Current Offerings

“Life begins at the end of your comfort zone.”

– Neale Donald Walsch

“Life begins at the end of your comfort zone.”

– Neale Donald Walsch

Acquisition Entrepreneur Fund II

This investment is designed to target durable cash flow, structural downside protection, and long-term equity appreciation through diversified acquisitions of established, profitable lower-middle market businesses.

This fund invests in the acquisition of established B2B companies with stable earnings, long operating histories, and diversified bases of repeat customers. Rather than funding speculative startups, the strategy focuses on profitable operating businesses that have demonstrated durability through multiple economic cycles. By targeting companies typically acquired at 3x–5x EBITDA — below the traditional private equity strike zone — the fund seeks to enter at attractive valuations while positioning for both consistent distributions and meaningful long-term equity appreciation.

Each investment is structured using participating preferred equity, which includes a preferred return, liquidation preference, and equity step-up. This structure is designed to prioritize investor capital while preserving upside participation alongside highly vetted owner-operators who provide personal guarantees and/or meaningful co-investment. Through a diversified portfolio approach across industries and geographies in the U.S., Canada, and UK, the fund aims to reduce concentration risk while capitalizing on a once-in-a-generation transition of small business ownership as retiring founders seek succession solutions.

Preferred Return: 8%

Target Average Annual Return: 27.8%-30.66%

Fund Size: $20M

Fund Term: 7 Years

Distributions: Quarterly

Why This Strategy Works?

- Superior Returns

We have negotiated superior returns for the Timberview Capital network for both class A and class B, compared to going directly with the sponsor. - Generational Ownership Transition

Over 3 million small businesses owned by operators age 65+ are expected to change hands in the coming years, creating a historic acquisition opportunity. - Attractive Entry Multiples

Target businesses are typically acquired at 3x–5x EBITDA — below traditional private equity thresholds — with potential to grow into higher exit multiples. - Established, Cash-Flowing Businesses

Focus on profitable B2B companies with stable earnings and repeat customers, supported by historically low SBA acquisition default rates (2.1%). - Aligned Incentives

Entrepreneurs provide personal guarantees and/or meaningful co-investment, and the sponsor commits $500,000 alongside investors. - Structural Downside Protection

Participating preferred structure includes a preferred return, liquidation preference, and equity step-up. - Diversified Portfolio Approach

Investments across industries and geographies in the U.S., Canada, and UK.

Learn More About Acquisition Entrepreneur Fund II

Halston Waterleigh

This investment is designed to target durable cash flow, downside protection, and long-term appreciation through a newly constructed, professionally managed luxury apartment community.

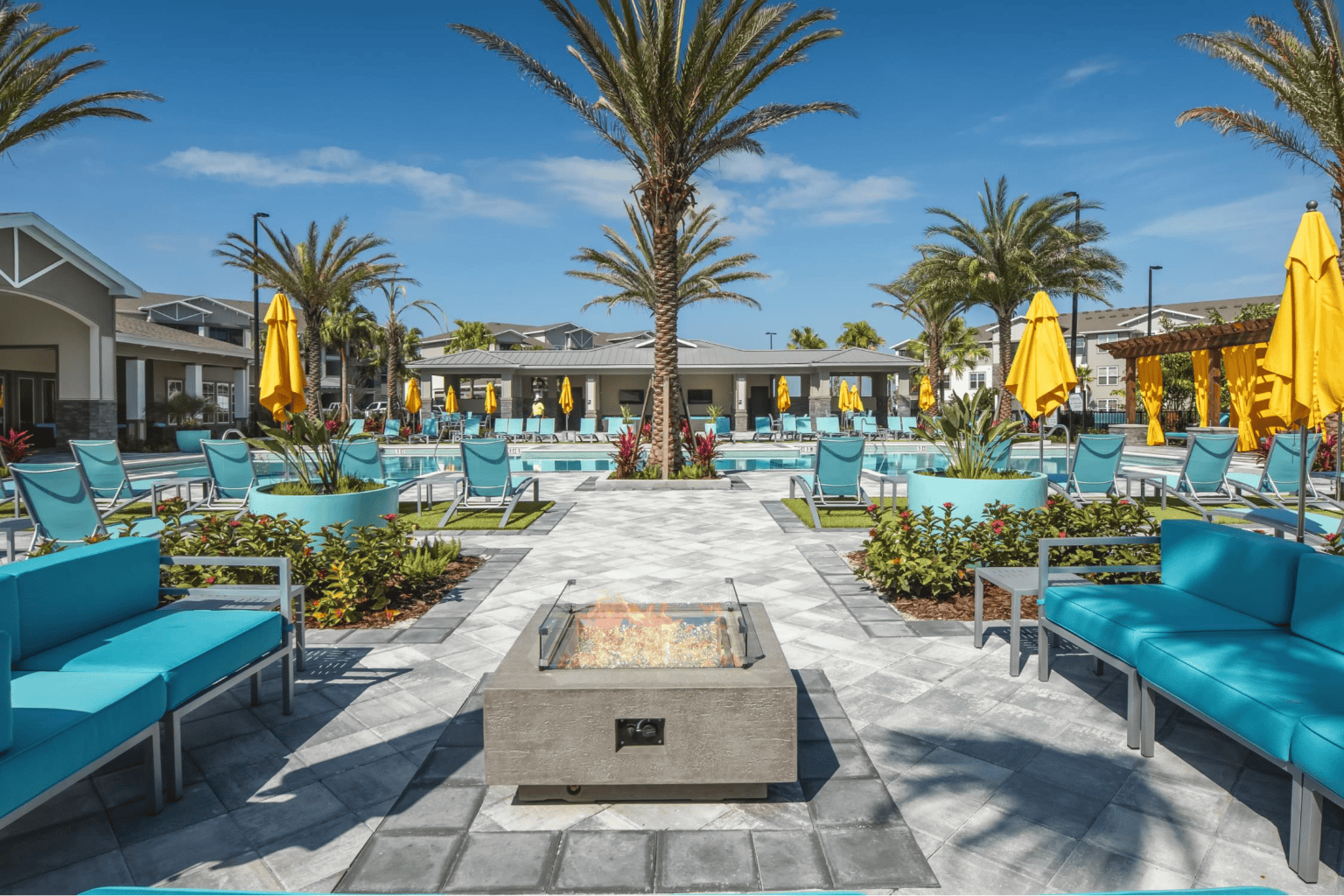

Timberview Capital presents the opportunity to invest in Halston Waterleigh, a 354-unit, Class A multifamily property located in Horizon West / Winter Garden, one of the fastest-growing and highest-income submarkets in the Orlando MSA. Built in 2021 by D.R. Horton, the asset was acquired at a rare basis for new construction, providing immediate value creation through both pricing and operational upside.

The investment benefits from strong in-place occupancy, mark-to-market rent growth, and favorable fixed-rate agency financing. The business plan focuses on targeted interior enhancements, amenity upgrades, and professional in-house management to enhance performance over a projected four-year hold period.

With Orlando’s supply pipeline expected to materially decline and demand supported by population growth, employment expansion, and top-rated schools, Halston Waterleigh is positioned to deliver attractive, risk-adjusted returns in a resilient market.

7% Preferred Return

Target IRR: 18.80%–19.60%

Target Equity Multiple: 1.98x – 2.03x

Projected Hold Period: 4 Years

Minimum Investment: $100,000

Why Halston Waterleigh?

- Superior Returns

We have negotiated superior returns for the Timberview Capital network compared to going directly with the sponsor. - Exceptional Basis

Acquired below replacement cost at a compelling cap rate for new construction, providing built-in downside protection. - Strong In-Place Performance

Occupancy trending around 93%, outperforming newer competing deliveries in the submarket. - Mark-to-Market Rent Upside

In-place rents remain approximately $75–$100 below market, with immediate and ongoing rent lift opportunities. - High-Growth Orlando Submarket

Located minutes from Disney World within the Horizon West master-planned community, supported by population growth, job growth, and top-rated schools. - Operational Scale & Efficiencies

Adjacent ownership and management of Birchstone Waterleigh allows for shared expenses, operational efficiencies, and improved NOI performance. -

Learn more about the Halston Waterleigh

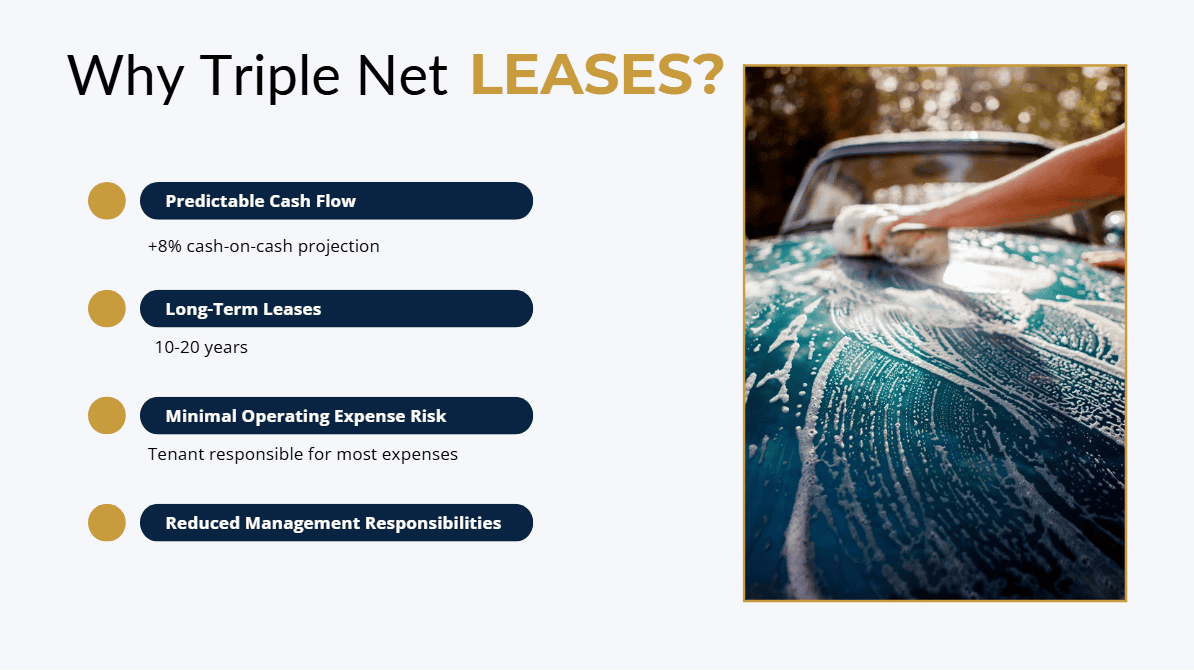

Triple Net Lease Roll-Up Fund

This investment is designed to target predictable income, downside protection, and long-term appreciation through essential-service, triple net leased retail assets.

Timberview Capital presents a triple-net lease retail real estate opportunity focused on essential-service properties such as gas stations, medical offices, and early education facilities. The strategy emphasizes long-term absolute NNN leases that shift operating expenses to tenants, creating stable, inflation-resistant cash flow with minimal management intensity.

The lead sponsor brings a proven roll-up track record, including a prior strategy that culminated in an $87 million exit and delivered a 5x equity multiple to investors over a four-year hold, providing strong validation of execution capability at scale.

The investment is structured to deliver an 8%–9% preferred return with monthly distributions, alongside attractive first-year tax advantages through bonus depreciation. The strategy targets 16–20% projected IRR through disciplined underwriting, contractual rent escalations, and multiple institutional exit pathways, including individual asset sales or a potential portfolio disposition to a retail REIT.

EARLY SUBSCRIBERS: The first $1 million of capital contributions received by the company will receive a 10% preferred return.

Why NNN Retail?

- Predictable Income: Long-term leases with fixed rent escalations

- Minimal Risk: Tenants cover taxes, insurance, and maintenance

- Essential Demand: Fuel, childcare, medical, and service retail

- Recession-Resistant: Stable traffic even during economic downturns

- Institutional Exit Optionality: Sale to or conversion into a REIT

-

Learn more about the Triple Net Lease Retail Real Estate

Next-Generation Infrastructure for Private Assets

This offering represents a late-stage fintech investment transforming how private assets are priced, traded, and accessed. The platform operates as a fully regulated, asset-agnostic marketplace supporting trading across commercial real estate, private equity, private credit, venture, and alternative assets — addressing a private market exceeding $50 trillion.

Often described as the “Bloomberg of Private Markets,” this private market utility delivers the core infrastructure private assets have historically lacked: price discovery, transaction execution, and settlement within a compliant regulatory framework.

Years of regulatory groundwork, proprietary technology, and patented architecture position it to unlock liquidity in markets where capital has traditionally remained trapped for years.

4X – 13X Total Return

$466M Total Valuation

2-Year Hold

80/20 LP / Fund Manager Split

$100K Minimum Investment

This opportunity offers rare access to a late-stage platform typically reserved for institutions, with asymmetric upside supported by active institutional pilots—not early-stage execution risk.

