“Imagine if your path to retirement was not a distant journey, but a decade away.”

This thought-provoking proposition lies at the heart of the 10Y Exponential Wealth Multiplier Fund.

In a world where traditional real estate investments move at a gradual pace, the 10Y model emerges as a beacon of innovation – a strategy designed not just to follow the currents of the market, but to create waves of its own. For those accustomed to the slow burn of conventional investments, the 10Y model is an invitation to experience the thrill of rapid wealth growth, redefining the timeline to financial freedom.

Traditional Real Estate Investment Models

Traditional models, such as ‘Stabilize & Hold’ and BRRRR, have been the backbone of real estate investing for years. These strategies involve purchasing properties, possibly renovating them, and then relying on rental income and market appreciation for returns. However, these models often yield linear growth which can limit rapid wealth accumulation and extend the time required to achieve substantial retirement savings.

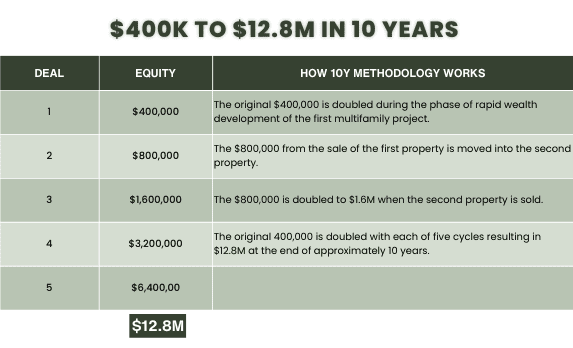

In contrast, the 10Y Exponential Wealth Multiplier Fund is specifically designed to accelerate the wealth creation process. This innovative model targets a remarkable 32X equity multiple over a 10 to 12-year period. Yes you read that correctly, put $400,000 in today and take out a potential $12.8 million in 10 to 12 years. Sounds to good to be true doesn’t it? It’s just math. It does this by combining the benefits of multifamily real estate investment with a strategic approach to reinvestment and growth.

Strategic Reinvestments for Compounded Growth

A core principle of the 10Y model is leveraging the power of compounded growth through strategic reinvestments. This is achieved by:

-

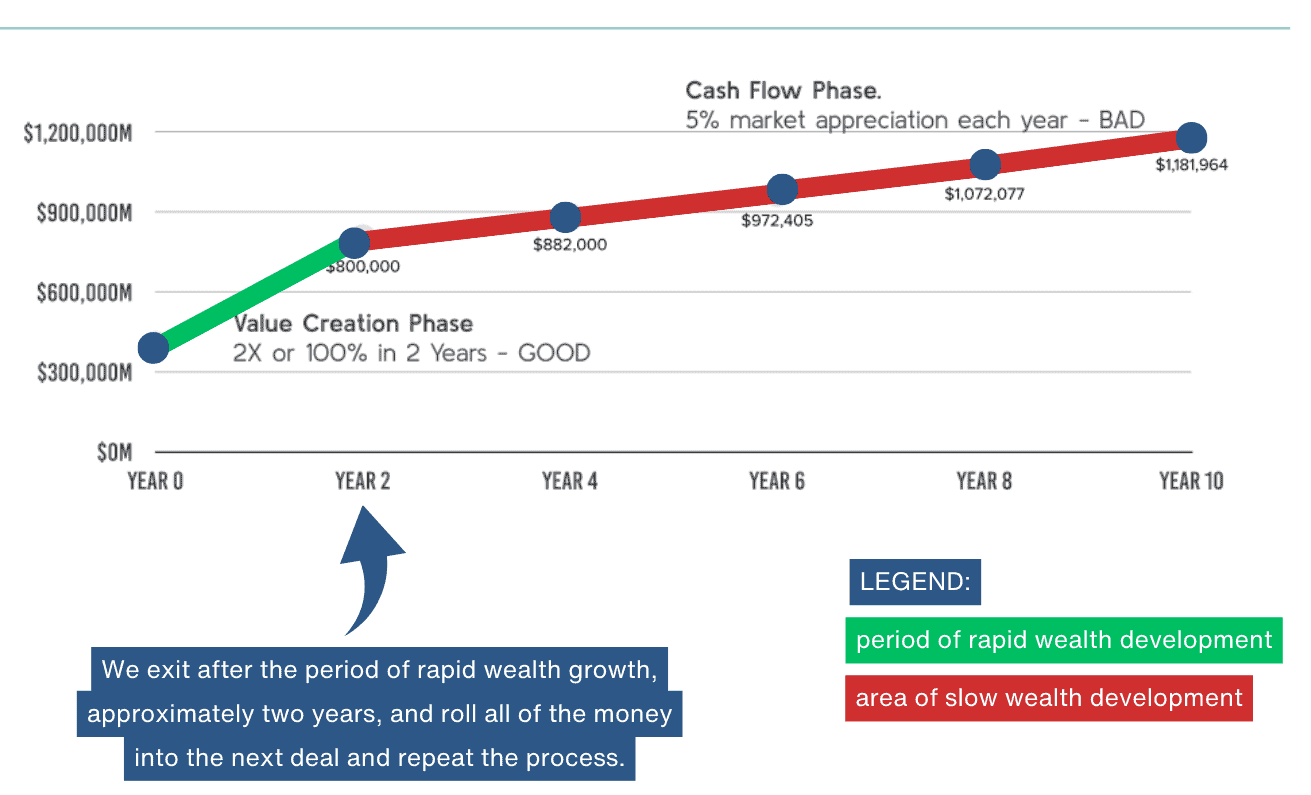

- Exiting Deals After Value Creation: The model involves exiting deals right after the value creation phase, which will include property development or existing property renovation. This strategy allows for the realization of profits at an optimized time.

