Foss Fields Phase I

A groundbreaking local heritage opportunity for accredited investors seeking passive income, tax efficiency, and risk management.

Located in Sioux Falls, South Dakota, this 100-unit development phase (for a projected total of 500 units) will be built within the 300-acre Foss Fields master development dedicated to WWII fighter pilot and local hero Joe Foss, who grew up in a farmhouse on this same land. The project is engineered to work within a high interest rate environment, building and leasing faster than nearly any other comparable apartment development, and delivering risk-adjusted passive returns and superior tax benefits for investors.

Foss Fields Phase I

A groundbreaking local heritage opportunity for accredited investors seeking passive income, tax efficiency, and risk management.

Located in Sioux Falls, South Dakota, this 100-unit development phase (for a projected total of 500 units) will be built within the 300-acre Foss Fields master development dedicated to WWII fighter pilot and local hero Joe Foss, who grew up in a farmhouse on this same land. The project is engineered to work within a high interest rate environment, building and leasing faster than nearly any other comparable apartment development, and delivering risk-adjusted passive returns and superior tax benefits for investors.

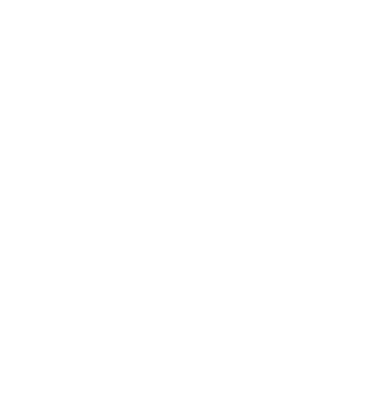

Targeted Returns

We negotiated superior returns for the Timberview Capital network to gain access to Institutional returns with just a $50K minimum, typically reserved for $1M investors.

Targeted Returns

We negotiated superior returns for the Timberview Capital network to gain access to Institutional returns with just a $50K minimum, typically reserved for $1M investors.

POTENTIAL TAX BENEFITS

Estimated totals for every $100K invested

45L Tax Credits Due To Energy Efficient Construction — $4,153

Accelerated Depreciation Due To Cost Segregation — $19,939

TOTAL BENEFITS: $24,092

These numbers are a best estimate as of Feb 2025 and may change.

POTENTIAL TAX BENEFITS

Estimated totals for every $100K invested

45L Tax Credits Due To Energy Efficient Construction — $4,153

Accelerated Depreciation Due To Cost Segregation — $19,939

TOTAL BENEFITS: $24,092

These numbers are a best estimate as of Feb 2025 and may change.

Why Sioux Falls

%

Occupancy

%

YOY Rent Growth

%

Population Growth Since 2020

%

Unemployment Rate

Why Sioux Falls

%

Occupancy

%

YOY Rent Growth

%

Population Growth Since 2020

%

Unemployment Rate

Offering Summary

Offering Summary

FullY Entitled, Shovel-Ready In Affluent Zip Code

This Class A location (57110 zip) is next to the second largest retail center (Dawley Farm) in Sioux Falls. The high-demand, supply-starved submarket is mostly affluent single-family homes and acreages, so little development opportunity remains in the area (extremely limited competition).

- $87,114 median household income

- An A-Rated school district; among top in state

- Sioux Falls metro had lowest unemployment in US (1.6%-1.9%) with steady population growth (2.66%) in 2024

FullY Entitled, Shovel-Ready In Affluent Zip Code

This Class A location (57110 zip) is next to the second largest retail center (Dawley Farm) in Sioux Falls. The high-demand, supply-starved submarket is mostly affluent single-family homes and acreages, so little development opportunity remains in the area (extremely limited competition).

- $87,114 median household income

- An A-Rated school district; among top in state

- Sioux Falls metro had lowest unemployment in US (1.6%-1.9%) with steady population growth (2.66%) in 2024

