Instead of managing tenants, handling repairs, or paying property bills, investors in triple net lease properties enjoy consistent income while the tenant covers taxes, insurance, and maintenance. This low-effort model has become a preferred strategy for high-income professionals such as doctors, dentists, and business owners who are looking to grow long-term wealth without adding more work to their plate.

This article explores how triple net leases work and why they are a hidden gem in the world of passive investing.

What Is a Triple Net Lease?

A triple net lease, often written as “NNN,” is a type of lease where the tenant agrees to pay for three things:

- Property taxes

- Insurance

- Maintenance costs

This is in addition to their rent.

That means the landlord does not have to worry about fixing broken air conditioners, paying yearly taxes, or shopping for insurance. The tenant handles it all. The landlord simply collects rent every month.

This type of lease is common in commercial real estate. It is often used by big national brands like Walgreens, Starbucks, and Dollar General. But it is also used in healthcare buildings, office space, and other long-term business locations.

Why Triple Net Leases Matter for Passive Investors

Many investors want passive income. But not every real estate deal is truly passive. Single-family homes need repairs. Apartments need a manager. Short-term rentals need cleaning and bookings.

Triple net leases are different. They are low-touch and steady. Once you buy the building and sign the lease, the tenant takes over most of the responsibilities.

Here is why NNN leases are a hidden gem for passive investors:

1. Steady Income with Less Risk

Tenants usually sign long-term leases, often between 10 to 20 years. These leases often include built-in rent increases every year. This gives you a clear picture of how much income you can expect.

2. Low Maintenance

Since the tenant covers maintenance, insurance, and property taxes, you do not have to worry about surprise costs. You can focus on enjoying your income instead of fixing plumbing issues.

3. Good Tenants

Triple net leases are often used by large businesses, medical groups, or essential service providers. These types of tenants are more likely to pay rent on time and stay in the building long-term.

4. Easier to Predict Cash Flow

Because your expenses are low and fixed, it is easier to predict how much money you will make each month. You don’t get this level of stability with many other real estate options.

5. Easy to Scale

NNN leases are great for building wealth over time. Once one deal is working, you can repeat the process. Some investors build entire portfolios of triple net properties and collect checks from each one.

How Passive Income Grows with One Smart Deal

Imagine you invest $100,000 into a medical office building. The building is leased to a dentist. That tenant pays rent plus the property taxes, insurance, and maintenance.

As the investor, you receive about $7,000 to $8,000 per year. This is called a preferred return. It is regular and passive.

After a few years, the property might be refinanced. You could receive your $100,000 back while still earning income from the same building. That money can then be reinvested into a second deal.

Now you are earning income from two properties. Over time, this cycle builds real wealth.

Are Triple Net Leases Safe?

No investment is without risk. But triple net leases are considered one of the safest real estate options, especially when the tenant is strong.

Here are a few things to watch for:

- Make sure the tenant is financially healthy.

- Look for leases that are long-term with built-in rent increases.

- Check the location. Is it a growing area? Will the tenant want to stay for years?

Most experienced investors also work with professionals who review the lease, the building, and the tenant to make sure it is a good deal.

Tax Benefits of Triple Net Leases

One of the hidden powers of real estate is how much you can save on taxes.

Even though you are collecting income, the IRS allows you to use something called “depreciation” to lower your taxable income. You may also qualify for “bonus depreciation” and “cost segregation” studies that increase your tax savings in the first few years of the investment.

In some cases, a $100,000 investment could create more than $50,000 in paper tax losses in the first year

These savings can offset your real estate income and sometimes even your other earned income. That means more cash in your pocket.