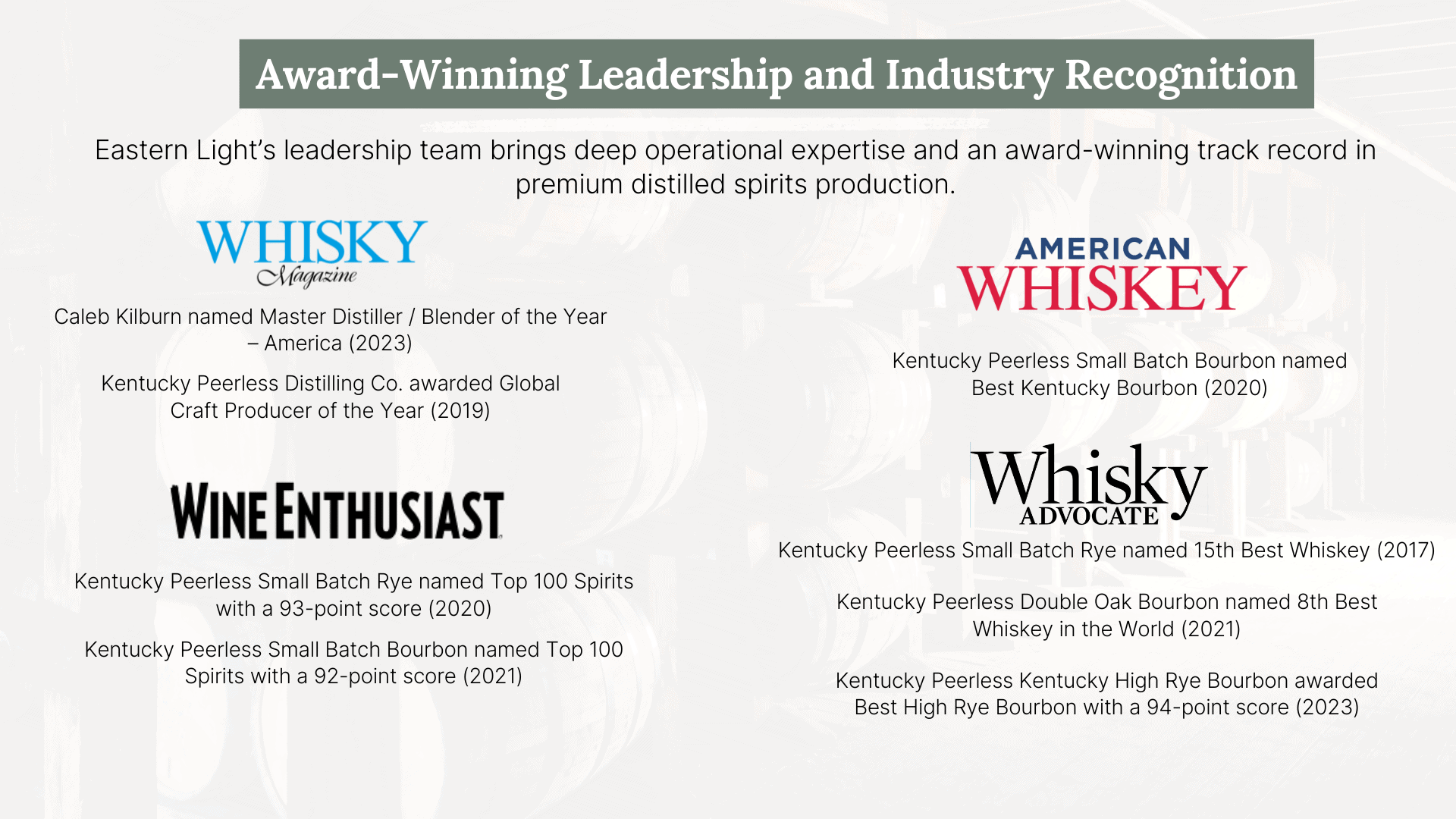

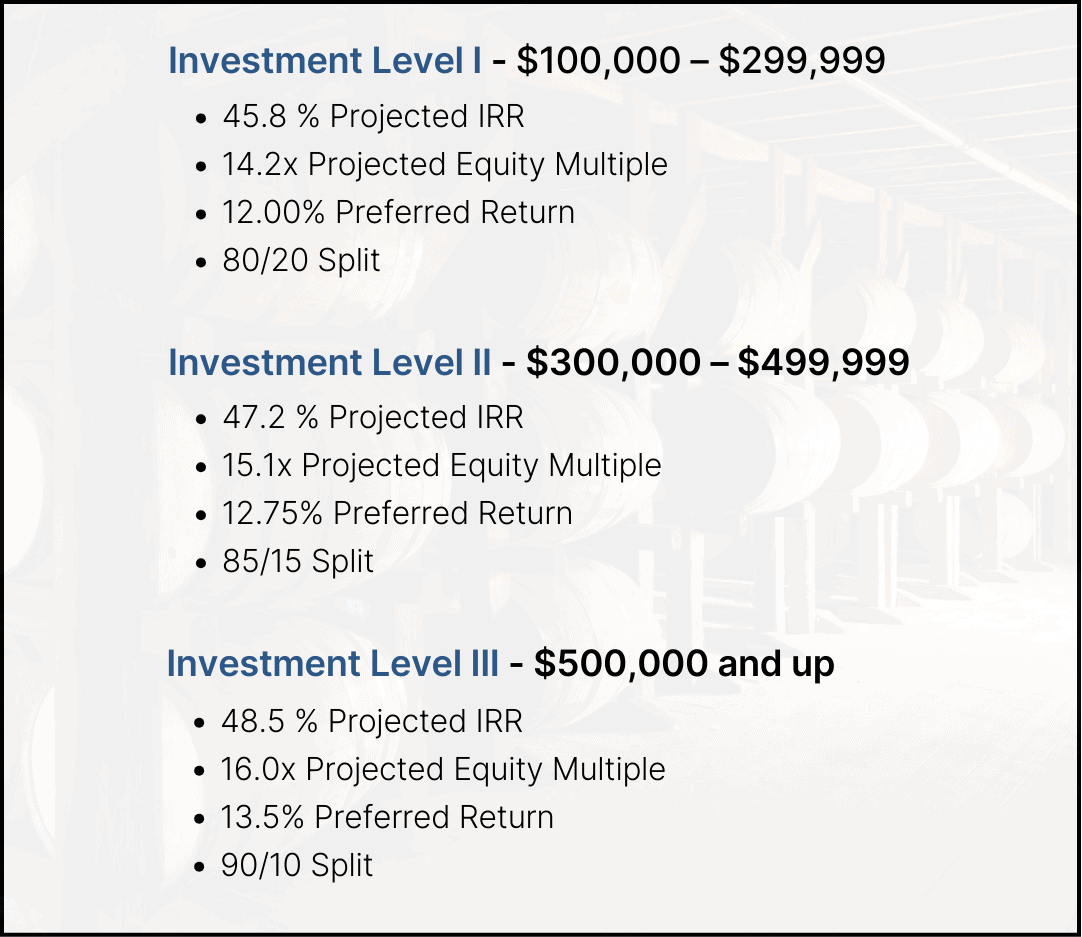

Eastern Light Distilling

Timberview Capital presents an investment in Eastern Light Distilling, a structured, asset-backed opportunity in a B2B whiskey production and storage platform designed to generate recurring cash flow, deliver tiered preferred returns of 12–13.5%, and provide significant early-year tax advantages through accelerated depreciation.

The investment offers participation in long-term value creation as client brands scale and aged inventory appreciates, supported by a growing pipeline of third-party distillers and a fragmented, underserved contract distillation market poised for consolidation and disciplined expansion.

12 – 13.5% Preferred Return

45.8 – 48.5 % projected IRR

14.2x – 16xprojected equity multiple

$100k minimum investment

Projected Distributions: Monthly

8 Years Hold Period

First-year K-1 loss is estimated to be 100% of the investment amount

Learn more about the Eastern Light Distilling

Ultra Luxury Short-Term Rental Development

This investment is designed to target premium income and long-term appreciation through professionally managed luxury short-term rentals.

Timberview Capital presents a luxury short-term rental development opportunity in Joshua Tree, California, one of the fastest-growing high-end travel destinations in the country. The investment focuses on the development of modern, design-driven desert retreat homes in a market supported by over three million annual visitors, year-round tourism, and strong demand for premium accommodations. With limited supply of true luxury short-term rentals, professionally designed and managed homes are positioned to achieve strong nightly rates and attractive operating performance.

This opportunity offers investors a fixed preferred return structure with projected annual returns ranging from 13% to 15% based on investment size, projected monthly distributions beginning the first full month after funding, and a targeted three to five-year hold period.

The first $1.2M funded will receive 16% preferred returns.

13% preferred return ($100K–$299K)

14% preferred return ($300K–$499K)

16% preferred return ($500K+)

The first $1.2M funded will receive 16% preferred returns

Monthly Distributions (beginning the first full month after funding)

3-5 Year Hold Period

No Equity or Backend Split

Learn more about the Ultra Luxury Short-Term Rental Development

Ultra Luxury Short-Term Rental Development

This investment is designed to target premium income and long-term appreciation through professionally managed luxury short-term rentals.

Timberview Capital presents a luxury short-term rental development opportunity in Joshua Tree, California, one of the fastest-growing high-end travel destinations in the country. The investment focuses on the development of modern, design-driven desert retreat homes in a market supported by over three million annual visitors, year-round tourism, and strong demand for premium accommodations. With limited supply of true luxury short-term rentals, professionally designed and managed homes are positioned to achieve strong nightly rates and attractive operating performance.

This opportunity offers investors a fixed preferred return structure with projected annual returns ranging from 13% to 15% based on investment size, projected monthly distributions beginning the first full month after funding, and a targeted three to five-year hold period.

The first $1.2M funded will receive 16% preferred returns.

13% preferred return ($100K–$299K)

14% preferred return ($300K–$499K)

16% preferred return ($500K+)

The first $1.2M funded will receive 16% preferred returns

Monthly Distributions (beginning the first full month after funding)

3-5 Year Hold Period

No Equity or Backend Split

Learn more about the Ultra Luxury Short-Term Rental Development

Smart Management Investment

A structured tax-advantaged investment designed to help high-income earners offset taxable income while preserving capital and generating long-term value, including up to 300% depreciation.

Timberview Capital presents an AI-driven software investment opportunity through Smart Management, a fully built property management platform entering its national growth phase. The investment is designed to deliver scalable returns through a combination of preferred income, long-term equity appreciation, and significant tax advantages. With a massive addressable market of over 50 million rental units in the U.S. and a growing pipeline of operators and landlords, Smart Management is positioned to scale rapidly as adoption accelerates over the next three to five years.

5% Preferred Return

10K – $15K Annual Cash Flow

4X+ Targeted Equity Multiple

77.6% Targeted Average Annual Return

36-60 Months Hold Period

Why These Strategies:

-

Powerful 2026 Tax Advantage: Targeted 3:1 bonus depreciation delivering up to $300,000 in depreciation per $100,000 invested, potentially offsetting passive and in some cases active or W-2 income with CPA guidance.

- Multiple Return Sources: Preferred returns, targeted cash flow, equity growth, and prioritized return of capital in one offering.

- Risk Mitigation and Alignment: CPA-reviewed structure, ~70% of capital in interest-bearing accounts, and $500K–$1M sponsor co-investment.

- Scalable Growth Platform: Fully built software entering expansion with 50,000+ units on the waitlist in a 50M-unit market.

Learn more about the Smart Management Investment

Smart Management Investment

A structured tax-advantaged investment designed to help high-income earners offset taxable income while preserving capital and generating long-term value, including up to 300% depreciation.

We are pleased to present a $75MM+ diversified oil & gas fund focused on investing in what we believe to be the best risk- adjusted opportunities.

This Fund will be focusing on investing in a combination of existing producing assets for current cash flow (PDP) along with acreage for new drilling for upside value (PUD). We’ll be targeting multiple basins.

The Fund will generally be focused on investing in non-operating working interests (“NOWI”) and overriding royalty interests (“ORRI”). This reduces operational risk but gives the opportunity to participate in new drilling programs.

Timberview Capital presents an AI-driven software investment opportunity through Smart Management, a fully built property management platform entering its national growth phase. The investment is designed to deliver scalable returns through a combination of preferred income, long-term equity appreciation, and significant tax advantages. With a massive addressable market of over 50 million rental units in the U.S. and a growing pipeline of operators and landlords, Smart Management is positioned to scale rapidly as adoption accelerates over the next three to five years.

5% Preferred Return

10K – $15K Annual Cash Flow

4X+ Targeted Equity Multiple

77.6% Targeted Average Annual Return

36-60 Months Hold Period

Why These Strategies:

-

Powerful 2026 Tax Advantage: Targeted 3:1 bonus depreciation delivering up to $300,000 in depreciation per $100,000 invested, potentially offsetting passive and in some cases active or W-2 income with CPA guidance.

- Multiple Return Sources: Preferred returns, targeted cash flow, equity growth, and prioritized return of capital in one offering.

- Risk Mitigation and Alignment: CPA-reviewed structure, ~70% of capital in interest-bearing accounts, and $500K–$1M sponsor co-investment.

- Scalable Growth Platform: Fully built software entering expansion with 50,000+ units on the waitlist in a 50M-unit market.