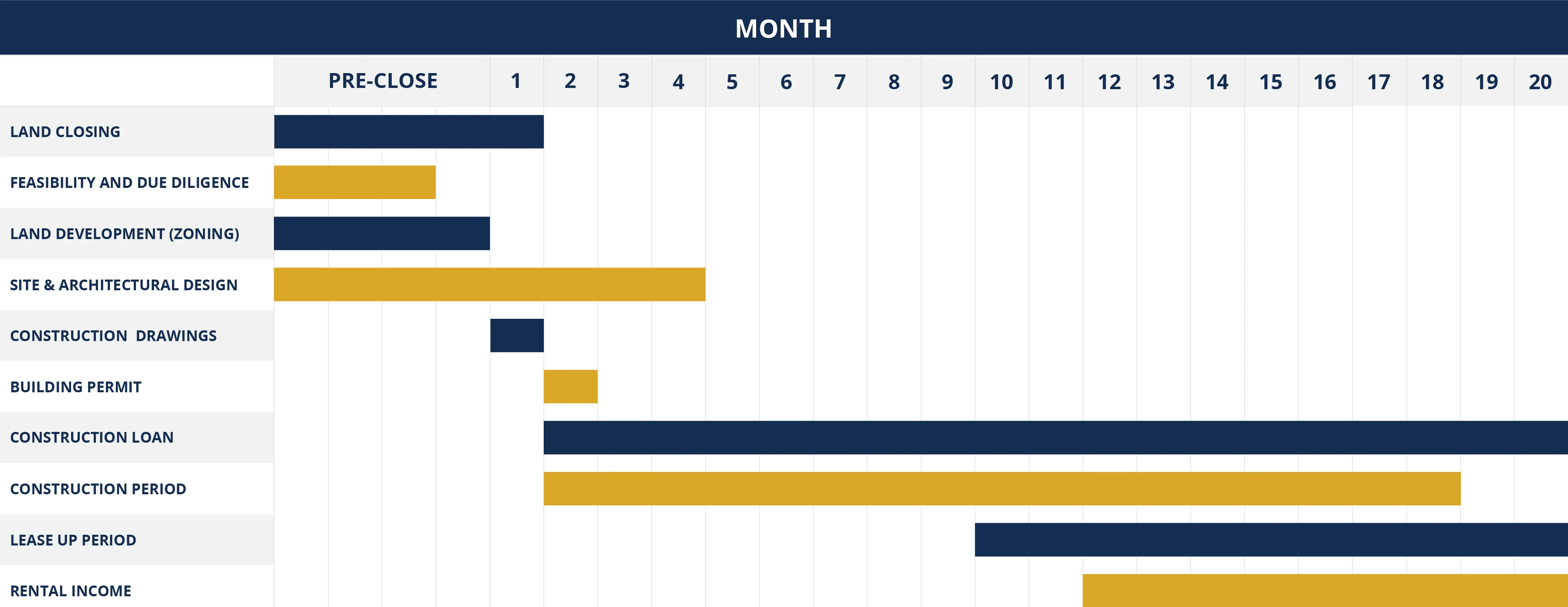

Development Model Accelerates Cash Flow

This Core-Amenity “Reserve Style” project is a set of four 25-unit buildings. We are targeting first unit delivery in 8-10 months, and total construction completion within 16 months. By excluding traditional frills like a gym and underground parking, we build faster, then lease up as each building is completed.

- Incredible $140K cost per unit for gorgeous brand new units

- Quicker lease-up means faster cash flows

- Faster cash flows mean better finance and refinance options

- Core Amenities approach nets rents slightly under market premiums but with greatly reduced construction time, cost, and risk

Development Model Accelerates Cash Flow

This Core-Amenity “Reserve Style” project is a set of four 25-unit buildings. We are targeting first unit delivery in 8-10 months, and total construction completion within 16 months. By excluding traditional frills like a gym and underground parking, we build faster, then lease up as each building is completed.

- Incredible $140K cost per unit for gorgeous brand new units

- Quicker lease-up means faster cash flows

- Faster cash flows mean better finance and refinance options

- Core Amenities approach nets rents slightly under market premiums but with greatly reduced construction time, cost, and risk

Heritage Land Of Local Hero

The project is especially exciting as the property will rest on the original farmhouse land of WWII flying ace Joe Foss; hence “Foss” Fields.

- Medal of Honor recipient

- 20th Governor of South Dakota

- Our head of construction, Caleb Veldhouse, sourced the land directly from the descendents

- As Joe Foss had to answer the call to go fight in a World War, so do we now answer the call to tackle (and WIN) the battle for modern affordable housing

Heritage Land Of Local Hero

The project is especially exciting as the property will rest on the original farmhouse land of WWII flying ace Joe Foss; hence “Foss” Fields.

- Medal of Honor recipient

- 20th Governor of South Dakota

- Our head of construction, Caleb Veldhouse, sourced the land directly from the descendents

- As Joe Foss had to answer the call to go fight in a World War, so do we now answer the call to tackle (and WIN) the battle for modern affordable housing

