—are entirely tax-free in retirement. Roth accounts are ideal for those expecting to be in a higher tax bracket later in life.

How do I get started with a Roth rollover?

If you’re considering a Roth rollover to optimize your retirement strategy and want to learn how it can benefit you, email [email protected]. We’ll introduce you to professionals who can help you navigate the process and determine if it’s the right move for your financial goals.

In contrast, a Roth IRA offers tax-free growth, meaning you pay taxes on contributions upfront, but your withdrawals—including gains—are entirely tax-free in retirement. Roth accounts are ideal for those expecting to be in a higher tax bracket later in life.

If these deals are so great, why open them to outside investors?

Timberview Capital’s investment portfolio exceeds $1 billion, a scale that would be impossible to achieve individually. By partnering with investors, we can access larger, higher-quality opportunities. This collaborative model not only strengthens our ability to secure top-tier properties but also creates a pathway for better returns for everyone involved.

Why aren’t preferred returns always paid?

A preferred return means investors receive 100% of the available cash flow until their stated return is met (for example, 8%). This gives investors priority over the sponsor when distributions are made.

However, preferred returns depend on the actual performance of the investment. If a property or project doesn’t generate enough cash flow in a given period, payments may be delayed. This doesn’t mean the preferred return is lost—it accrues and is paid out once there is sufficient cash flow. The preferred return is designed to prioritize investors, but it is not a guaranteed payment on a fixed schedule.

Are there ways to use Real Estate Investments to offset taxes associated with Surgery Center Ownership Income?

Yes, most income from surgery center ownership is passive. Check with your CPA to confirm that your’s is set up this way. If your income from surgery center ownership is passive then the taxes associated from that income can be offset with depreciation from limited partner investments in real estate syndications.

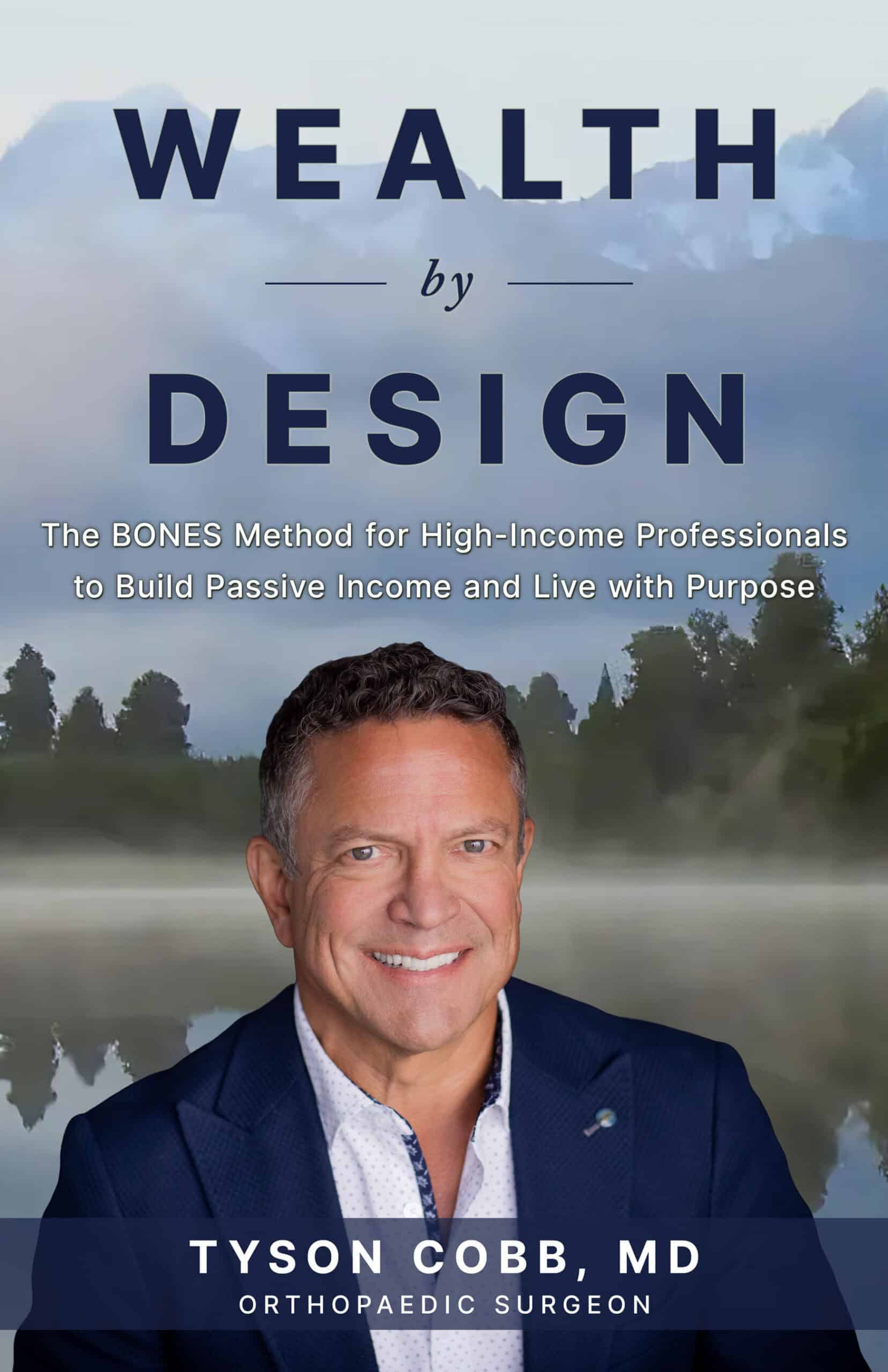

Reading List

A collection of our best of the best – informational, creative, powerful works that inspire and educate. Read along at your leisure and contact us to let us know some of your favorites!