Learn more about the Smart Management Investment

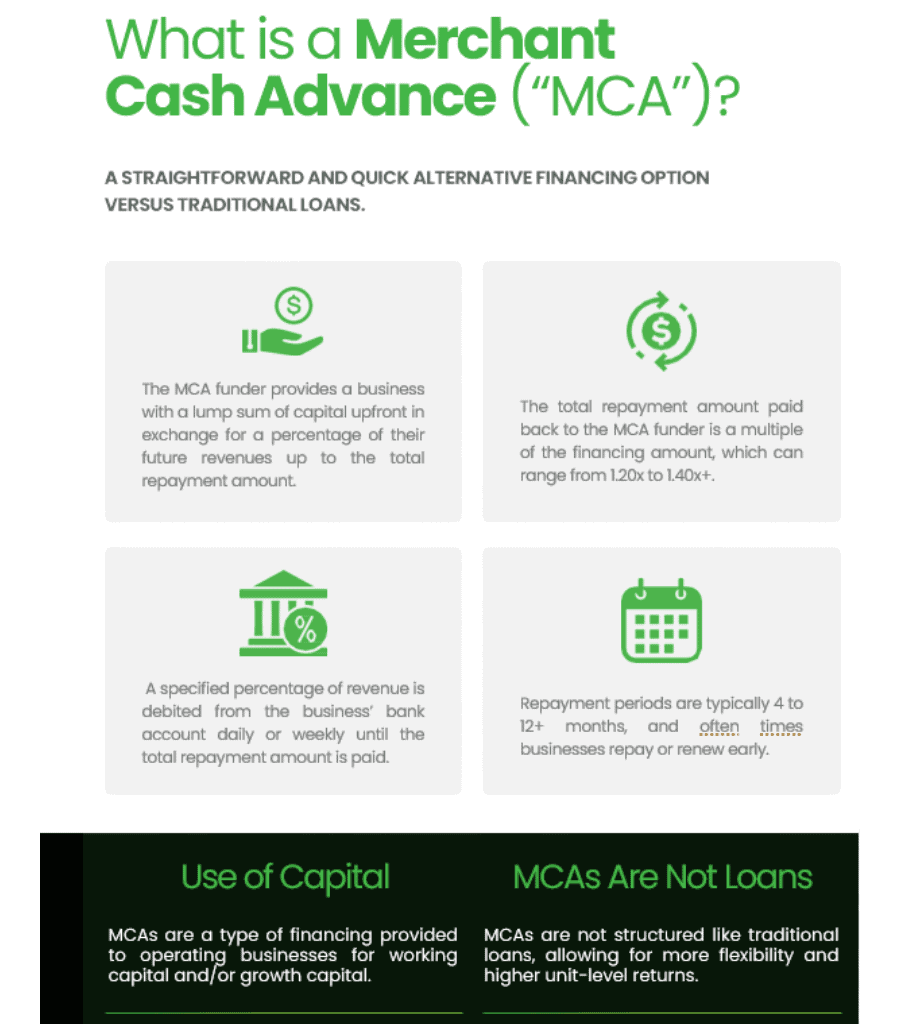

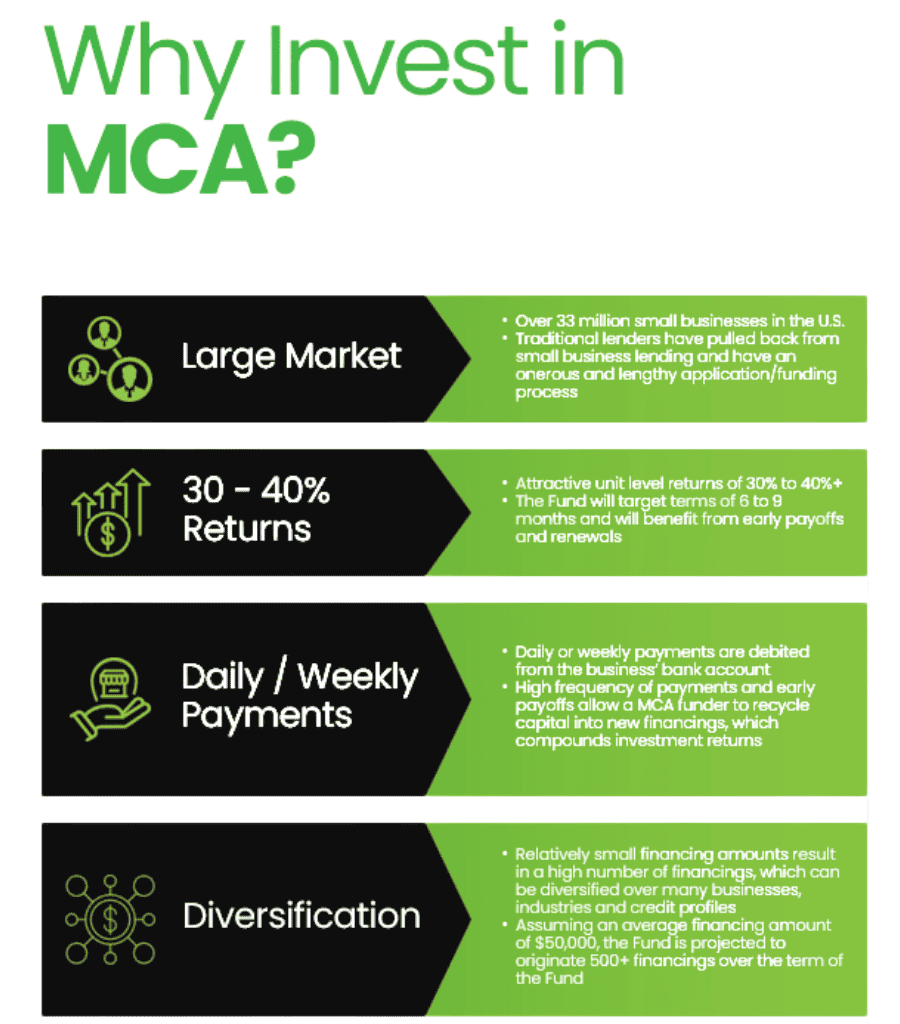

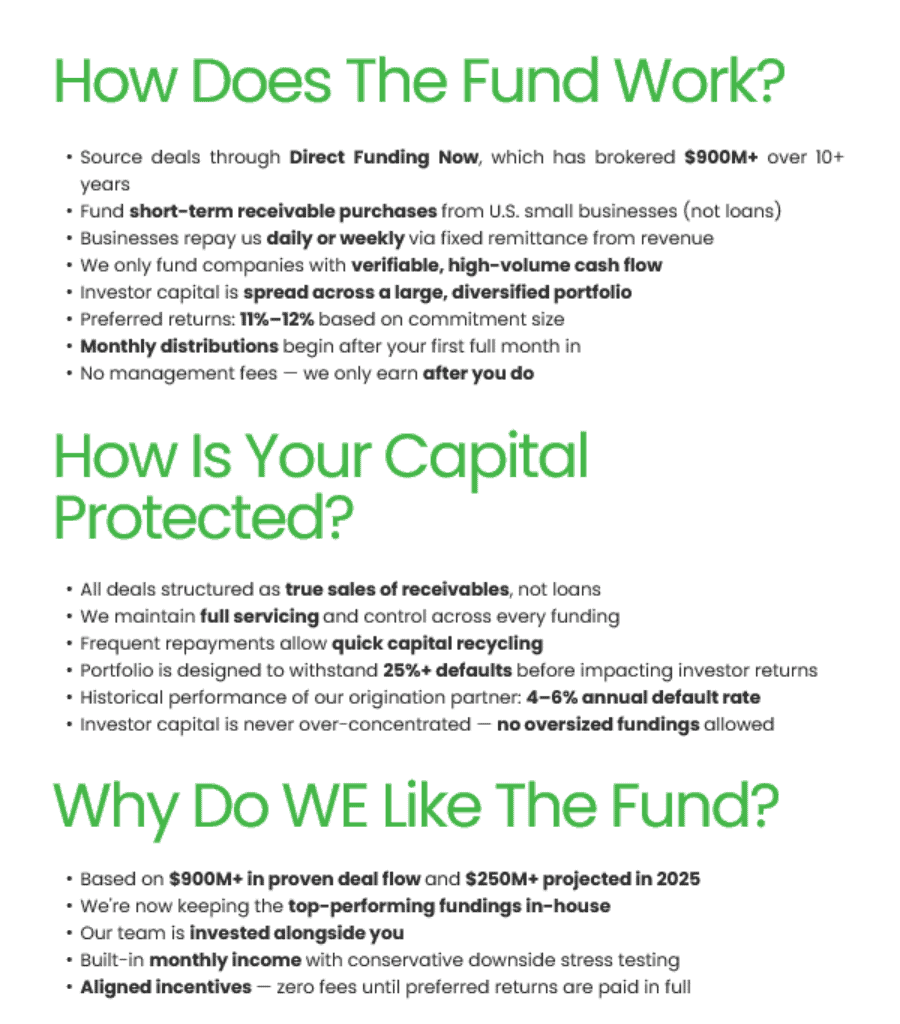

Small Business Accounts

Receivable Fund

This investment has the advantages of strong monthly cash flow and liquidity

Timberview Capital introduces an income-focused opportunity through the Small Business Accounts Receivable Fund. Instead of traditional loans, this fund advances capital to small businesses in return for their accounts receivable, generating consistent monthly cash flow backed by daily and weekly repayment streams.

With a portfolio diversified across hundreds of receivable purchases, the fund is designed to absorb 25%+ defaults before investor returns are impacted. This type of program typically sees a 4% to 6% default rate. Investors benefit from liquidity after a 12-month lockup, followed by a 90-day redemption window, and strong preferred returns of 11%–12% paid monthly.

11% preferred return ($100K–$199K)

12% preferred return ($200K+)

Paid monthly after the first full active month

$100K minimum investment

Learn more about the Small Business Accounts Receivable Fund

Small Business Accounts

Receivable Fund

This investment has the advantages of strong monthly cash flow and liquidity

Timberview Capital introduces an income-focused opportunity through the Small Business Accounts Receivable Fund. Instead of traditional loans, this fund advances capital to small businesses in return for their accounts receivable, generating consistent monthly cash flow backed by daily and weekly repayment streams.

With a portfolio diversified across hundreds of receivable purchases, the fund is designed to absorb 25%+ defaults before investor returns are impacted. This type of program typically sees a 4% default rate, whereas to date, our default rate has been 0%. Investors benefit from liquidity after a 12-month lockup, followed by a 90-day redemption window, and strong preferred returns of 11%–12% paid monthly.

11% preferred return ($100K–$199K)

12% preferred return ($200K+)

Paid monthly after the first full active month

$100K minimum investment

Learn more about the Small Business Accounts Receivable Fund

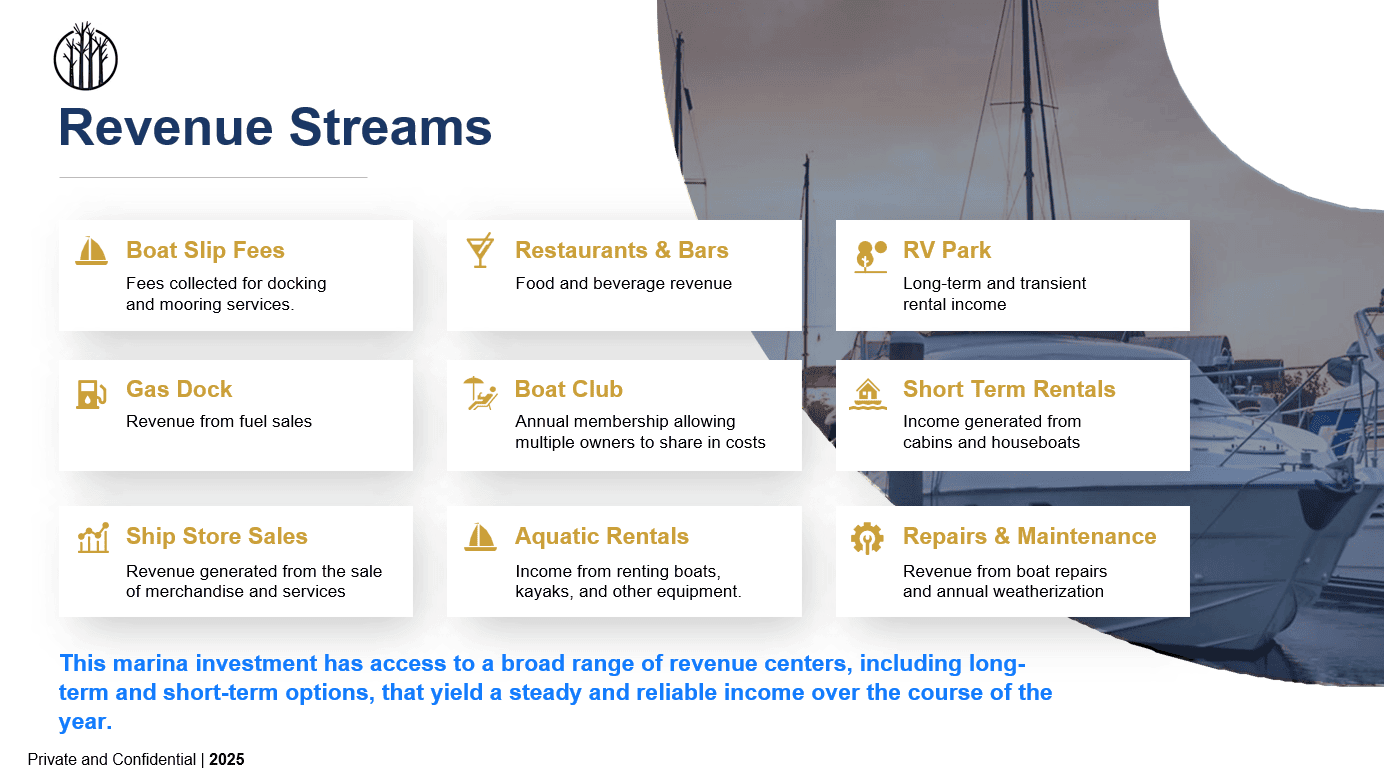

Marina Acquisition and Roll-up Fund

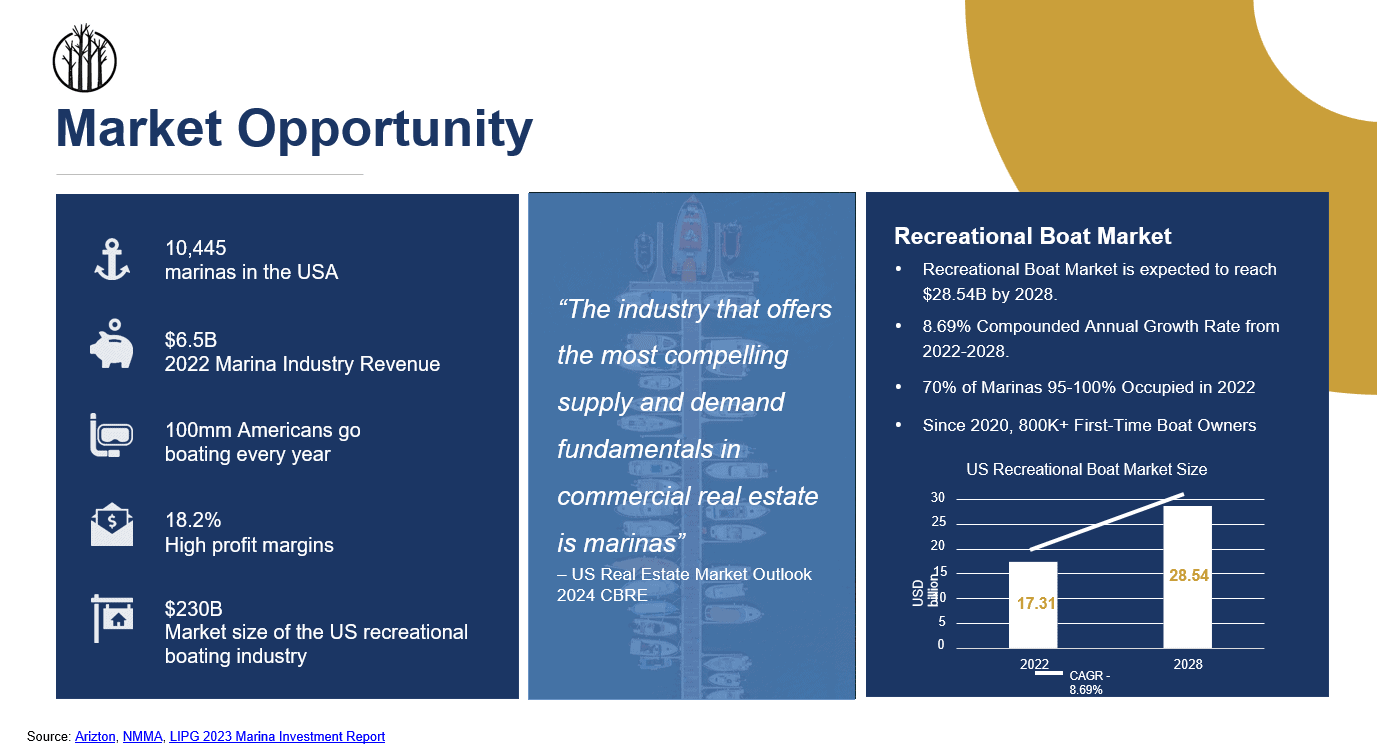

Timberview Capital is excited to present the Marina Fund Investment, a private real estate offering targeting the acquisition of cash-flowing, value-add marina properties across the U.S. This fund aims to capitalize on the growing recreational boating industry by investing in high-occupancy marinas with multiple income streams, including boat slips, fuel docks, ship stores, and short-term rentals.

9% Preferred Return

25% Target IRR

2.75x Equity Multiple

5 Years Hold Time

$50,000 Minimum Investment

Key Highlights:

-

Experienced Sponsor Team: Our partner boasts over 50 years of combined experience and more than $300 million in successfully managed investments across real estate, private equity, and oil & gas.