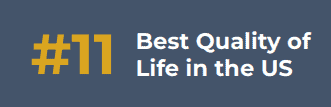

THE SIOUX FALLS ADVANTAGE

☑ Thriving & diversified economy: healthcare, tech, retail, service

☑ Higher average household income than national average

☑ Housing demand far outpacing supply

☑ Lower unemployment rate than the national average

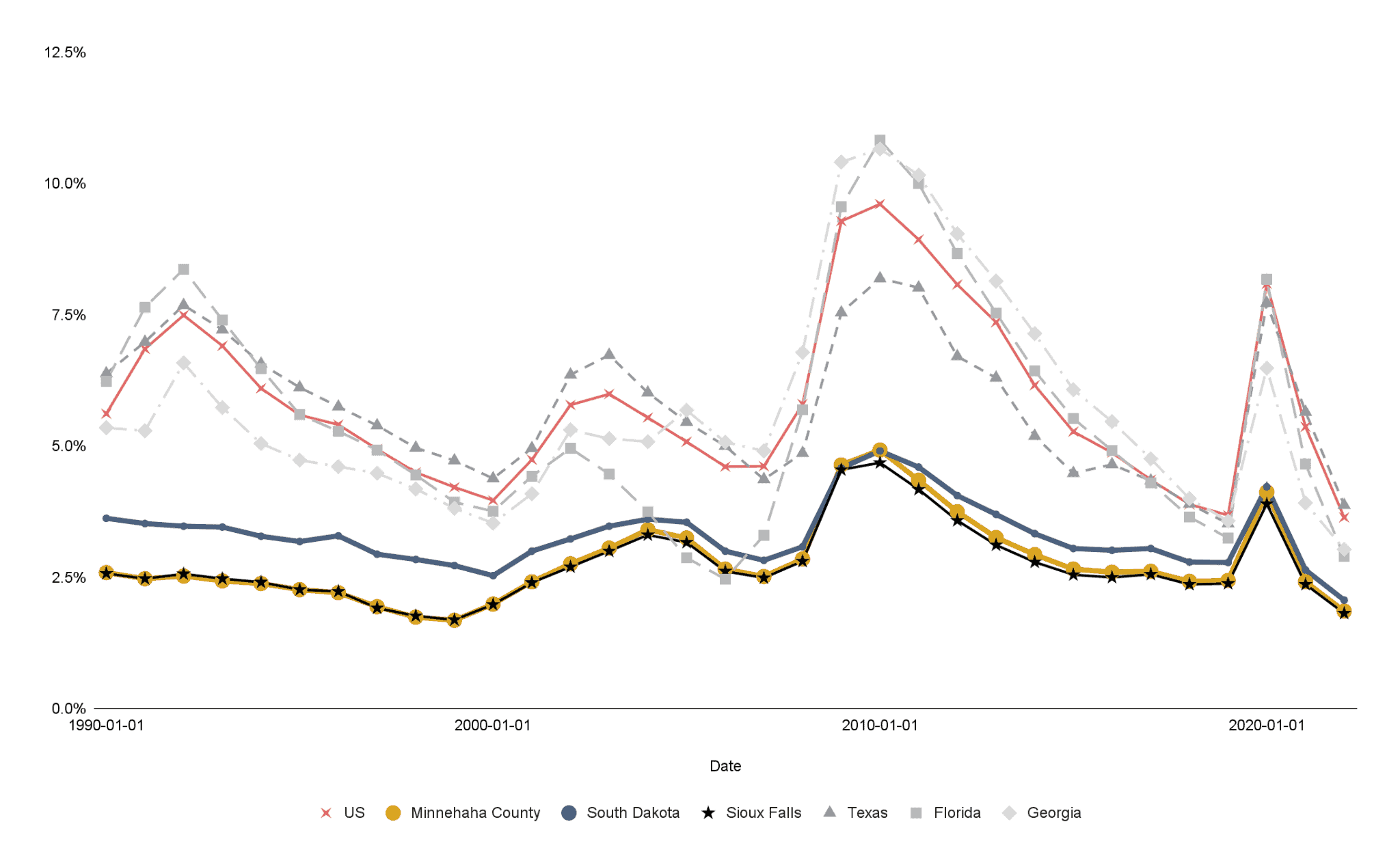

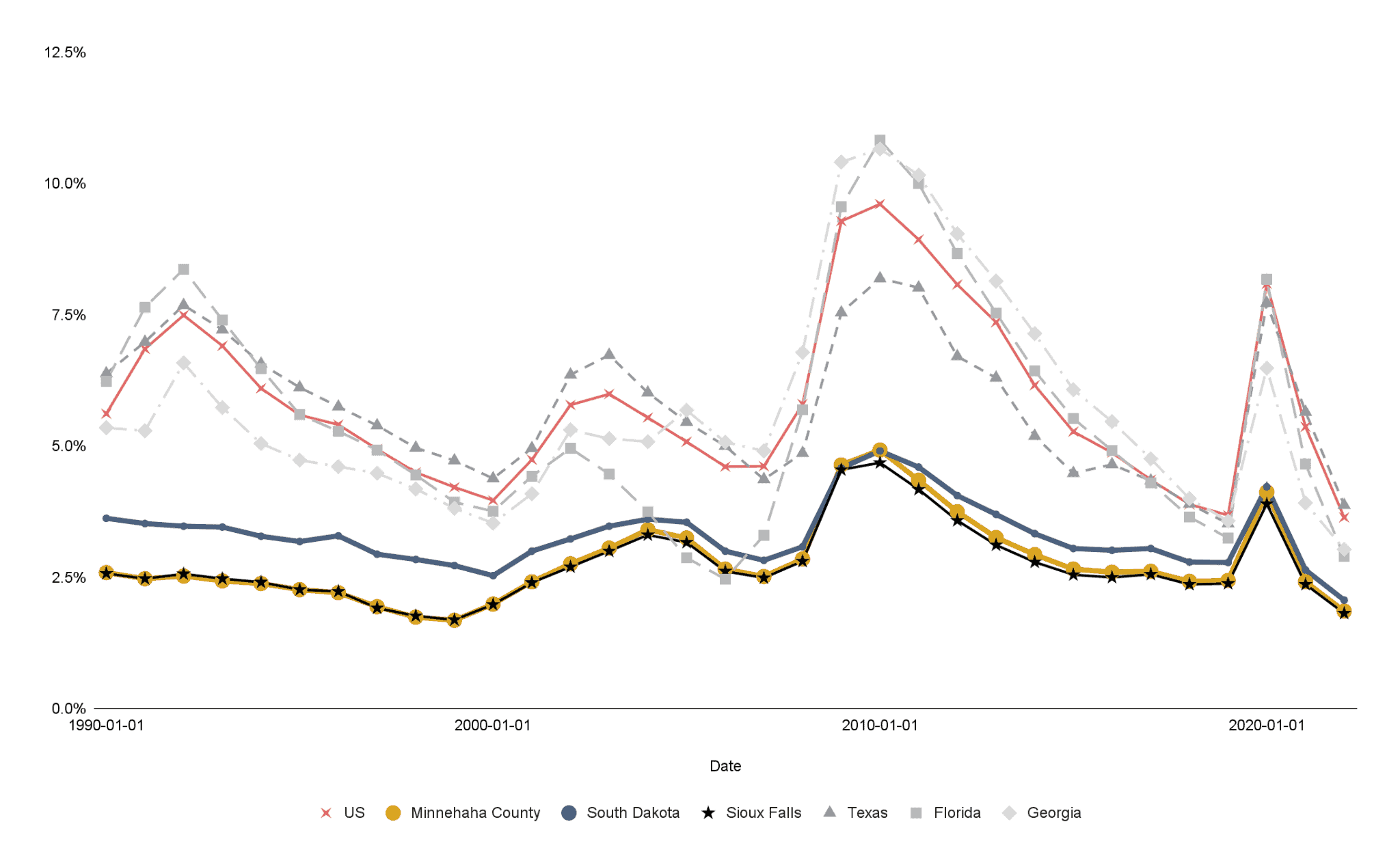

Unemployment Trend

Sioux Falls consistently maintains a lower long-term unemployment rate than the national average and major markets like Texas, Florida, and Georgia.

☑ Our existing developments in the area allow us insider knowledge plus economies of scale when it comes to property management contracts, maintenance fees, and the like

☑ Rising home prices & rents due to competition from buyers & renters

☑ Minimal competition from existing product as well as constrained future supply as weaker developers have put their pencils down/stopped developing

