Diversified Oil & Gas Investment Opportunity

Diversify beyond traditional assets with a cash-flowing, inflation-resistant investment that’s built to perform—even when markets don’t.

Overview

We are pleased to present a $75MM+ diversified oil & gas fund focused on investing in what we believe to be the best risk- adjusted opportunities.

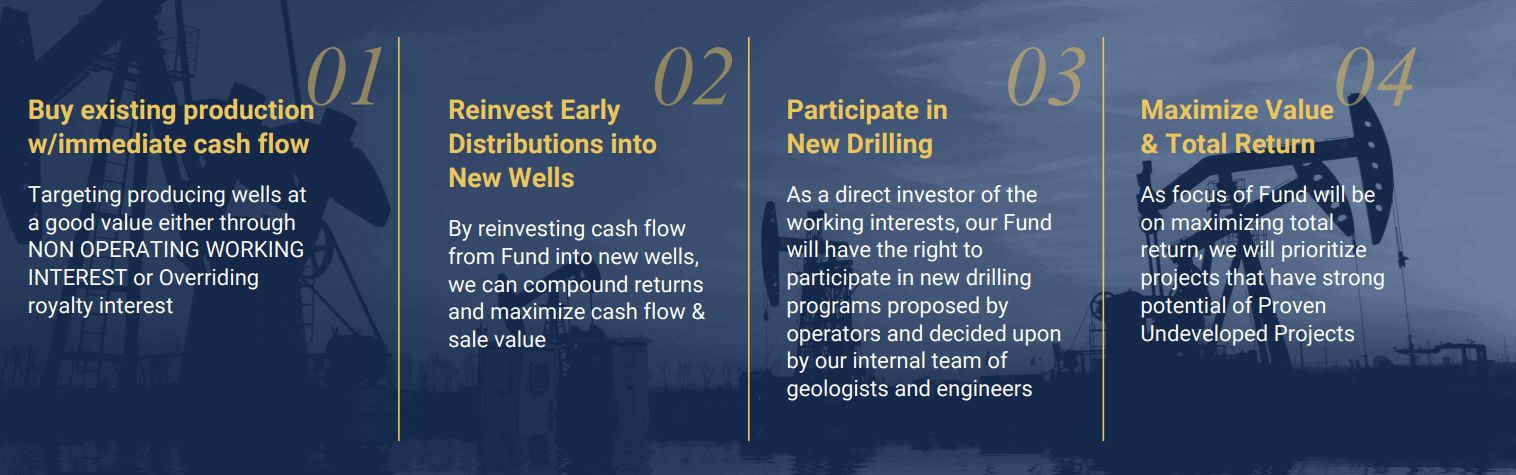

This Fund will be focusing on investing in a combination of existing producing assets for current cash flow (PDP) along with acreage for new drilling for upside value (PUD). We’ll be targeting multiple basins.

The Fund will generally be focused on investing in non-operating working interests (“NOWI”) and overriding royalty interests (“ORRI”). This reduces operational risk but gives the opportunity to participate in new drilling programs.

Investment Highlights

We’ve negotiated BETTER RETURNS and a LOWER ENTRY POINT for our network.

31.6%

Estimated IRR

80%

Average Annual Return

9.08x

Equity Multiple

8-10 years

Hold Time

$100,000

Minimum Investment

Key Reasons to Invest

Discover a thoughtfully designed strategy that combines deep industry expertise, income-producing assets, and long-term growth potential. With access to deals overlooked by institutional capital and backed by favorable energy market dynamics, this opportunity is built to deliver consistent returns and meaningful portfolio diversification.

Experienced Sponsor Team

Our sponsorship team has extensive experience in operating and engineering on oil & gas assets for the last 40 years, with a 5-project track record.

Middle Market Opportunities

Given target size of fund and lack of capital market activity, we’ll be able to participate in larger assets in proven basins with larger operators.

Tax Benefits

Numerous tax benefits for investors including: Intangible Drilling Costs, Depletion & Depreciation to offset passive income.

Favorable Fundamentals

Lower global inventories and minimal domestic investment in production, along with strong projected fossil fuel demand creates potentially favorable economic fundamentals.

Cash Flow + Total Return

Our fund strategy will combine a focus on existing, producing assets at good values, with additional upside through drilling. We’re targeting a mix of distributions and reinvestment into new drilling to compound returns.

Sponsor Track Record by the Numbers

$250M +

Investor Capital Manage

$600M +

Assets Under Management

12 +

Years Track Record

$61M +

Investor Distributions Since Inception

800

Investors Served

Prior Fund Performance

$41M

Invested Capital

15%

Distribution Yield in 2024

36%

Estimated IRR from Current Value

Our 4-Step Energy Investment Strategy

Cash Flow Today. Huge Upside Potential

Watch the Webinar Recording

Frequently Asked Questions

What is the minimum investment?