-

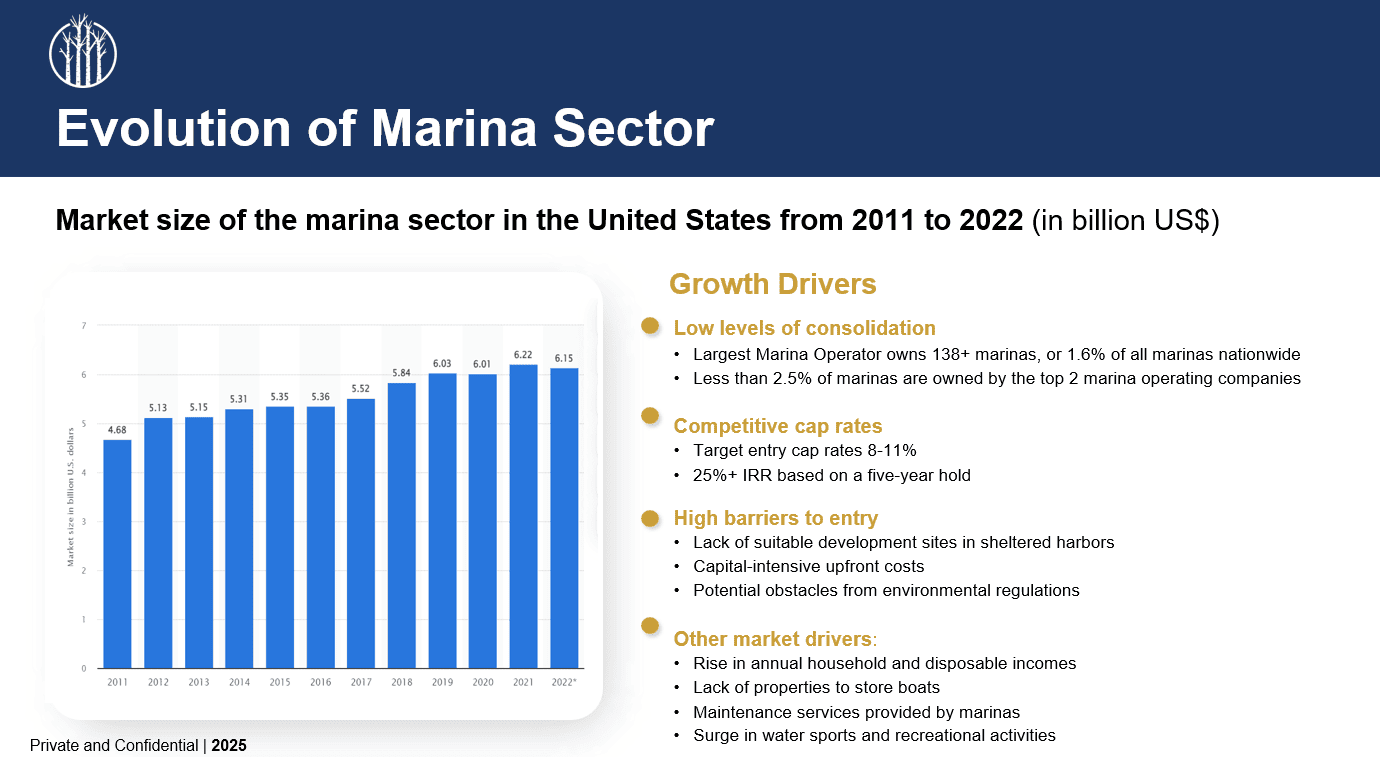

High-Demand Asset Class: The U.S. recreational boat market is projected to reach $28.5 billion by 2028, growing at an 8.69% CAGR.

-

Limited Institutional Ownership: The top 2 marina operators own less than 2.5% of the market, leaving consolidation opportunities wide open.

-

Multiple Revenue Streams: Income from boat slip fees, fuel sales, ship store merchandise, aquatic rentals, short-term lodging, restaurants & bars, boat clubs, RV parks, and maintenance services.

-

Strategic Growth Plan: Aim to build a portfolio of 5,000+ wet slips, refinance in Year 3–4, and exit or recapitalize in Year 5 at a 6–8% target cap rate.

Learn more about the Marina Fund Investment

Marina Acquisition

and Roll-up Fund

Timberview Capital is excited to present the Marina Fund Investment, a private real estate offering targeting the acquisition of cash-flowing, value-add marina properties across the U.S. This fund aims to capitalize on the growing recreational boating industry by investing in high-occupancy marinas with multiple income streams, including boat slips, fuel docks, ship stores, and short-term rentals.

9% Preferred Return

25% Target IRR

2.75x Equity Multiple

5 Years Hold Time

$50,000 Minimum Investment

Key Highlights:

-

Experienced Sponsor Team: Our partner boasts over 50 years of combined experience and more than $300 million in successfully managed investments across real estate, private equity, and oil & gas.

-

High-Demand Asset Class: The U.S. recreational boat market is projected to reach $28.5 billion by 2028, growing at an 8.69% CAGR.

-

Limited Institutional Ownership: The top 2 marina operators own less than 2.5% of the market, leaving consolidation opportunities wide open.

-

Multiple Revenue Streams: Income from boat slip fees, fuel sales, ship store merchandise, aquatic rentals, short-term lodging, restaurants & bars, boat clubs, RV parks, and maintenance services.

-

Strategic Growth Plan: Aim to build a portfolio of 5,000+ wet slips, refinance in Year 3–4, and exit or recapitalize in Year 5 at a 6–8% target cap rate.