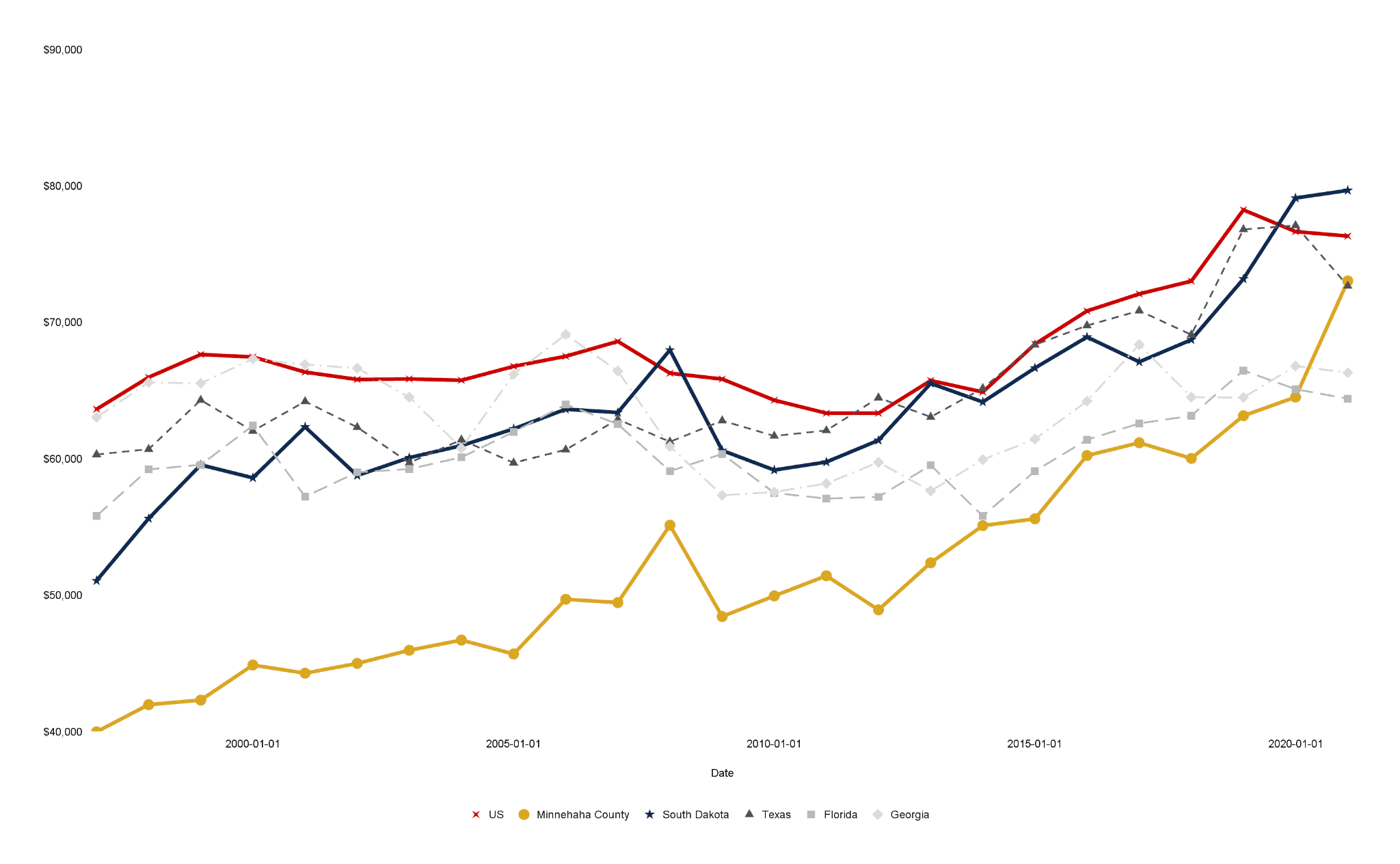

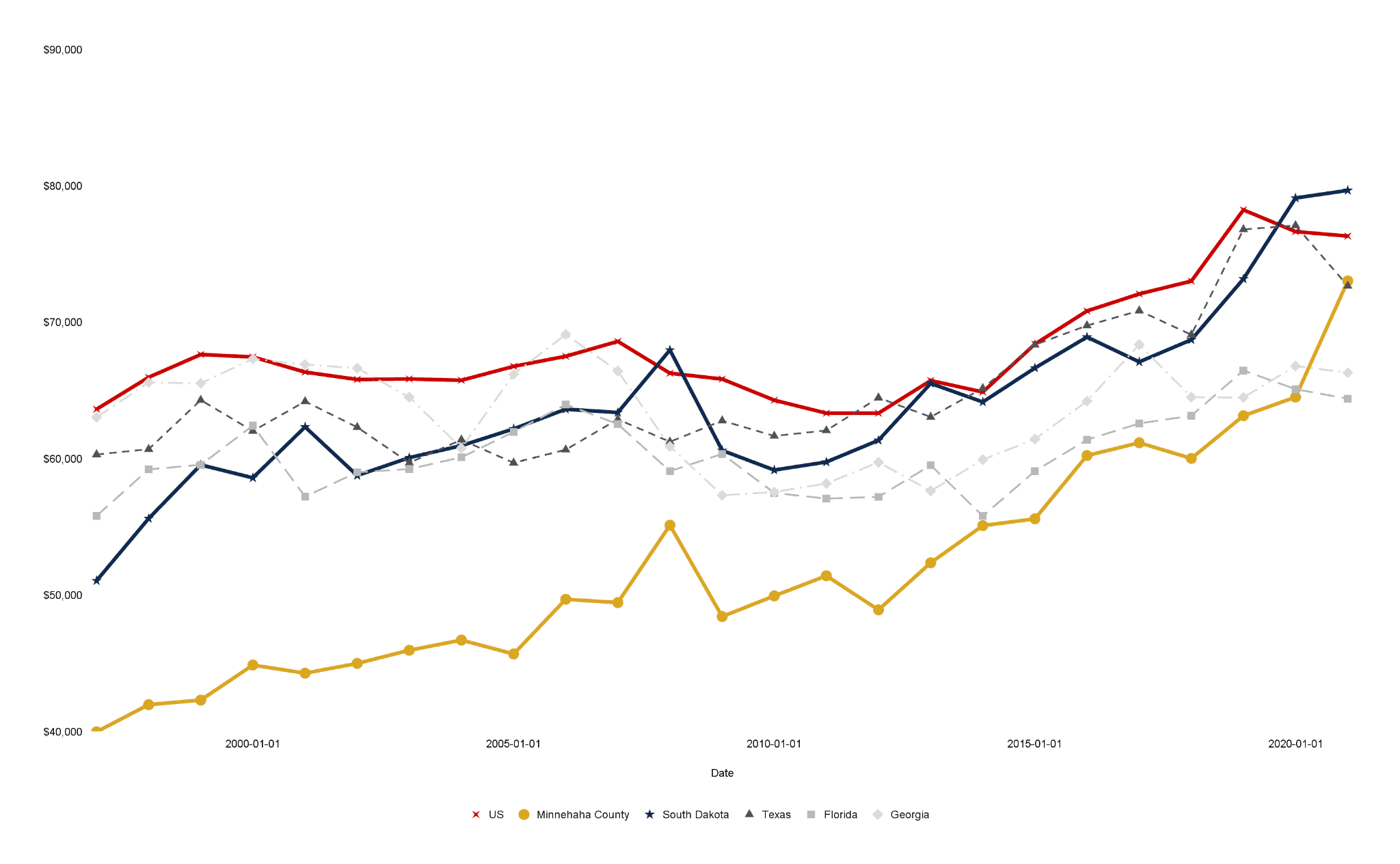

Household Income

South Dakota boasts a median income that surpasses both the U.S. national average and other prominent markets like Texas, Florida, and Georgia.

