New Braunfels – Northcliffe

New Braunfels & Northcliffe, TX

We are excited to present a horizontal land development investment opportunity in one of the fastest-growing regions in the U.S. Our New Braunfels & Northcliffe projects focus on the horizontal development phase of build-to-rent communities. This means you are investing in the early stages—securing entitlements, infrastructure, and utilities—positioning the land for future vertical development by builders.

- 25% Preferred Return + 20% Equity Participation

- Projected 2.00x Equity Multiple

- Target: Principal + 28% Return in the First Year

- Investment Term: 9 to 24 Months

- Investment Minimum: $100,000

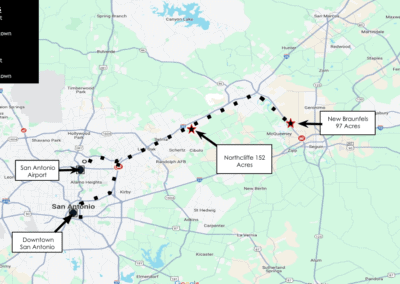

- Prime Developable Land: 97 acres in New Braunfels, 152 acres in Schertz (Northcliffe)

Why Invest in Horizontal Development?

-

Low-Risk Entry into High-Growth Markets

Horizontal development involves preparing land for future construction without the risks of building. The New Braunfels and Schertz areas are part of the booming San Antonio-Austin corridor, one of the most rapidly expanding regions in the U.S., ensuring strong demand for fully entitled and shovel-ready land. -

Shorter Investment Term, Faster Returns

With an investment term of 9 to 24 months, this horizontal development project offers the potential for faster returns compared to full-scale construction projects. Our first-year target is to return your principal plus 28% through the sale or joint venture of shovel-ready land. -

Prime Locations in High-Demand Markets

Both New Braunfels and Schertz are strategically located in one of the most desirable growth areas in Texas:New Braunfels: 32 miles from San Antonio International Airport

Schertz (Northcliffe): 20 miles from San Antonio International Airport.

These locations benefit from high household incomes and a growing demand for housing. -

De-risked Investment Structure

This opportunity is designed to mitigate risk by focusing on the horizontal phase, avoiding the complexities of vertical construction. You’ll benefit from rising land values as the property becomes shovel-ready for builders, while retaining the flexibility to exit via land sales or joint ventures with vertical developers

New Braunfels – Northcliffe

New Braunfels & Northcliffe, TX

We are excited to present a horizontal land development investment opportunity in one of the fastest-growing regions in the U.S. Our New Braunfels & Northcliffe projects focus on the horizontal development phase of build-to-rent communities. This means you are investing in the early stages—securing entitlements, infrastructure, and utilities—positioning the land for future vertical development by builders.

- 25% Preferred Return + 20% Equity Participation

- Projected 2.00x Equity Multiple

- Target: Principal + 28% Return in the First Year

- Investment Term: 9 to 24 Months

- Investment Minimum: $100,000

- Prime Developable Land: 97 acres in New Braunfels, 152 acres in Schertz (Northcliffe)

Why Invest in Horizontal Development?

-

Low-Risk Entry into High-Growth Markets

Horizontal development involves preparing land for future construction without the risks of building. The New Braunfels and Schertz areas are part of the booming San Antonio-Austin corridor, one of the most rapidly expanding regions in the U.S., ensuring strong demand for fully entitled and shovel-ready land. -

Shorter Investment Term, Faster Returns

With an investment term of 9 to 24 months, this horizontal development project offers the potential for faster returns compared to full-scale construction projects. Our first-year target is to return your principal plus 28% through the sale or joint venture of shovel-ready land. -

Prime Locations in High-Demand Markets

Both New Braunfels and Schertz are strategically located in one of the most desirable growth areas in Texas:New Braunfels: 32 miles from San Antonio International Airport

Schertz (Northcliffe): 20 miles from San Antonio International Airport.

These locations benefit from high household incomes and a growing demand for housing. -

De-risked Investment Structure

This opportunity is designed to mitigate risk by focusing on the horizontal phase, avoiding the complexities of vertical construction. You’ll benefit from rising land values as the property becomes shovel-ready for builders, while retaining the flexibility to exit via land sales or joint ventures with vertical developers

The testimonials, statements, and opinions presented are applicable to the individuals listed. Results will vary and may not be representative of the experience of others. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services, or any benefits in exchange for said statements. The testimonials are representative of client experience, but the exact results and experience will be unique and individual to each client. All offers and sales of any securities will be made only to Accredited Investors, which, for natural persons, are investors who meet certain minimum annual income or net worth thresholds or hold certain SEC-approved certifications. Any securities that are offered in reliance on certain exemptions from the registration requirements of the Securities Act of 1933 (primarily Rule 506C of Regulation D and/or Section 4(a)(2) of the Act) and are not required to comply with specific disclosure requirements that apply to registrations under the Act. The SEC has not passed upon the merits of, or given its approval to, any securities offered by Timberview Capital LLC, the terms of the offering, or the accuracy or completeness of any offering materials. Any securities that are offered by Timberview Capital LLC are subject to legal restrictions on transfer and resale, and investors should not assume they will be able to resell any securities offered by Timberview Capital LLC. Investing in securities involves risk, and investors should be able to bear the loss of their investment. Any securities offered by Timberview Capital LLC are not subject to the protections of the Investment Company Act. Any performance data shared by Timberview Capital LLC represents past performance, and past performance does not guarantee future results. Neither Timberview Capital LLC nor any of its funds is required by law to follow any standard methodology when calculating and representing performance data, and the performance of any such funds may not be directly comparable to the performance of other private or registered funds.