Learn more about the Marina Fund Investment

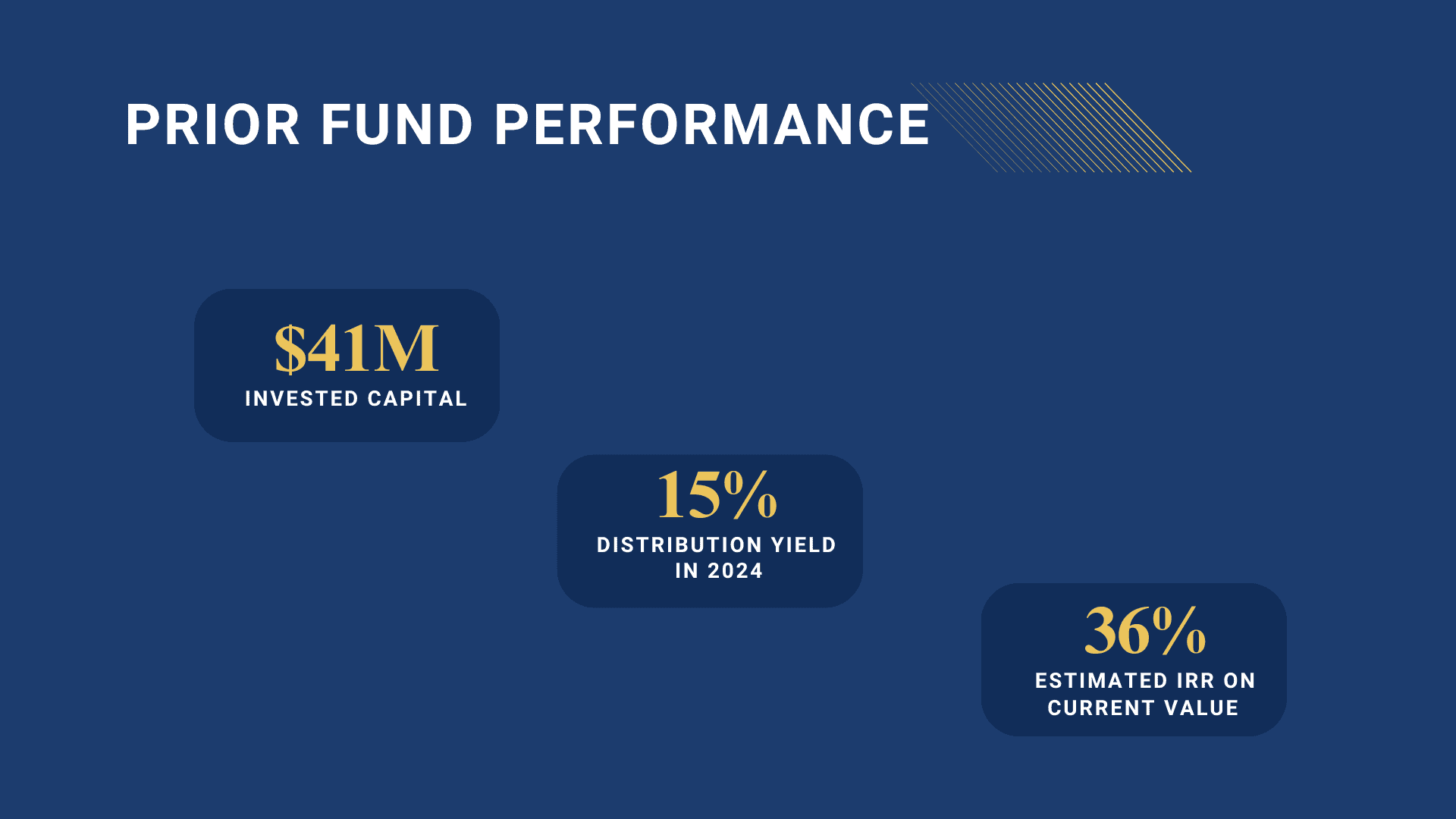

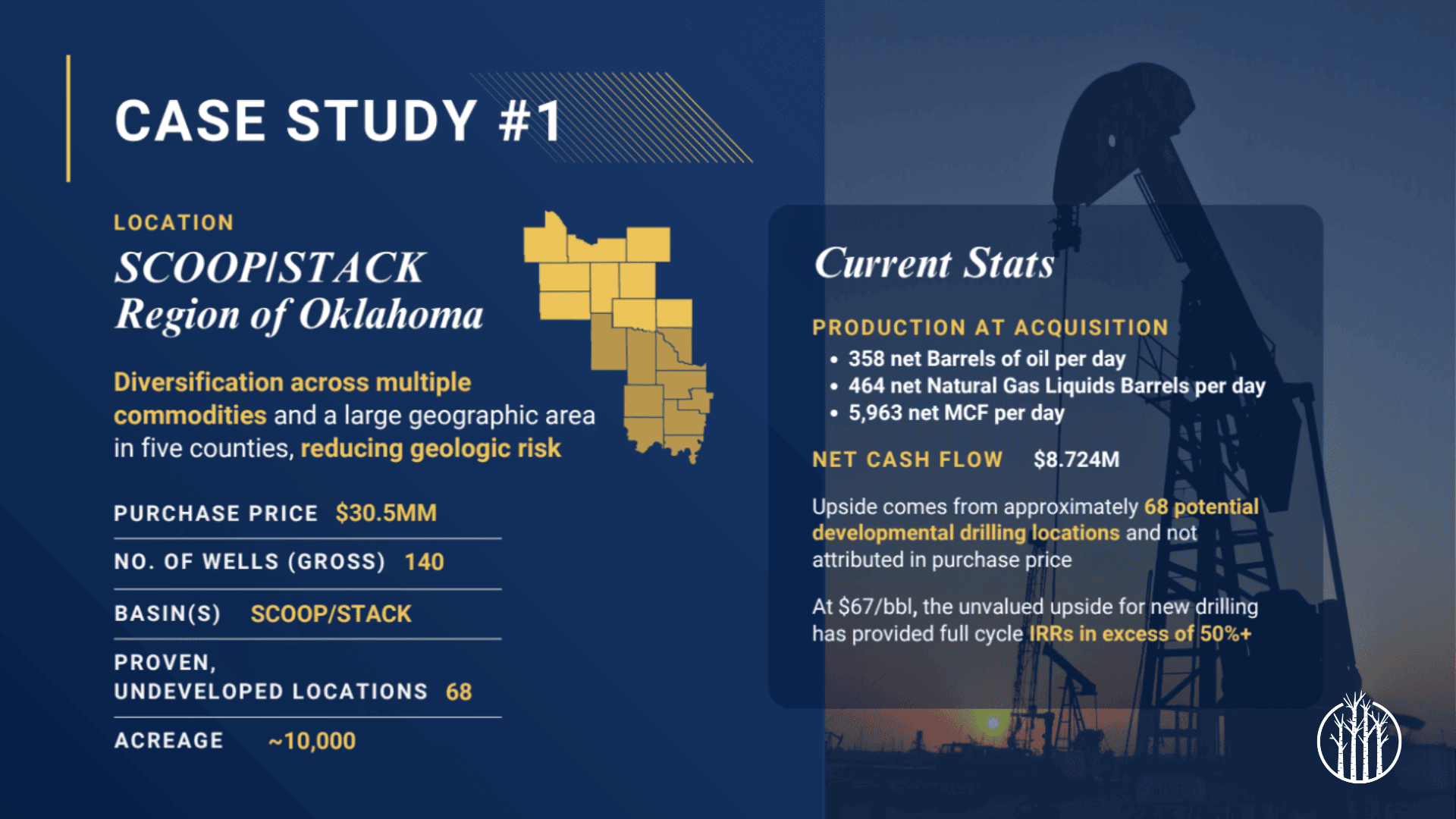

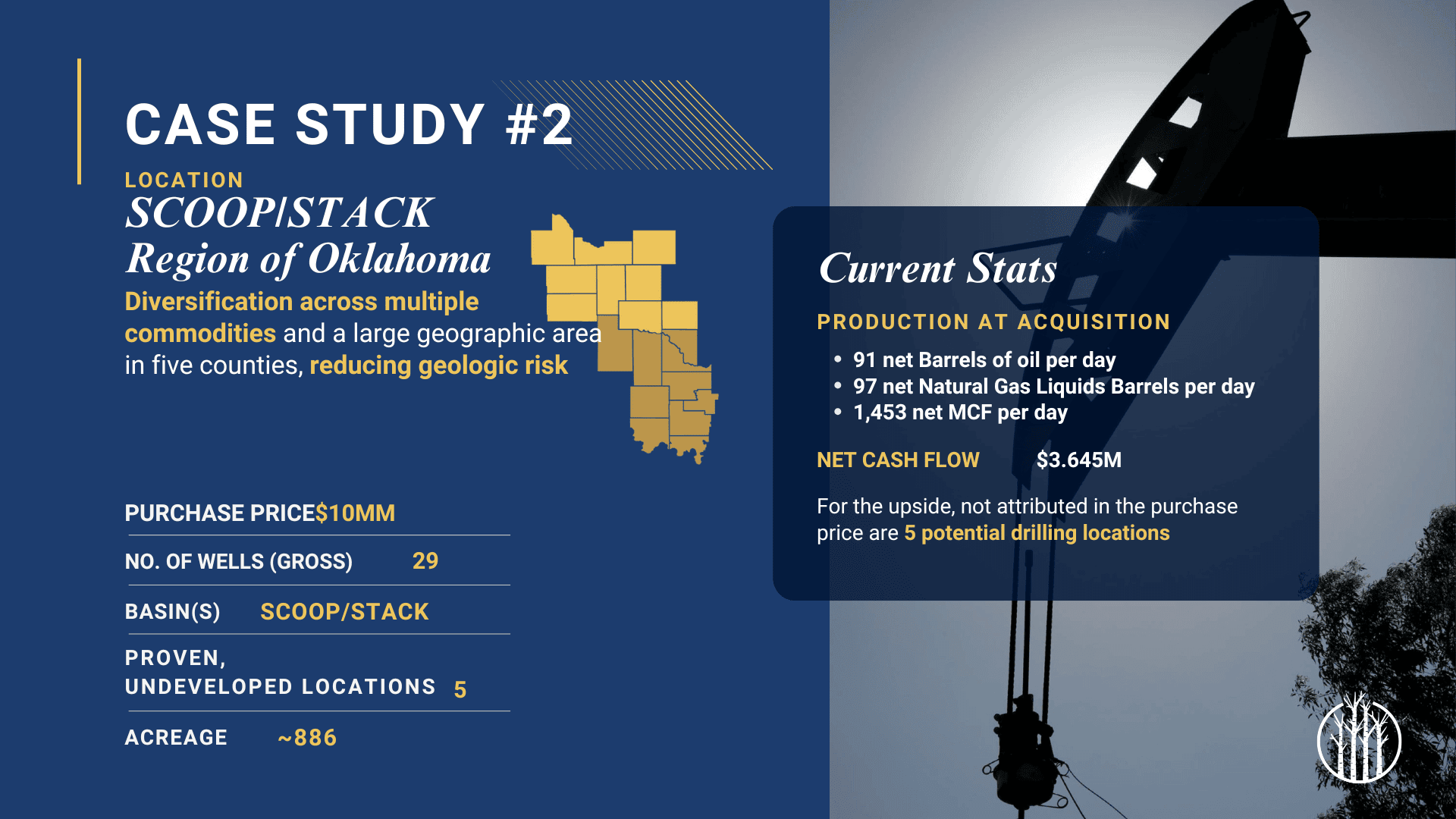

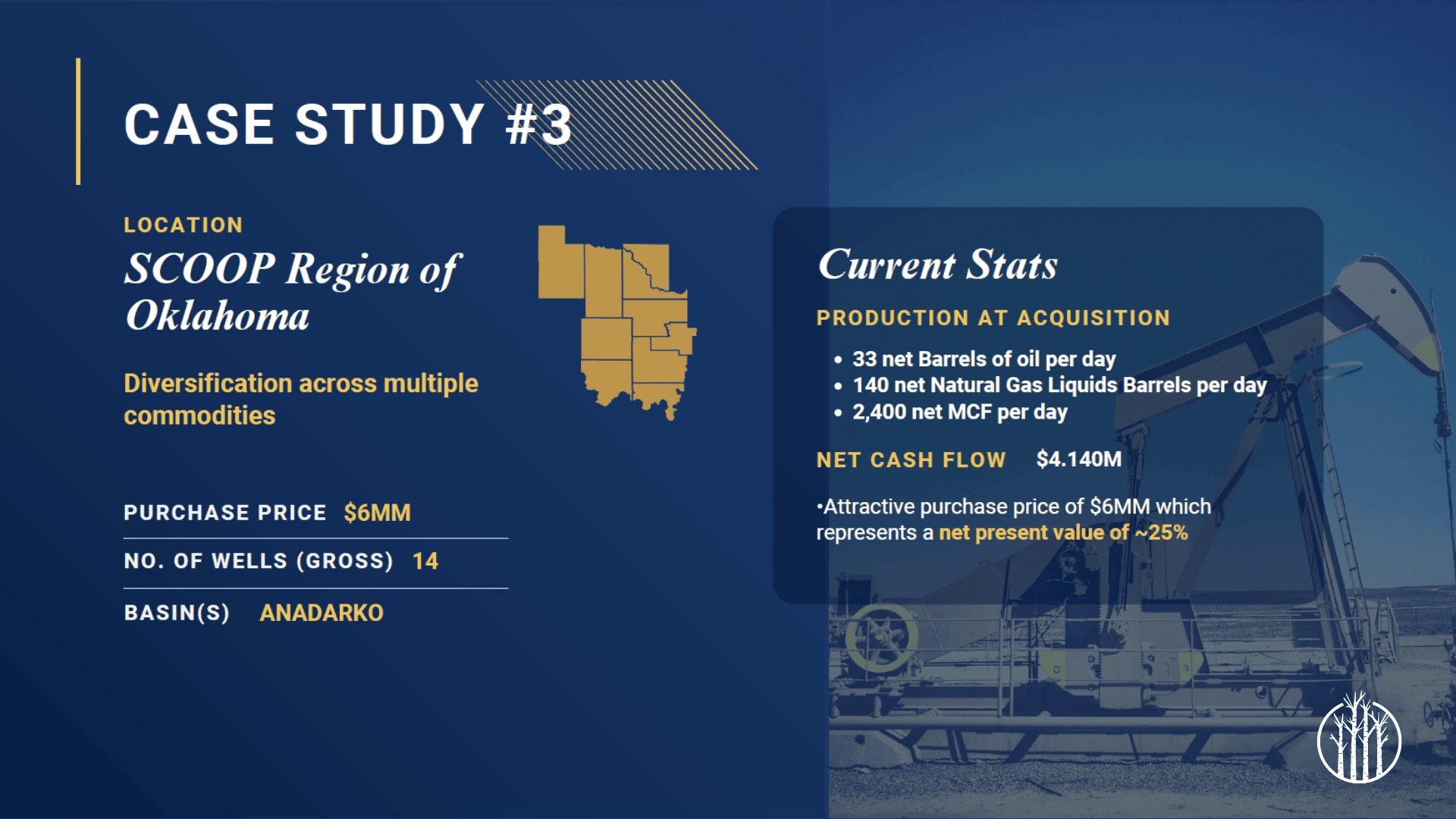

Diversified Oil and Gas

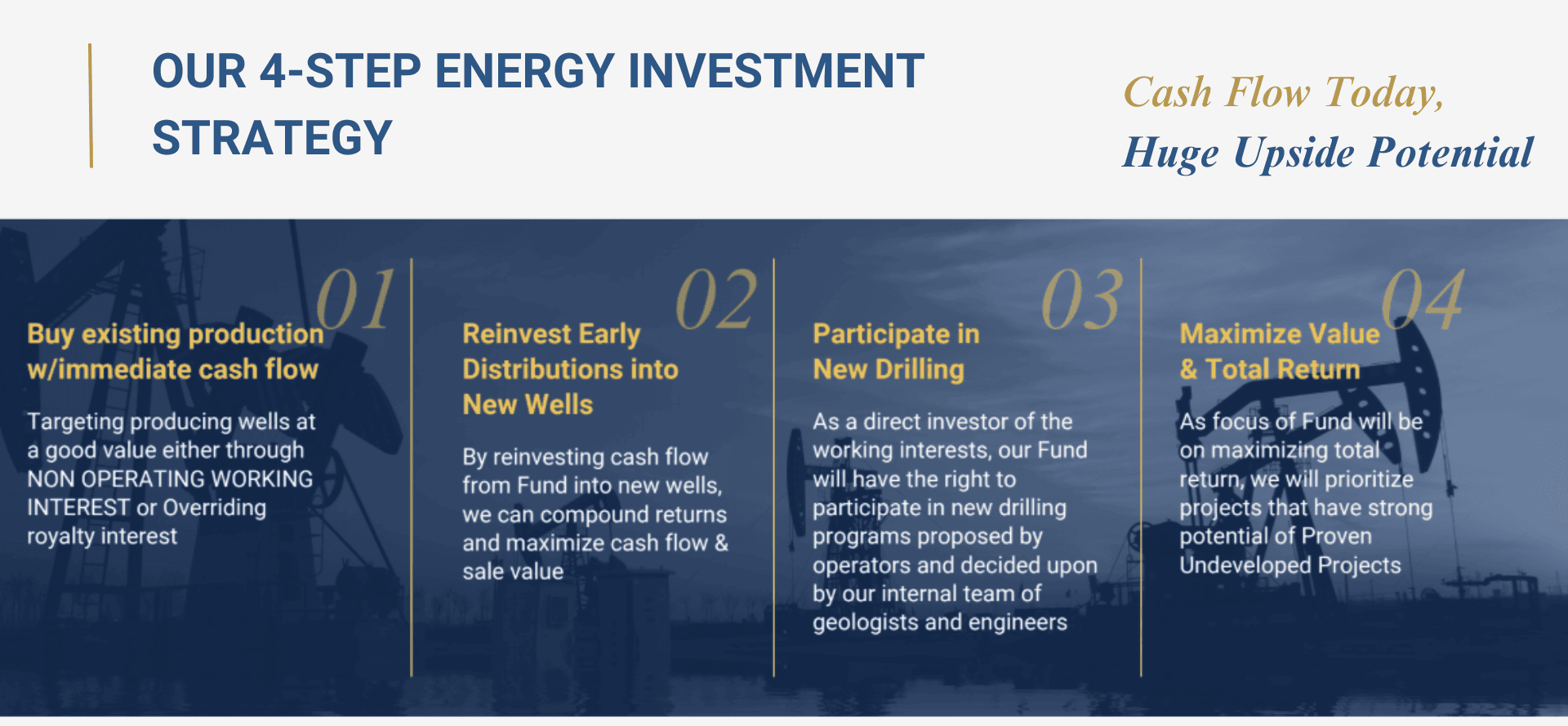

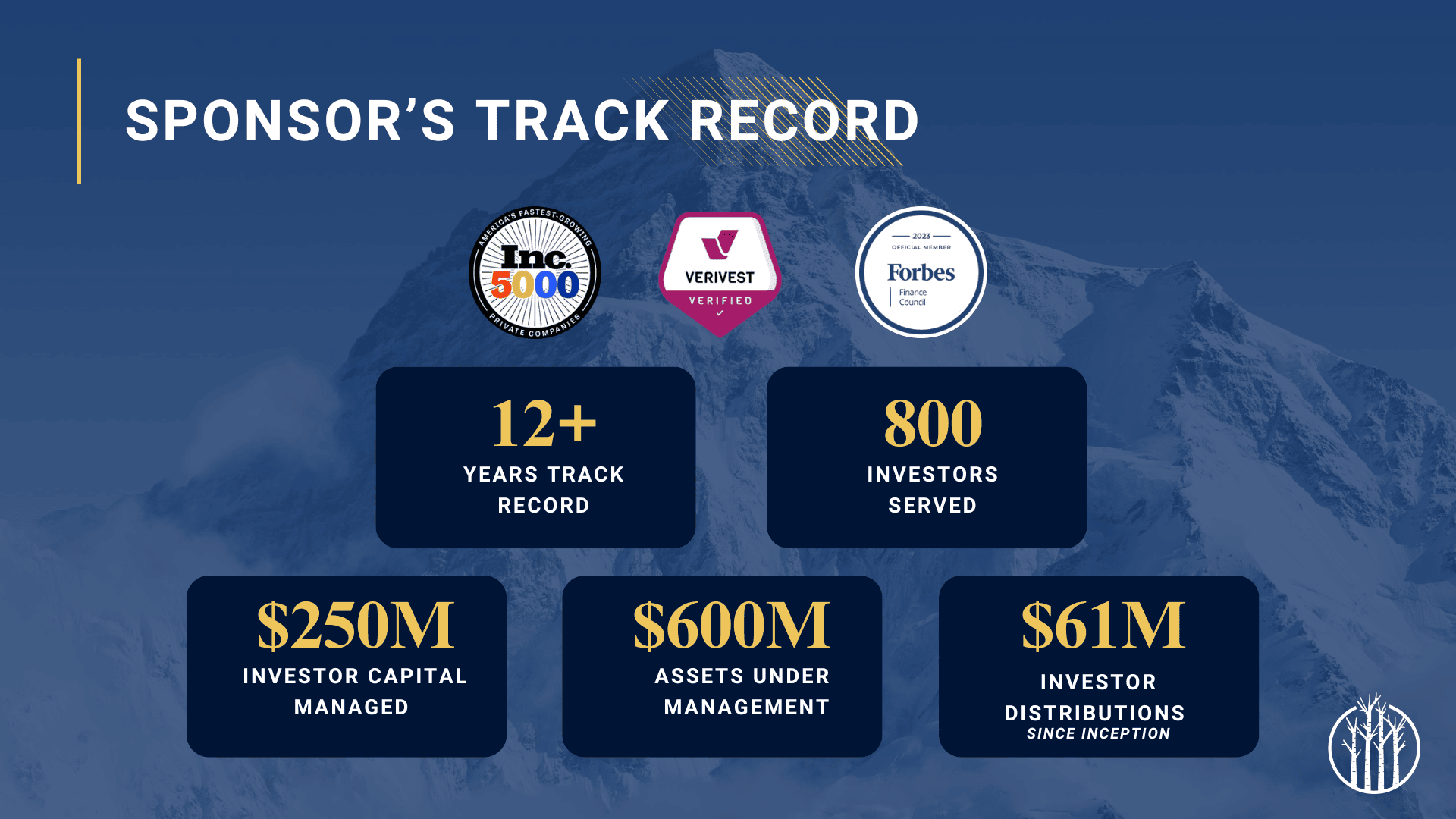

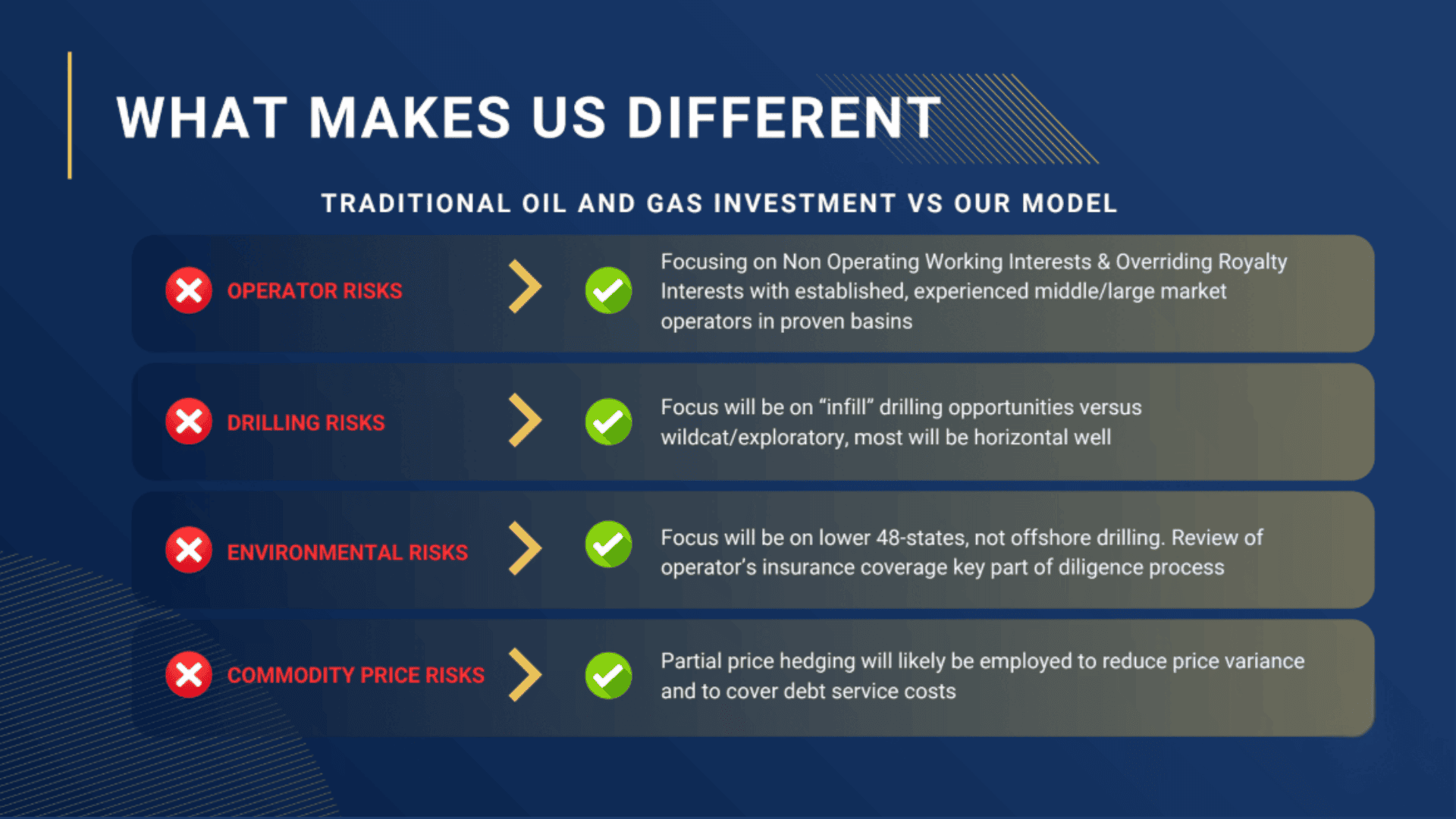

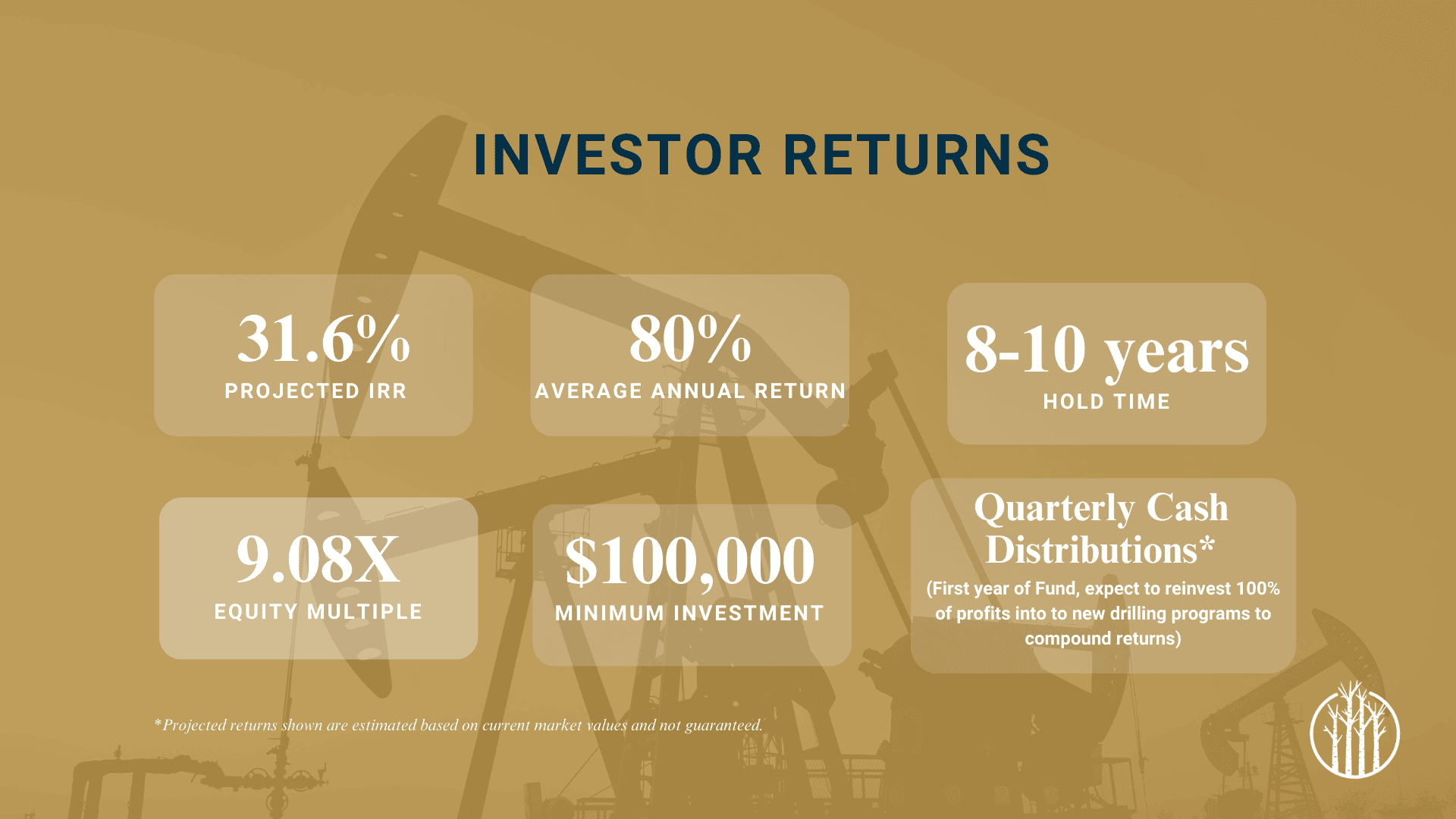

We are pleased to present a $75MM+ diversified oil & gas fund focused on investing in what we believe to be the best risk- adjusted opportunities.

This Fund will be focusing on investing in a combination of existing producing assets for current cash flow (PDP) along with acreage for new drilling for upside value (PUD). We’ll be targeting multiple basins.

The Fund will generally be focused on investing in non-operating working interests (“NOWI”) and overriding royalty interests (“ORRI”). This reduces operational risk but gives the opportunity to participate in new drilling programs.

31.6% Projected IRR

9.08x Equity Multiple

80% Average Annual Return

8-10 years Hold Time

$100,000 Minimum Investment

Key Highlights:

- Exclusive Returns: We’ve negotiated better returns and a lower entry point for our network.

- Experienced Sponsor Team: Our sponsorship team has extensive experience in operating and engineering on oil & gas assets for the last 40 years, with a 5-project track record.

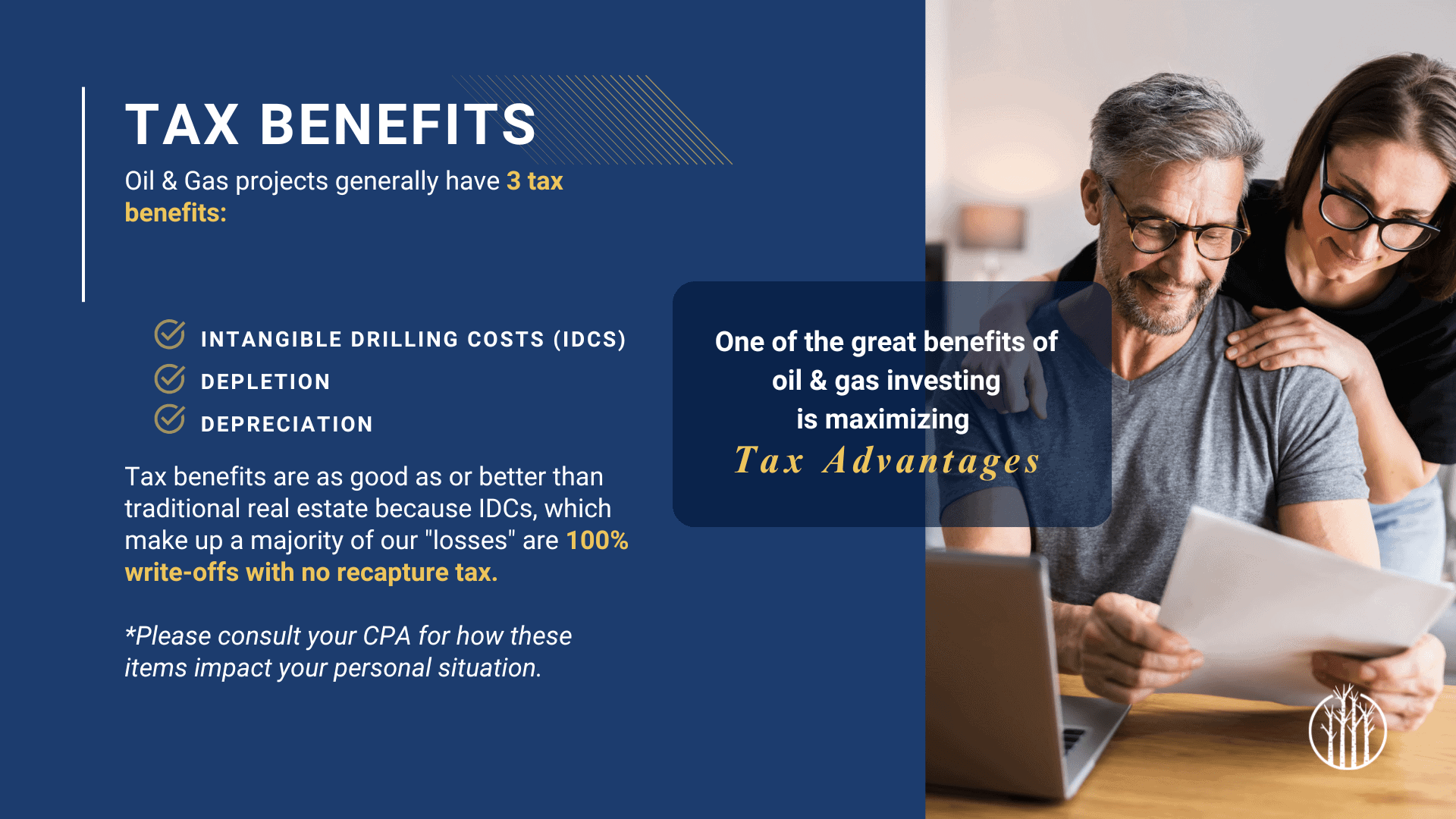

- Tax Benefits: Numerous tax benefits for our investors including: Intangible Drilling Costs, Depletion & Depreciation to offset passive income.