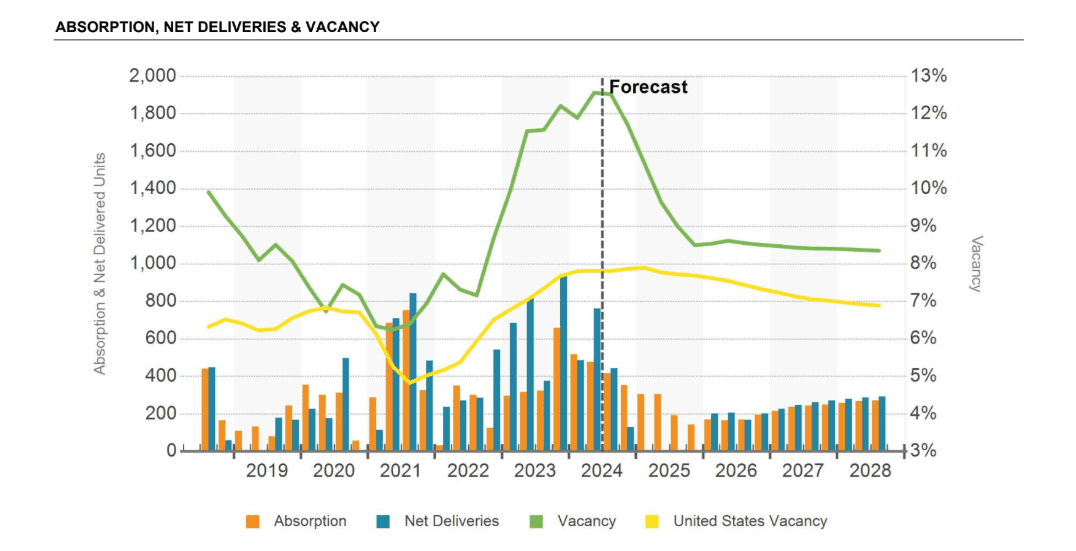

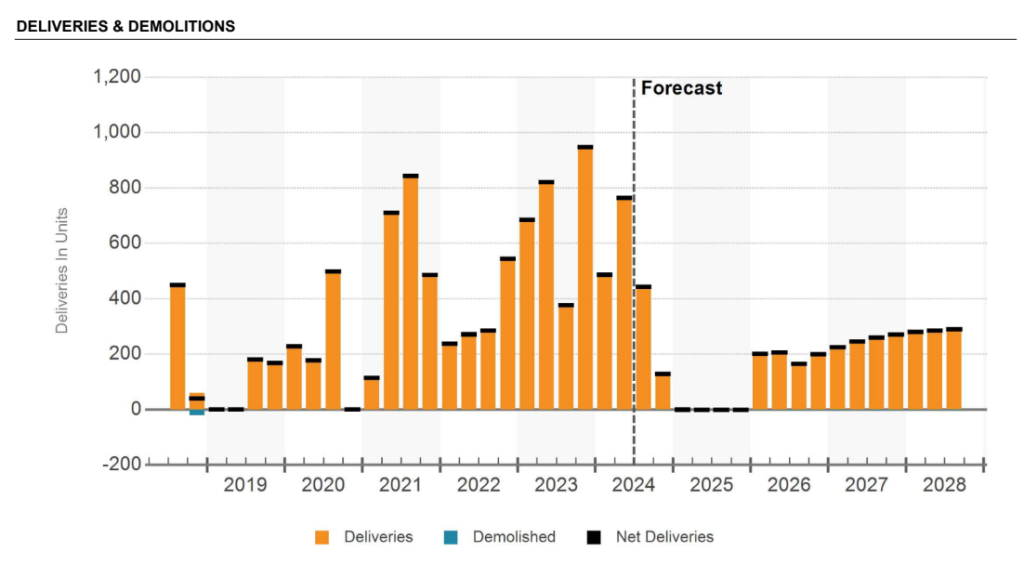

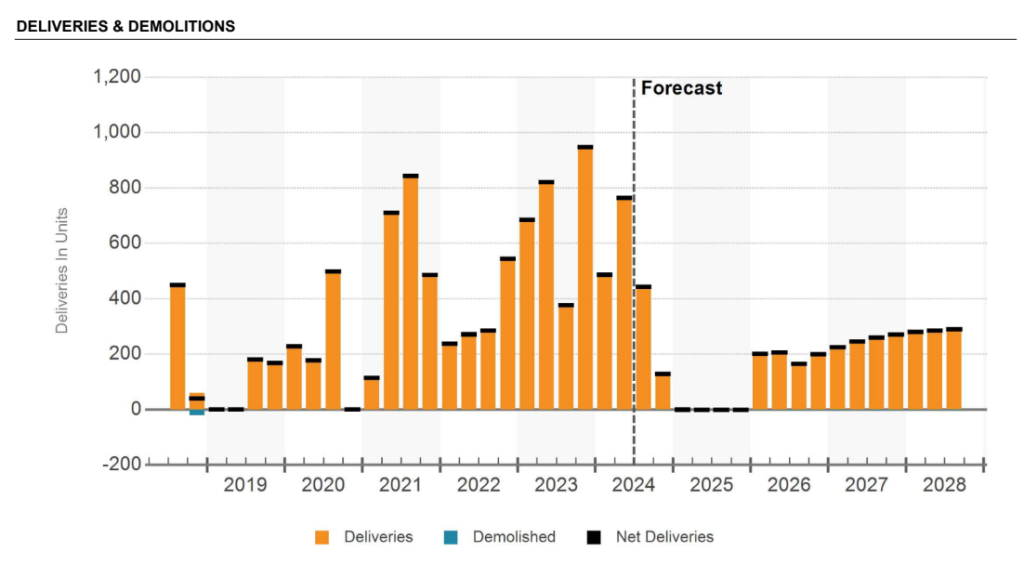

MULTIFAMILY ACTION WAY BELOW 2020-2023 LEVELS

This is very pronounced in Sioux Falls, with permitting data in 2024 much lower than the same timeframe in 2023 and 2022, and projected deliveries falling off a cliff.

Yet demand for housing remains strong. Showing that once the current supply is absorbed, there will not be enough future supply to meet demand… likely resulting in upward pressure on rents!

We have underwritten conservatively to not rely on higher rents, but this is a powerful potential upside.

THE SIOUX FALLS ADVANTAGE

☑ Thriving & diversified economy: healthcare, tech, retail, service

☑ Higher average household income than national average

☑ Housing demand far outpacing supply

☑ Lower unemployment rate than the national average

Unemployment Trend

Sioux Falls consistently maintains a lower long-term unemployment rate than the national average and major markets like Texas, Florida, and Georgia.