“Not all readers are leaders, but all leaders are

readers.”

-Harry S. Truman

Real Estate:

Wealth By Design

Tyson Cobb, MD

Rich Dad Poor Dad

Robert Kiyosaki

How to Create Lifetime Cash Flow

Rod Khleif

The Multifamily Millionaire

Brandon Turner & Brian Murray

Apartment Syndication Made Easy

Vinney Chopra

Best Ever Apartment Syndication Book

Joe Fairless

The Millionaire Real Estate Investor

Gary Keller

Wealth Can't Wait

David Osborne & Paul Morris

Retail Property Riches

A.J. Peak

Broader Topics:

Unshakeable

Tony Robbins

Think And Grow Rich

Napoleon Hill

The Miracle Morning

Hal Elrod

Good To Great

Jim Collins

7 Habits of Highly Effective People

Stephen Covey

The One Thing

Gary Keller

Building A Story Brand

Donald Miller

The Purpose Driven Life

Rick Warren

The Gap And The Gain

Dan Sullivan

12 Pillars

Jim Rohn & Chris Widener

Unshakeable

Christine Caine

Your Best Life Now

Joel Olsteen

Better Decisions, Fewer Regrets

Andy Stanley

The Practice of the Presence of God

Brother Lawrence

Emotional Intelligence

Daniel Goleman

Man's Search For Meaning

Viktor Frankl

Atomic Habits

James Clear

How To Win Friends And Influence People

Dale Carnegie

10x Is Easier Than 2x

Dan Sullivan & Dr. Benjamin Hardy

The Success Principles

Jack Canfield

High Performance Habits

Brendon Burchard

You Can, You Will

Joel Osteen

Reading List

A collection of our best of the best – informational, creative, powerful works that inspire and educate. Read along at your leisure and contact us to let us know some of your favorites!

“Not all readers are leaders, but all leaders are readers.”

-Harry S. Truman

Real Estate:

Wealth By Design

Tyson Cobb

Rich Dad Poor Dad

Robert Kiyosaki

How to Create Lifetime Cash Flow

Rod Khleif

The Multifamily Millionaire

Brandon Turner & Brian Murray

Apartment Syndication Made Easy

Vinney Chopra

Best Ever Apartment Syndication Book

Joe Fairless

The Millionaire Real Estate Investor

Gary Keller

Wealth Can't Wait

David Osborne & Paul Morris

Retail Property Riches

A.J. Peak

Broader Topics:

Unshakeable

Tony Robbins

Think And Grow Rich

Napoleon Hill

The Miracle Morning

Hal Elrod

Good To Great

Jim Collins

7 Habits of Highly Effective People

Stephen Covey

The One Thing

Gary Keller

Building A Story Brand

Donald Miller

The Purpose Driven Life

Rick Warren

The Gap And The Gain

Dan Sullivan

12 Pillars

Jim Rohn & Chris Widener

Unshakeable

Christine Caine

Your Best Life Now

Joel Olsteen

Better Decisions, Fewer Regrets

Andy Stanley

The Practice of the Presence of God

Brother Lawrence

Emotional Intelligence

Daniel Goleman

Man's Search For Meaning

Viktor Frankl

Atomic Habits

James Clear

How To Win Friends And Influence People

Dale Carnegie

Better Decisions, Fewer Regrets

Andy Stanley

The Practice of the Presence of God

Brother Lawrence

Emotional Intelligence

Daniel Goleman

Man's Search For Meaning

Viktor Frankl

Atomic Habits

James Clear

How To Win Friends And Influence People

Dale Carnegie

10x Is Easier Than 2x

Dan Sullivan & Dr. Benjamin Hardy

The Success Principles

Jack Canfield

High Performance Habits

Brendon Burchard

You Can, You Will

Joel Osteen

The testimonials, statements, and opinions presented are applicable to the individuals listed. Results will vary and may not be representative of the experience of others. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services, or any benefits in exchange for said statements. The testimonials are representative of client experience, but the exact results and experience will be unique and individual to each client. All offers and sales of any securities will be made only to Accredited Investors, which, for natural persons, are investors who meet certain minimum annual income or net worth thresholds or hold certain SEC-approved certifications. Any securities that are offered in reliance on certain exemptions from the registration requirements of the Securities Act of 1933 (primarily Rule 506C of Regulation D and/or Section 4(a)(2) of the Act) and are not required to comply with specific disclosure requirements that apply to registrations under the Act. The SEC has not passed upon the merits of, or given its approval to, any securities offered by Timberview Capital LLC, the terms of the offering, or the accuracy or completeness of any offering materials. Any securities that are offered by Timberview Capital LLC are subject to legal restrictions on transfer and resale, and investors should not assume they will be able to resell any securities offered by Timberview Capital LLC. Investing in securities involves risk, and investors should be able to bear the loss of their investment. Any securities offered by Timberview Capital LLC are not subject to the protections of the Investment Company Act. Any performance data shared by Timberview Capital LLC represents past performance, and past performance does not guarantee future results. Neither Timberview Capital LLC nor any of its funds is required by law to follow any standard methodology when calculating and representing performance data, and the performance of any such funds may not be directly comparable to the performance of other private or registered funds.