- Cash Flow + Total Return: Our fund strategy will combine a focus on existing producing assets at good values, with additional upside through drilling. We’re targeting a mix of distributions and reinvestment into new drilling to compound returns.

Learn more about Oil and Gas Investment

Diversified Oil and Gas

We are pleased to present a $75MM+ diversified oil & gas fund focused on investing in what we believe to be the best risk- adjusted opportunities.

This Fund will be focusing on investing in a combination of existing producing assets for current cash flow (PDP) along with acreage for new drilling for upside value (PUD). We’ll be targeting multiple basins.

The Fund will generally be focused on investing in non-operating working interests (“NOWI”) and overriding royalty interests (“ORRI”). This reduces operational risk but gives the opportunity to participate in new drilling programs.

31.6% Projected IRR

9.08x Equity Multiple

80% Average Annual Return

8-10 years Hold Time

$100,000 Minimum Investment

Key Highlights:

- Exclusive Returns: We’ve negotiated better returns and a lower entry point for our network.

- Experienced Sponsor Team: Our sponsorship team has extensive experience in operating and engineering on oil & gas assets for the last 40 years, with a 5-project track record.

- Tax Benefits: Numerous tax benefits for our investors including: Intangible Drilling Costs, Depletion & Depreciation to offset passive income.

- Cash Flow + Total Return: Our fund strategy will combine a focus on existing producing assets at good values, with additional upside through drilling. We’re targeting a mix of distributions and reinvestment into new drilling to compound returns.