☑ Our existing developments in the area allow us insider knowledge plus economies of scale when it comes to property management contracts, maintenance fees, and the like

☑ Rising home prices & rents due to competition from buyers & renters

☑ Minimal competition from existing product as well as constrained future supply as weaker developers have put their pencils down/stopped developing

Household Income

South Dakota boasts a median income that surpasses both the U.S. national average and other prominent markets like Texas, Florida, and Georgia.

MULTIFAMILY ACTION WAY BELOW 2020-2023 LEVELS

This is very pronounced in Sioux Falls, with permitting data in 2024 much lower than the same timeframe in 2023 and 2022, and projected deliveries falling off a cliff.

Yet demand for housing remains strong. Showing that once the current supply is absorbed, there will not be enough future supply to meet demand… likely resulting in upward pressure on rents!

We have underwritten conservatively to not rely on higher rents, but this is a powerful potential upside.

Watch the Webinar Recording

Watch the Webinar Recording

1. How did you get such extensive development experience & success in this market?

Both Caleb (lead of construction), and Dusten (developer) from the sponsor team have been successfully operating in the local market for over a decade and have deep business, family and community ties in Sioux Falls.

We have two premium developments in Sioux Falls (Blu on Lorraine and The Velthuis) that have an amenity-rich design, opened in 2023, and are at stable occupancy.

In terms of the Core-Amenity “Reserve Style” projects, we have successfully executed this strategy on four other South Dakota developments: the Reserve Flats in Brookings, Washington Crossing in Sioux Falls, Briarwood Reserve in Sioux Falls, and Jefferson Reserve in Sioux Falls. In addition we also have three other Reserve projects in the construction stage — Maple Rock Reserve, Aspen Ridge Reserve, and Bluestem Reserve.

This approach builds faster, gets rents faster, and feeds the starving local demand for quality-yet-amenity-lite Class A shelter.

2. Why develop in a high interest-rate environment?

Rising rates have made it harder to qualify for a home loan. This comes on top of the existing housing shortage in the local market. Further, the higher interest rates have forced less qualified developers out of the market.

Our (successful) policy is to develop if inventory is needed, regardless of the rising or falling of interest rates. When the rates drop back down we refinance, because the price to construction is always cheaper today than tomorrow (with few exceptions).

After a historic supply hitting the market (this is a nationwide phenomenon) in the last few years, in 2025 and beyond we are going to have significantly less supply that should put upwards pressure on rental rates for 2 reasons: (1) strong demand for quality housing as Sioux Falls continues to grow and (2) minimal supply (see image below) to satiate demand. This is on top of housing affordability continuing to worsen nationwide which forces more renters i.e. apartment demand keeps going up.

3. What is the construction plan?

Foss Fields Phase I will be a series of four 25-plexes for 100 units in this phase. This quality but Core-Amenity only design reduces construction costs and allows significant operating efficiencies pre- and post-construction.

Each building will be built one after the other, leasing up as they are complete.

Hard costs of $140K/unit allow us significant luxury to develop a quality product at a lowered price versus our competitors who have not value-engineered effectively.

Upon the completion of each building, the cash flow stream will be seasoned earlier versus the typical development where the entire development has to be constructed before cash flow begins. The earlier seasoning of cash flow allows for a potential earlier refinance (not included in the underwriting for conservatism).

4. What is the exit strategy?

There is only one exit strategy in any real estate investment — sale.

Our unique approach can allow for a quicker refinance due to income seasoning earlier, but we are not hinging on it. If that happens we expect agency or HUD financing.

We are targeting a holding period of 45 months from start of construction.

5. Why Sioux Falls?

Favorable population growth and job growth along with supply-demand imbalances and an “under the syndication radar” baseline make the Sioux Falls metro an obvious target for the savvy real estate investor.

Beyond that, our developments here keep working, coming in on schedule, and leasing up fast. We have tons of penetration and experience in this market — all “unfair” advantages that investors need to lean on.

We never would have been able to secure the land and zoning for multifamily on this very special heritage site dedicated to the legacy of a beloved war hero had we not been deeply connected and appreciated in this market.

1. How did you get such extensive development experience & success in this market?

Both Caleb (lead of construction), and Dusten (developer) from the sponsor team havea been successfully operating in the local market for over a decade and have deep business, family and community ties in Sioux Falls.

We have two premium developments in Sioux Falls (Blu on Lorraine and The Velthuis) that have an amenity-rich design, opened in 2023, and are at stable occupancy.

In terms of the Core-Amenity “Reserve Style” projects, we have successfully executed this strategy on four other South Dakota developments: the Reserve Flats in Brookings, Washington Crossing in Sioux Falls, Briarwood Reserve in Sioux Falls, and Jefferson Reserve in Sioux Falls. In addition we also have three other Reserve projects in the construction stage — Maple Rock Reserve, Aspen Ridge Reserve, and Bluestem Reserve.

This approach builds faster, gets rents faster, and feeds the starving local demand for quality-yet-amenity-lite Class A shelter.

2. Why develop in a high interest-rate environment?

Rising rates have made it harder to qualify for a home loan. This comes on top of the existing housing shortage in the local market. Further, the higher interest rates have forced less qualified developers out of the market.

Our (successful) policy is to develop if inventory is needed, regardless of the rising or falling of interest rates. When the rates drop back down we refinance, because the price to construction is always cheaper today than tomorrow (with few exceptions).