The minimum investment of this oil and gas investment opportunity is $100,000

What is the lock-up period on this fund?

The fund life is expected to be 10 years; however, our team is always evaluating exit opportunities and will consider exiting early should it benefit investor returns.

How often will I be updated about my investment?

Once you invest, you will be given an investor portal to track your investment. We provide capital account statements, investor newsletters, and financial statements on a quarterly basis. We also always welcome calls from our investors.

What’s the difference between working interest and royalty interest?

Operating Working Interest: an interest in an oil or gas property through an operating agreement, lease, fee title, or another arrangement. The owner must pay part of the expense of the property’s operating costs, including drilling, leasing, and operating oil and gas wells. In addition, the working interest owner is entitled to a percentage of the oil and gas revenue.

Non-Operating Working Interest: refers to an interest in an oil and gas property that does not participate in the day-to-day operations of drilling, testing, completion, and maintenance of the production or the sale of the minerals produced. Unlike royalty interests, non-operating working interest must pay a portion of the costs associated with the day-to-day operation of the well, but also is entitle to a percentage of the oil & gas revenue.

Will I own a specific oil or gas well?

No. Investors in this Fund will be part owners of the Fund shares and thereby a portion of all assets owned in the Fund. Based on the strategy of the Fund it is anticipated there will be numerous wells, basins, & operators in the assets creating a diversified portfolio.

The Fund will focus on investing in a combination of multiple existing producing assets for current cash flow (PDP) along with acreage for new drilling for upside value (PUD). The Fund will generally be focused on investing in non-operating working interests (“NOWI”) and overriding royalty interests (“ORRI”). This reduces operational risk but gives the opportunity to participate in new drilling programs.

Are there tax advantages?

Yes. However, this deal is primarily focused on maximizing shareholder returns vs. primarily generating tax losses. As such, while we anticipate tax advantages to be passed through to the limited partners, our goal will be to make acquisitions first based on investor overall returns. Oil and gas investments generally offering tax advantages through depreciation, depletion, and intangible drilling costs.

Investors may elect to take part in either the GP side offering advantages toward active income or the LP side offering advantages toward passive income. It must be noted, taking part in the GP comes with additional risks.

Can I invest with an IRA or 401K?

Yes, our fund allows investment through qualified retirement money. This must be done through a self-directed IRA or 401K. If you don’t yet have a self-directed account, we can make introductions to several custodians that we have worked with.

Additionally, some funds implement leverage leading to the possibility of generating Unrelated Business Income Tax (UBIT). We would ask that you speak with your tax professional about potential implications.

Do I need to be an accredited investor to invest in the fund?

Yes, this investment opportunity currently only allow accredited investors.

What is an accredited investor?

An individual or an entity can generally qualify as an accredited investor if they meet at least one of the following criteria:

- an individual with income exceeding $200,000 or joint income with his or her spouse of at least $300,000, in each of the last two years with the expectation to reasonably maintain the same level of income in the present year

- an individual with a net worth exceeding $1 million, excluding the primary residence, either individually or jointly with his or her spouse;

- an entity that has assets exceeding $5 million that was not formed solely for the purpose of making the investment; or

- an entity whose owners all satisfy 1, 2, or 3 above.

- holds in good standing a Series 7, 65 or 82 license.

For more information about the requirements of an accredited investor, see this bulletin from the SEC.

4096 Treeline Dr., Bettendorf, Iowa 52722

The testimonials, statements, and opinions presented are applicable to the individuals listed. Results will vary and may not be representative of the experience of others. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services, or any benefits in exchange for said statements. The testimonials are representative of client experience, but the exact results and experience will be unique and individual to each client. All offers and sales of any securities will be made only to Accredited Investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds or hold certain SEC approved certifications. Any securities that are offered, are offered in reliance on certain exemptions from the registration requirements of the Securities Act of 1933 (primarily Rule 506C of Regulation D and/or Section 4(a)(2) of the Act) and are not required to comply with specific disclosure requirements that apply to registrations under the Act. The SEC has not passed upon the merits of, or given its approval to any securities offered by Timberview Capital LLC, the terms of the offering, or the accuracy of completeness of any offering materials. Any securities that are offered by Timberview Capital LLC are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell any securities offered by Timberview Capital LLC. Investing in securities involves risk, and investors should be able to bear the loss of their investment. Any securities offered by Timberview Capital LLC are not subject to the protections of the Investment Company Act. Any performance data shared by Timberview Capital LLC represents past performance and past performance does not guarantee future results. Neither Timberview Capital LLC nor any of its funds are required by law to follow any standard methodology when calculating and representing performance data and the performance of any such funds may not be directly comparable to the performance of other private or registered funds.