Learn more about Oil and Gas Investment

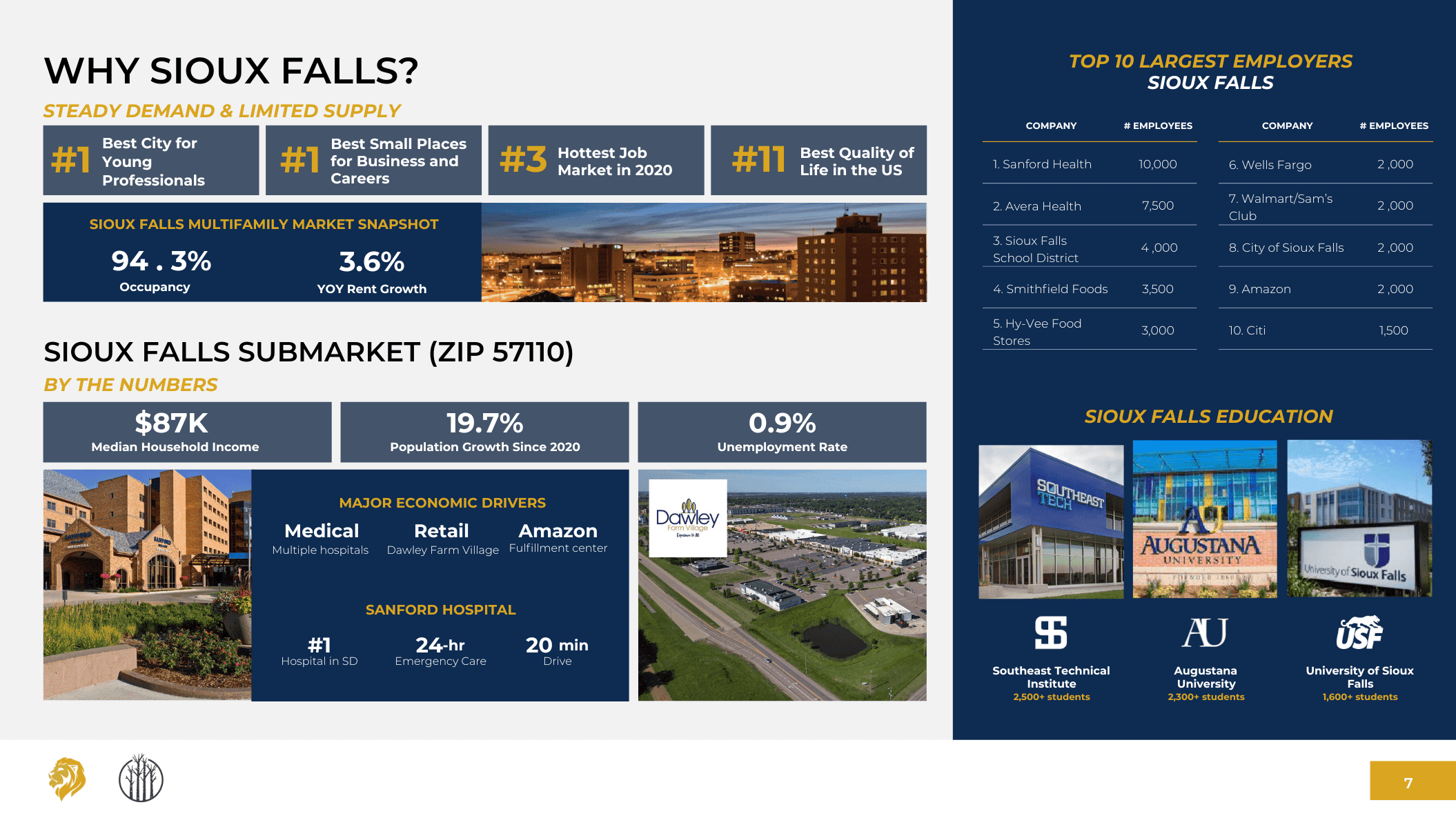

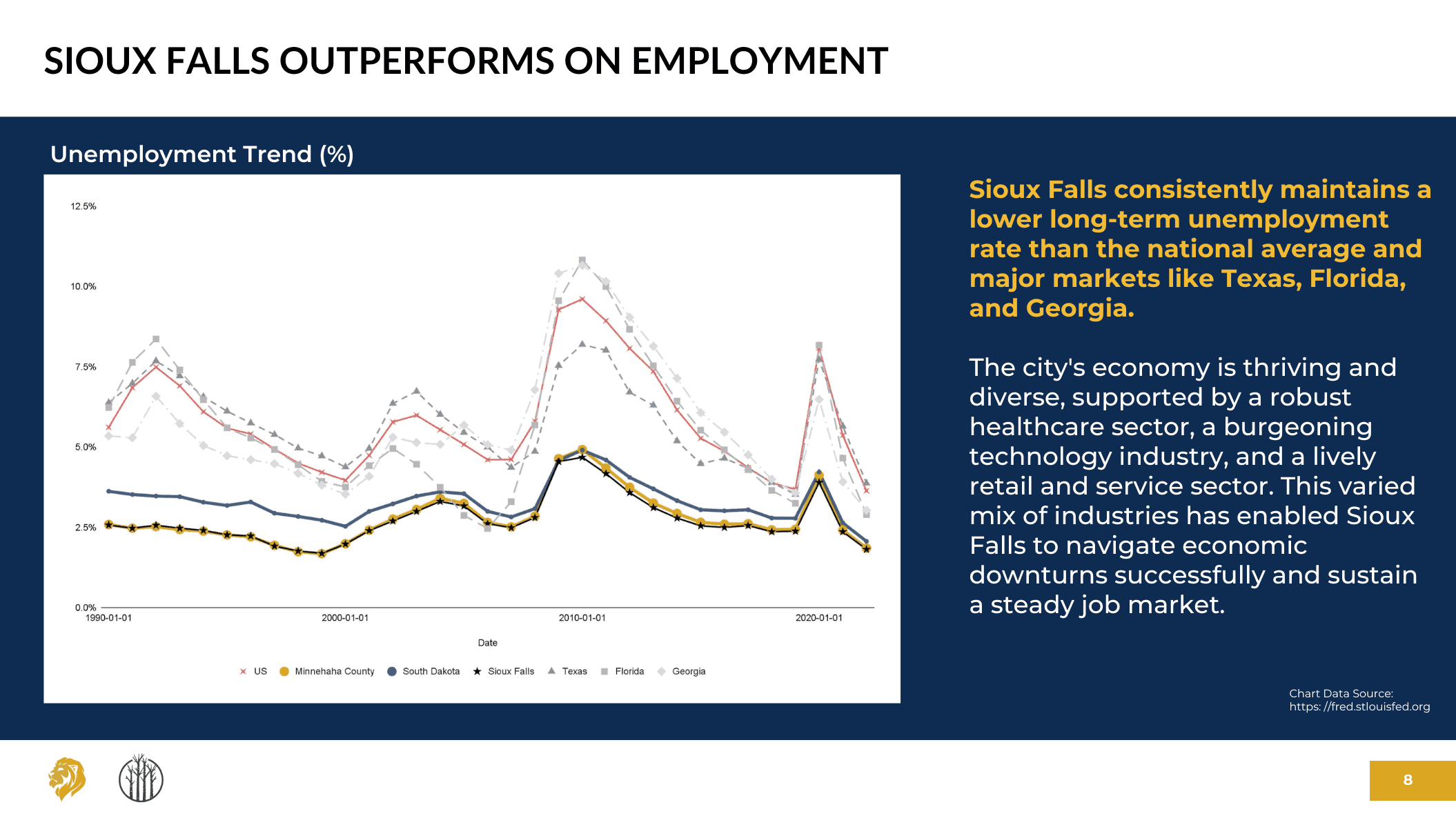

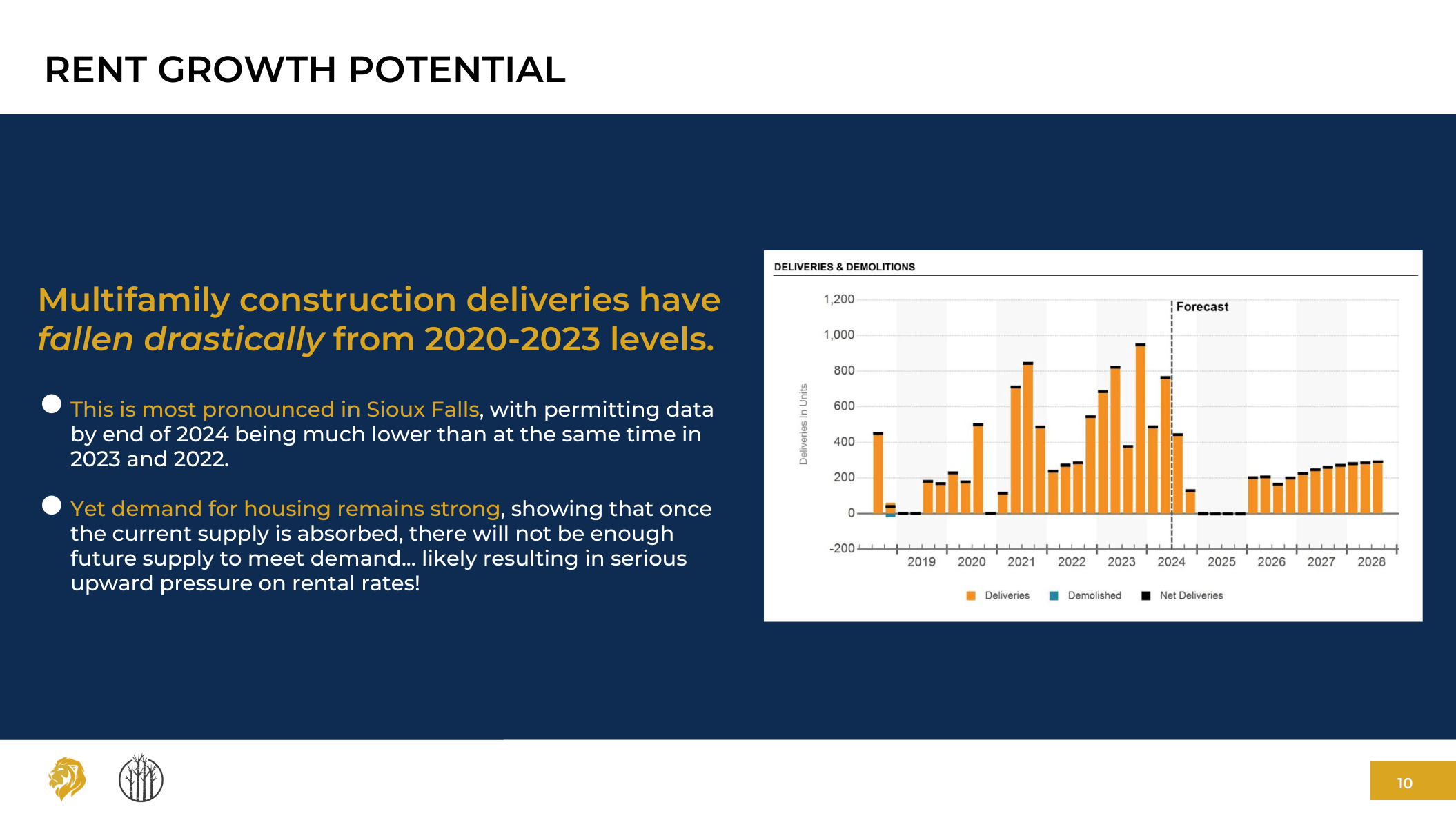

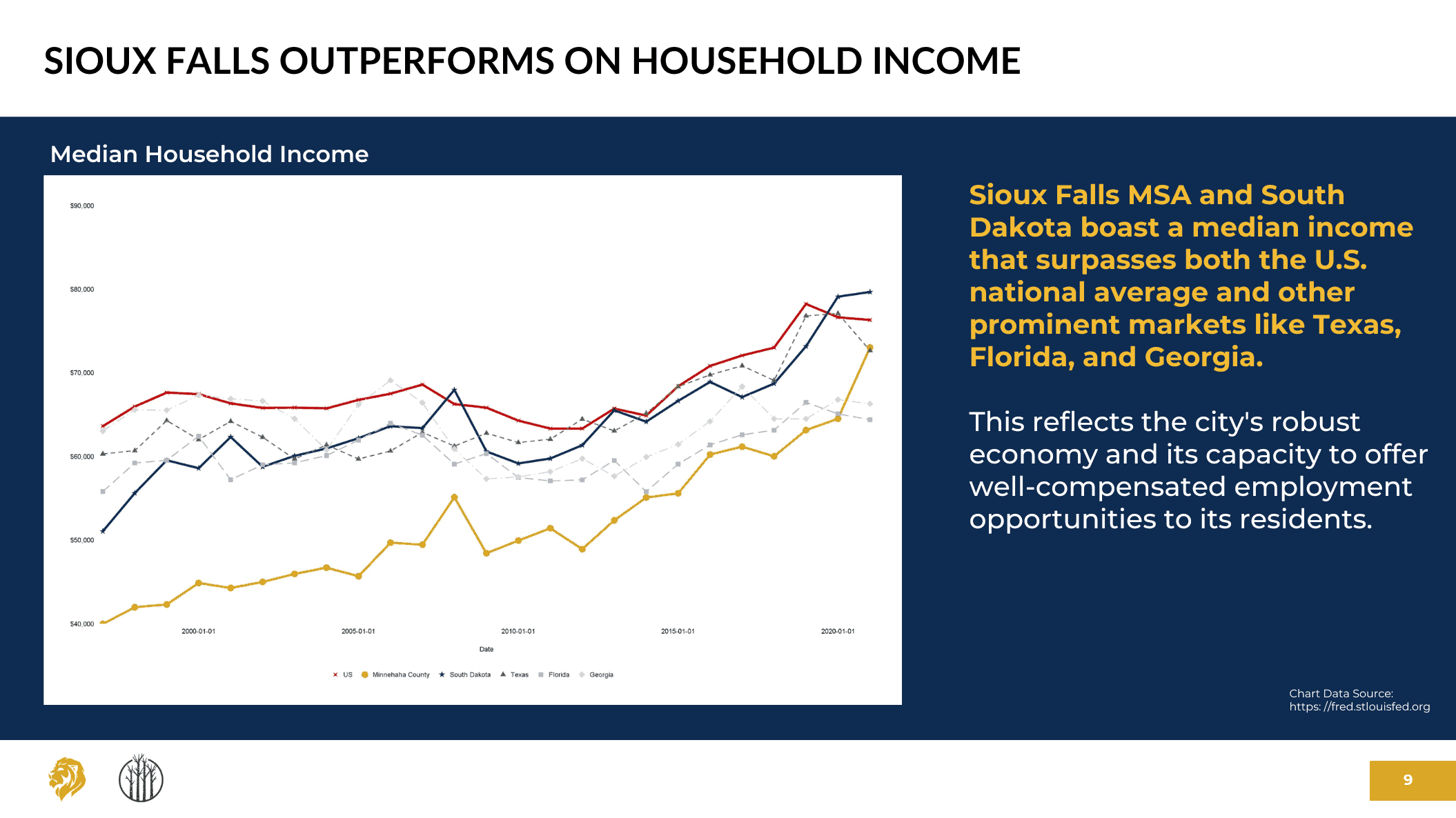

Foss Fields Phase 1

Sioux Falls, SD

Foss Fields is a 300-acre master development situated at the nexus of Sioux Falls’ next major commercial development. The master development will include residential, senior housing, multifamily, office park, retail, healthcare, and other components. Phase 1 of our Foss Fields multifamily project is targeted for 100 units.