After a historic supply hitting the market (this is a nationwide phenomenon) in the last few years, in 2025 and beyond we are going to have significantly less supply that should put upwards pressure on rental rates for 2 reasons: (1) strong demand for quality housing as Sioux Falls continues to grow and (2) minimal supply (see image below) to satiate demand. This is on top of housing affordability continuing to worsen nationwide which forces more renters i.e. apartment demand keeps going up.

3. What is the construction plan?

Foss Fields Phase I will be a series of four 25-plexes for 100 units in this phase. This quality but Core-Amenity only design reduces construction costs and allows significant operating efficiencies pre- and post-construction.

Each building will be built one after the other, leasing up as they are complete.

Hard costs of $140K/unit allow us significant luxury to develop a quality product at a lowered price versus our competitors who have not value-engineered effectively.

Upon the completion of each building, the cash flow stream will be seasoned earlier versus the typical development where the entire development has to be constructed before cash flow begins. The earlier seasoning of cash flow allows for a potential earlier refinance (not included in the underwriting for conservatism).

4. What is the exit strategy?

There is only one exit strategy in any real estate investment — sale.

Our unique approach can allow for a quicker refinance due to income seasoning earlier, but we are not hinging on it. If that happens we expect agency or HUD financing.

We are targeting a holding period of 45 months from start of construction.

5. Why Sioux Falls?

Favorable population growth and job growth along with supply-demand imbalances and an “under the syndication radar” baseline make the Sioux Falls metro an obvious target for the savvy real estate investor.

Beyond that, our developments here keep working, coming in on schedule, and leasing up fast. We have tons of penetration and experience in this market — all “unfair” advantages that investors need to lean on.

We never would have been able to secure the land and zoning for multifamily on this very special heritage site dedicated to the legacy of a beloved war hero had we not been deeply connected and appreciated in this market.

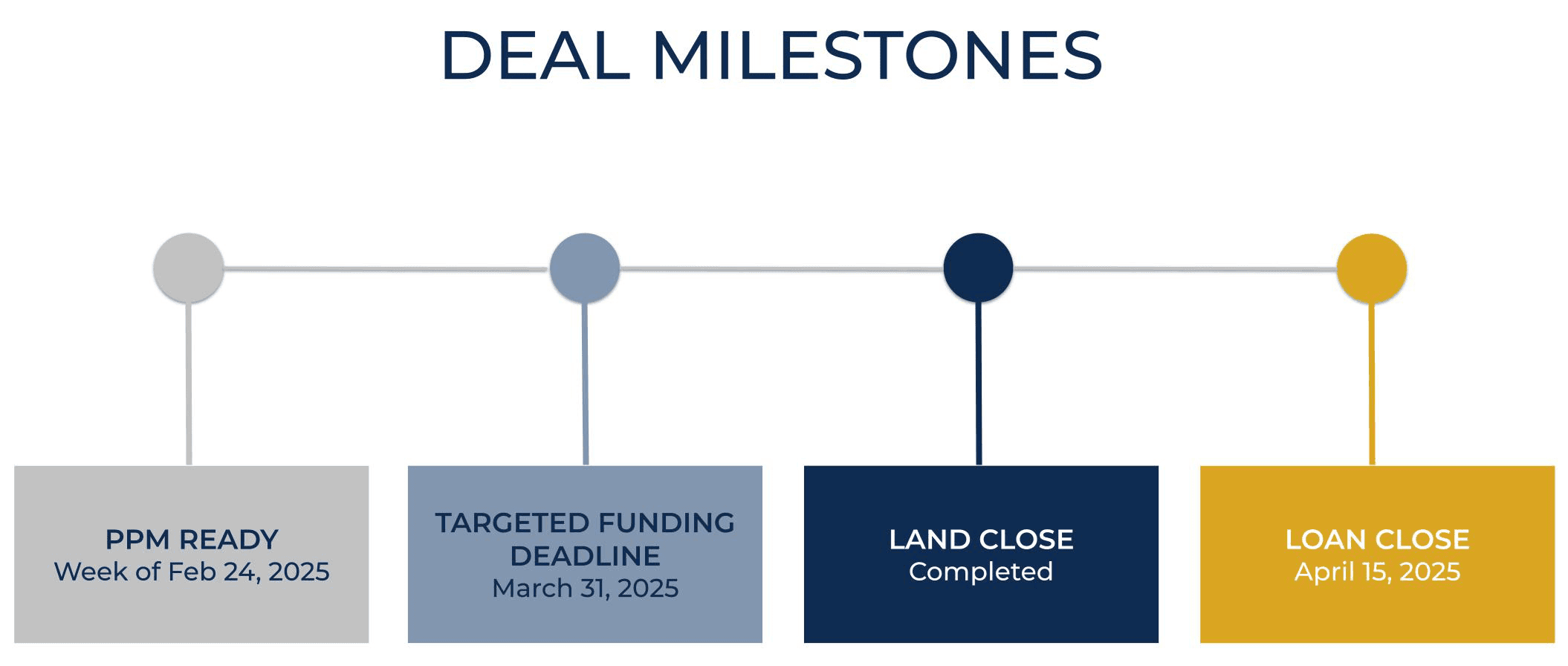

PROJECT TIMELINE

PROJECT TIMELINE

* Project Timeline and Milestones are a best estimate and subject to change.

* Project Timeline and Milestones are a best estimate and subject to change.