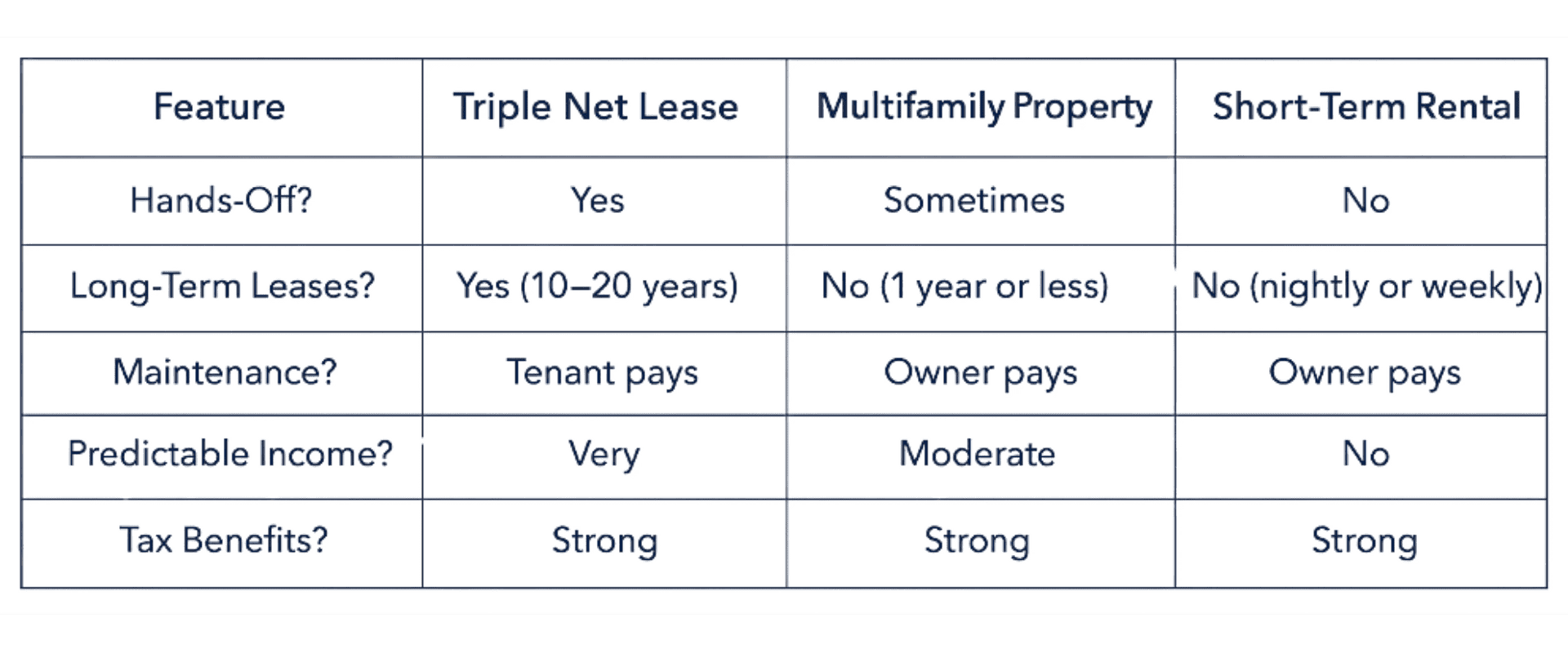

Triple Net Leases vs. Other Real Estate Investments

The Best Fit for Busy Professionals

If you are a busy doctor, business owner, or high-income earner, time is your most limited asset. Triple net leases allow you to grow your wealth while focusing on what you do best. You do not need to fix toilets. You do not need to answer midnight phone calls.

Triple net investments are quiet. They are steady. And they work while you rest.

The Quiet Power of Triple Net Lease Investing

Triple net leases are one of the most overlooked tools for building real wealth. They are simple to understand, low in maintenance, and offer reliable income. While not flashy, they are powerful for anyone who wants freedom from their work, a plan for early retirement, or just a way to stop trading time for money.

You do not have to manage property. You do not have to guess about returns. You just need to invest wisely and let time do the work.

Take the First Step Toward Passive Income and Peace of Mind

If you are ready to explore real estate opportunities that offer long-term wealth with less work, we invite you to take the next step. Learn how to grow your income without growing your to-do list.

Connect with Us: Contact Timberview Capital