Key Highlights:

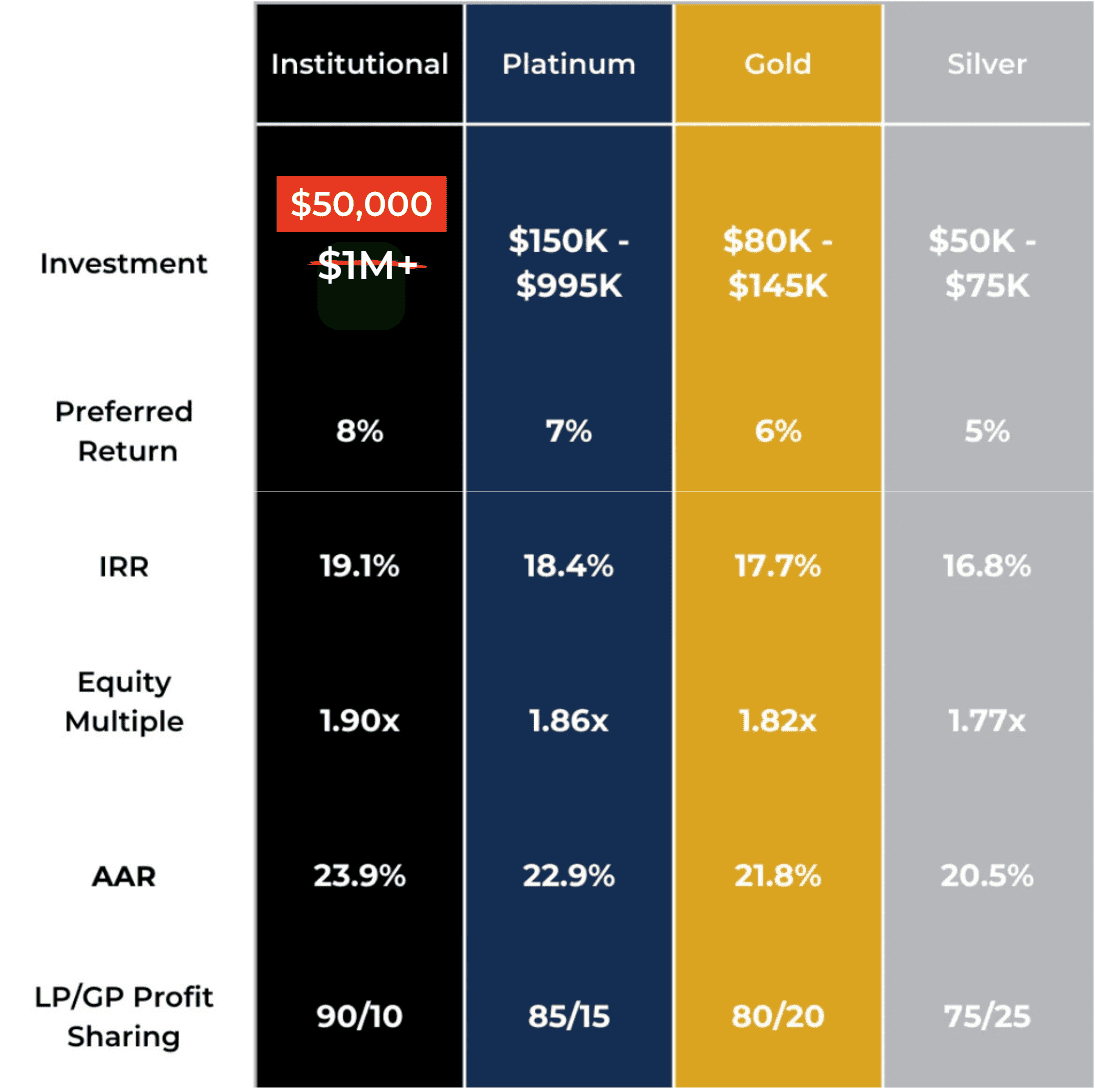

- Institutional Returns Access – Our network gains access to superior returns at a significantly reduced minimum investment of $50,000, typically reserved for $1M+ investors.

- Proven Track Record – Sponsored by Boardwalk Wealth who have successfully operated for over a decade and have deep business, family and community ties in this market.

- Heritage Land of a Local Hero – The property will rest on the original farmhouse land of WWII flying ace Joe Foss.

- Significant Tax Benefits – Estimated $24,092 in tax benefits per $100K invested, including $4,153 in 45L energy tax credits and $19,939 from accelerated depreciation.

19.1% IRR

8% Preferred Return

1.90x Equity Multiple on a 45-Month Holding Period

$50K Minimum Investment

Learn more about Foss Fields

Foss Fields Phase 1

Sioux Falls, SD

Foss Fields is a 300-acre master development situated at the nexus of Sioux Falls’ next major commercial development. The master development will include residential, senior housing, multifamily, office park, retail, healthcare, and other components. Phase 1 of our Foss Fields multifamily project is targeted for 100 units.

19.1% IRR

8% Preferred Return

1.90x Equity Multiple on a 45-Month Holding Period

$50K Minimum Investment

Key Highlights:

- Institutional Returns Access – Our network gains access to superior returns at a significantly reduced minimum investment of $50,000, typically reserved for $1M+ investors.

- Proven Track Record – Sponsored by Boardwalk Wealth who have successfully operated for over a decade and have deep business, family and community ties in this market.

- Heritage Land of a Local Hero – The property will rest on the original farmhouse land of WWII flying ace Joe Foss.

- Significant Tax Benefits – Estimated $24,092 in tax benefits per $100K invested, including $4,153 in 45L energy tax credits and $19,939 from accelerated depreciation.

Learn more about Foss Fields

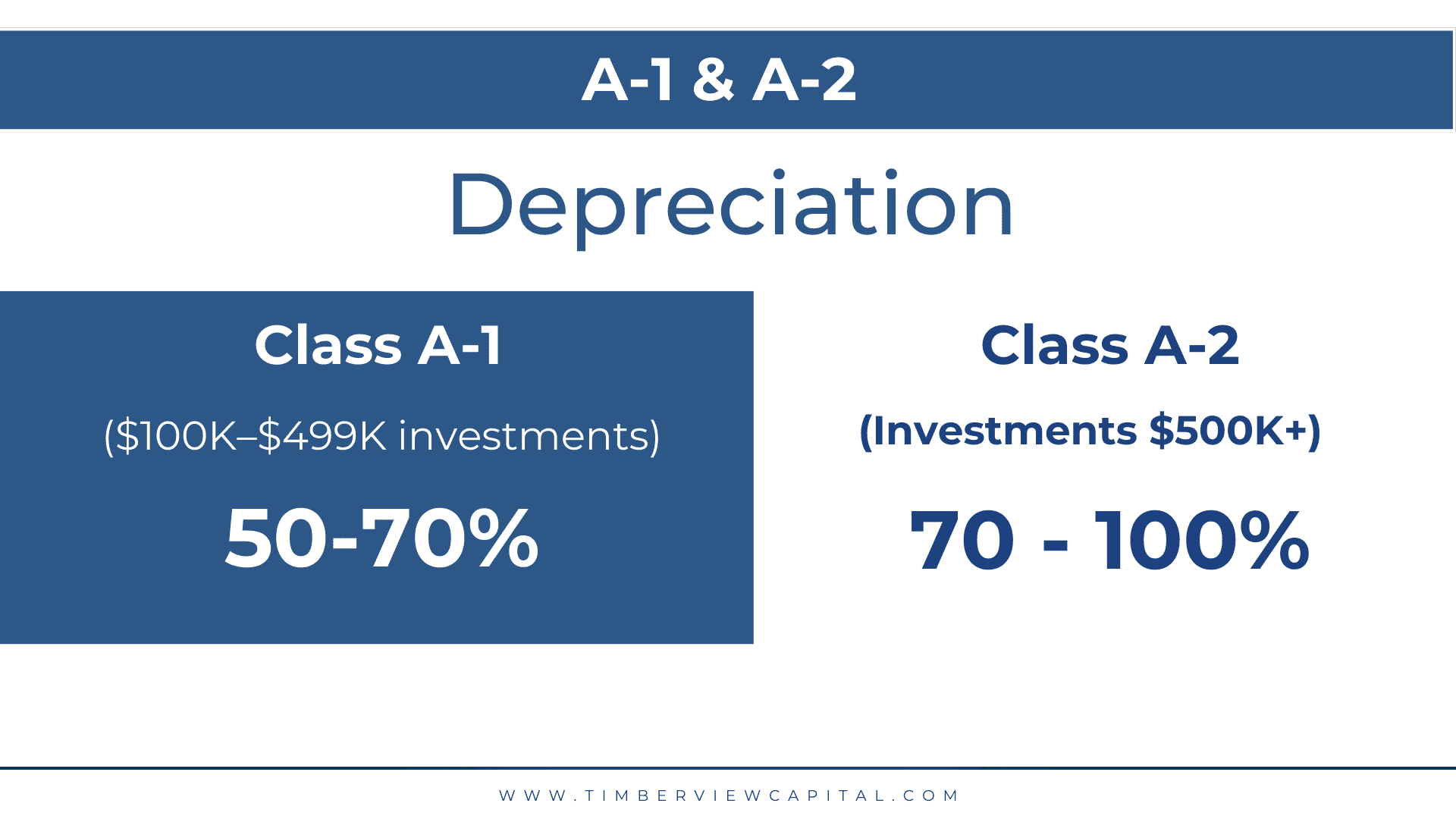

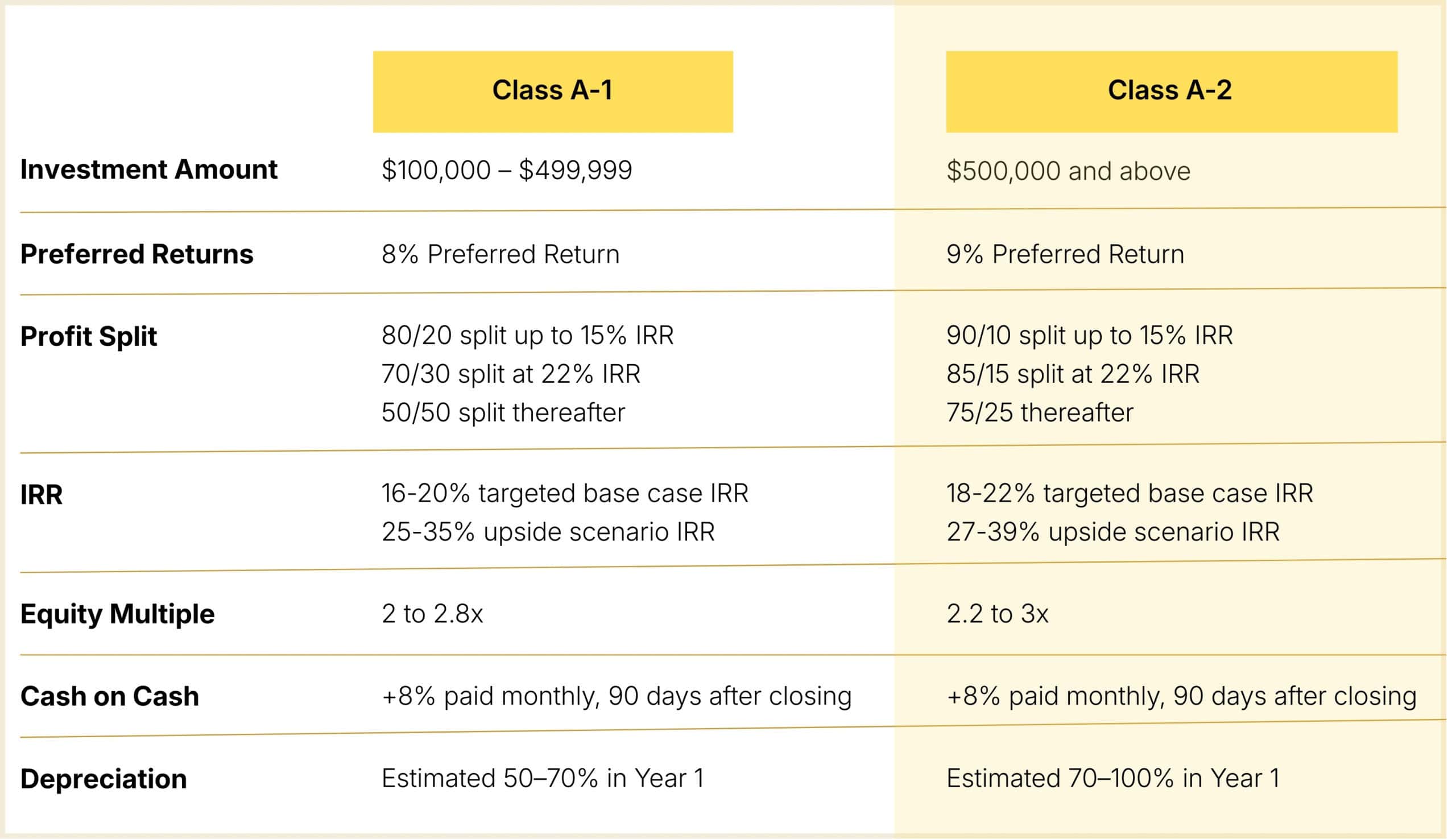

Medical Office

Roll-Up Fund

Timberview Capital brings you a unique investment opportunity in medical real estate. With a focus on healthcare and dental offices, this asset class offers long-term leases and recession-resistant tenants, providing a stable foundation for consistent returns. Medical real estate is positioned to grow alongside the increasing demand for healthcare services, making it a smart addition to any diversified portfolio.

16–20% targeted base case IRR

25–35% upside scenario IRR

2 to 3x targeted equity multiple

8-9% preferred return

50% – 70% depreciation in year 1

Preferred returns paid monthly, 30-90 post closing

Learn more about Medical Office Roll-Up Fund

Medical Office

Roll-Up Fund

Timberview Capital brings you a unique investment opportunity in medical real estate. With a focus on healthcare and dental offices, this asset class offers long-term leases and recession-resistant tenants, providing a stable foundation for consistent returns. Medical real estate is positioned to grow alongside the increasing demand for healthcare services, making it a smart addition to any diversified portfolio

16–20% targeted base case IRR

25–35% upside scenario IRR

2 to 3x targeted equity multiple

8-9% preferred return

50% – 70% depreciation in year 1

Preferred returns paid monthly, 30-90 post closing

Learn more about Medical Office Roll-Up Fund

The testimonials, statements, and opinions presented are applicable to the individuals listed. Results will vary and may not be representative of the experience of others. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services, or any benefits in exchange for said statements. The testimonials are representative of client experience, but the exact results and experience will be unique and individual to each client. All offers and sales of any securities will be made only to Accredited Investors, which, for natural persons, are investors who meet certain minimum annual income or net worth thresholds or hold certain SEC-approved certifications. Any securities that are offered in reliance on certain exemptions from the registration requirements of the Securities Act of 1933 (primarily Rule 506C of Regulation D and/or Section 4(a)(2) of the Act) and are not required to comply with specific disclosure requirements that apply to registrations under the Act. The SEC has not passed upon the merits of, or given its approval to, any securities offered by Timberview Capital LLC, the terms of the offering, or the accuracy or completeness of any offering materials. Any securities that are offered by Timberview Capital LLC are subject to legal restrictions on transfer and resale, and investors should not assume they will be able to resell any securities offered by Timberview Capital LLC. Investing in securities involves risk, and investors should be able to bear the loss of their investment. Any securities offered by Timberview Capital LLC are not subject to the protections of the Investment Company Act. Any performance data shared by Timberview Capital LLC represents past performance, and past performance does not guarantee future results. Neither Timberview Capital LLC nor any of its funds is required by law to follow any standard methodology when calculating and representing performance data, and the performance of any such funds may not be directly comparable to the performance of other private or registered funds.