Invest in Texas Vineyards

Build Your Family’s Legacy with Long-Term Passive Income

BUILD A FAMILY LEGACY

PASSIVE INCOME FOR 40+ YEARS

GET REAL DIVERSIFICATION

LAST OPPORTUNITY TO OWN A TEXAS VINEYARD

This is the final vineyard block our team is planting—filling a critical supply gap in Texas wine production. Don’t miss your chance to invest in a vineyard that will generate passive income for 40+ years.

Investment Highlights

454% – 845%

Return for Life of Project

Tax Benefits

Pass Through Losses + Cost Segregation

For Non-Accredited and Accredited Investors

2.7X

10-Year Equity Multiple

70/30 LP/GP Split

with Tiered Model

107+% Return by Year 8 + Infinite Returns for Another 35+ Years

17.7%

Average Annual COC

$75,000

Minimum Investment

IRA, Solo 401k, & QRP Funds Accepted

Why Texas

Texas is the 5th largest wine grape growing state in the U.S. with a $20B economic impact & growing.

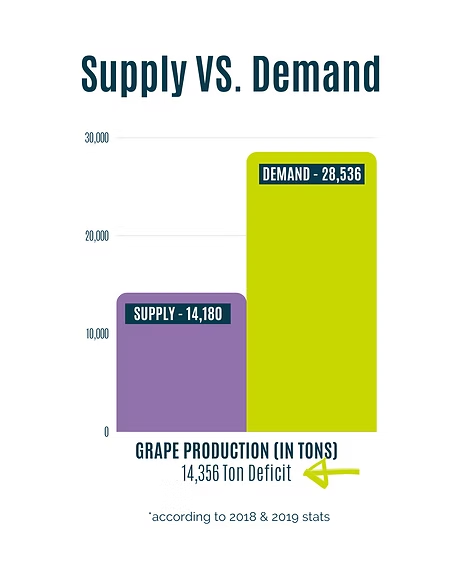

Major Supply Gap in Texas Wine Grapes

Wine demand continues to outpace the grape supply and Texas grape farmers can’t keep up. Our large, mechanized vineyards will fill that supply gap.

Our Vineyards are Mechanized

We utilize proven strategies from successful California wineries, eliminating high labor costs and creating larger profit margins for investors.

Why Investors Love Texas Vineyards

Our vineyards aren’t as sensitive to a volatile interest rate environment due to low LTV & strong cash flow. We can achieve 20%+ annual returns without being dependent upon executing a refinance.

Our vineyard investments offer stellar returns + tax advantages – 783% – 984% return over the life of the project

We are filling the supply gap in Texas wine grapes and will soon be the largest vineyard operator in the state, controlling more than 50% of the wine grape supply.

Our vineyard investments offer stellar returns + tax advantages – 783% – 984% return over the life of the project

Mitigated risk through multi-peril crop insurance so you can be confident your money is protected long-term

4096 Treeline Dr., Bettendorf, Iowa 52722

The testimonials, statements, and opinions presented are applicable to the individuals listed. Results will vary and may not be representative of the experience of others. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services, or any benefits in exchange for said statements. The testimonials are representative of client experience, but the exact results and experience will be unique and individual to each client. All offers and sales of any securities will be made only to Accredited Investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds or hold certain SEC approved certifications. Any securities that are offered, are offered in reliance on certain exemptions from the registration requirements of the Securities Act of 1933 (primarily Rule 506C of Regulation D and/or Section 4(a)(2) of the Act) and are not required to comply with specific disclosure requirements that apply to registrations under the Act. The SEC has not passed upon the merits of, or given its approval to any securities offered by Timberview Capital LLC, the terms of the offering, or the accuracy of completeness of any offering materials. Any securities that are offered by Timberview Capital LLC are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell any securities offered by Timberview Capital LLC. Investing in securities involves risk, and investors should be able to bear the loss of their investment. Any securities offered by Timberview Capital LLC are not subject to the protections of the Investment Company Act. Any performance data shared by Timberview Capital LLC represents past performance and past performance does not guarantee future results. Neither Timberview Capital LLC nor any of its funds are required by law to follow any standard methodology when calculating and representing performance data and the performance of any such funds may not be directly comparable to the performance of other private or registered funds.