-

- Reinvesting Entire Proceeds: Rather than distributing the proceeds, the 10Y model emphasizes reinvesting the entire amount into the next deal. This approach ensures that the profits are not only preserved but are also put to work to generate further growth.

-

- The Compounding Effect: This continuous cycle of reinvesting the profits leads to a compounding effect. Just like compound interest in a savings account, each investment cycle builds upon the previous one, exponentially increasing the overall value of the investment over time.

Example of Compounded Growth

As an illustration, consider an initial investment of $400,000. In the 10Y model, this amount is reinvested through five deal cycles. In each cycle, the equity is projected to double. This means the initial $400,000 could potentially grow to $800,000 in the first cycle, and continue doubling in each subsequent cycle, leading to significant growth over a 10-year period.

-

- 5 Cycles of Doubling: Over five cycles, this approach is expected to yield a 32X equity multiple on the initial investment, a stark contrast to traditional investment models which create linear growth.

- 5 Cycles of Doubling: Over five cycles, this approach is expected to yield a 32X equity multiple on the initial investment, a stark contrast to traditional investment models which create linear growth.

The peak velocity of wealth development occurs during the development phase of a development project or during the renovation/stabilization phase of a value add project.

Tax Efficiency in the 10Y Model

The 10Y model is distinguished not only by its investment strategy but also by its tax efficiency, which is a critical aspect for optimizing investor returns. This efficiency is achieved through several key mechanisms:

-

- Depreciation Benefits: The model takes advantage of the depreciation of properties within the portfolio. Depreciation serves as a non-cash expense that reduces taxable income, effectively lowering the overall tax liability for the investment. In the 10Y model, this benefit is strategically used to offset capital gains from property sales, potentially resulting in tax-free sale proceeds in each Deal Cycle.

-

- Diversification Across Properties: By spreading investments over multiple properties, the 10Y model not only diversifies risk but also maximizes the potential for depreciation benefits. Different properties may have different depreciation schedules and rates, allowing for a more nuanced and beneficial tax strategy.

-

- Tax Optimized Deal Cycles: Each cycle of investment and exit in the 10Y model is optimized for tax efficiency. This means that the timing of acquisitions and sales is considered not just from a market perspective but also from a tax perspective, ensuring that the tax implications are minimized and the after-tax returns are maximized.

Risk Management in the 10Y Model

Risk mitigation is a critical component of any investment strategy, particularly in real estate. The 10Y model addresses this through a multifaceted approach:

-

- Diversified Investments Across Various Properties: The 10Y model spreads investments across multiple properties. This diversification means that the performance of the fund isn’t reliant on a single property or market. By investing in various multifamily projects, both Value-Add and Ground-Up Construction, the model spreads risk and capitalizes on different market dynamics.

-

- Thorough Market Analysis: Before investing, each project undergoes an extensive market analysis. This includes examining factors like population growth, economic performance, job growth, and demand for rental housing. For example, the 10Y model focuses on areas like the Phoenix MSA, which has been ranked as the fastest-growing large city in the U.S. and shows strong economic performance and job growth. This careful selection of markets and properties ensures that investments are made in areas with strong fundamentals, reducing the risk of market downturns.

-

- Sensitivity Analysis of Return Outcomes: The 10Y model includes a sensitivity analysis that projects various exit scenarios based on ideal, reasonable, conservative, and pessimistic outcomes. This analysis helps investors understand the range of potential returns and timelines, allowing for a more informed investment decision.

-

- Profit Distributions that Favor the Investors: This aspect of the 10Y model ensures that the general partner (GP) shares in profits only after limited partners (LPs) get 100% of their money back. This aligns the interests of the GP with the LPs and adds an additional layer of security for investors.

-

- Investment Options Tailored to Risk Tolerance: In addition to these risk management strategies, the 10Y model provides two investment classes designed to cater to individual investor risk profiles:

-

- Class A – Conservative Option: Focused on capital preservation, this option aims for a full capital return by the end of Cycle 2, followed by a conservative yield leading to a 25X projected equity multiple at Cycle 5.

- Class B – Max Option: Geared towards maximum growth, this option seeks to maximize yields through the investment period, targeting a 32X projected equity multiple at Cycle 5.

-

- Investment Options Tailored to Risk Tolerance: In addition to these risk management strategies, the 10Y model provides two investment classes designed to cater to individual investor risk profiles:

Ideal Investors for the 10Y Model

The 10Y model is particularly suitable for investors seeking rapid wealth growth and those who prefer a more aggressive approach to investment. It’s an excellent fit for professionals like physicians, who often have limited time for hands-on investment management but are looking for substantial, efficient wealth growth to achieve early retirement or financial freedom.

The 10Y Exponential Wealth Multiplier Fund offers a groundbreaking approach to real estate investing. By combining accelerated wealth generation, strategic reinvestment, and diversified risk management, it opens up new possibilities for investors. This innovative model is not just about investing in real estate; it’s about reshaping your financial future and achieving your goals on an expedited timeline.

How Much Do You Need To Invest In Our 10-Year Fund Today To Be Able To Retire In 10 Years?

Here’s a simple computation:

-

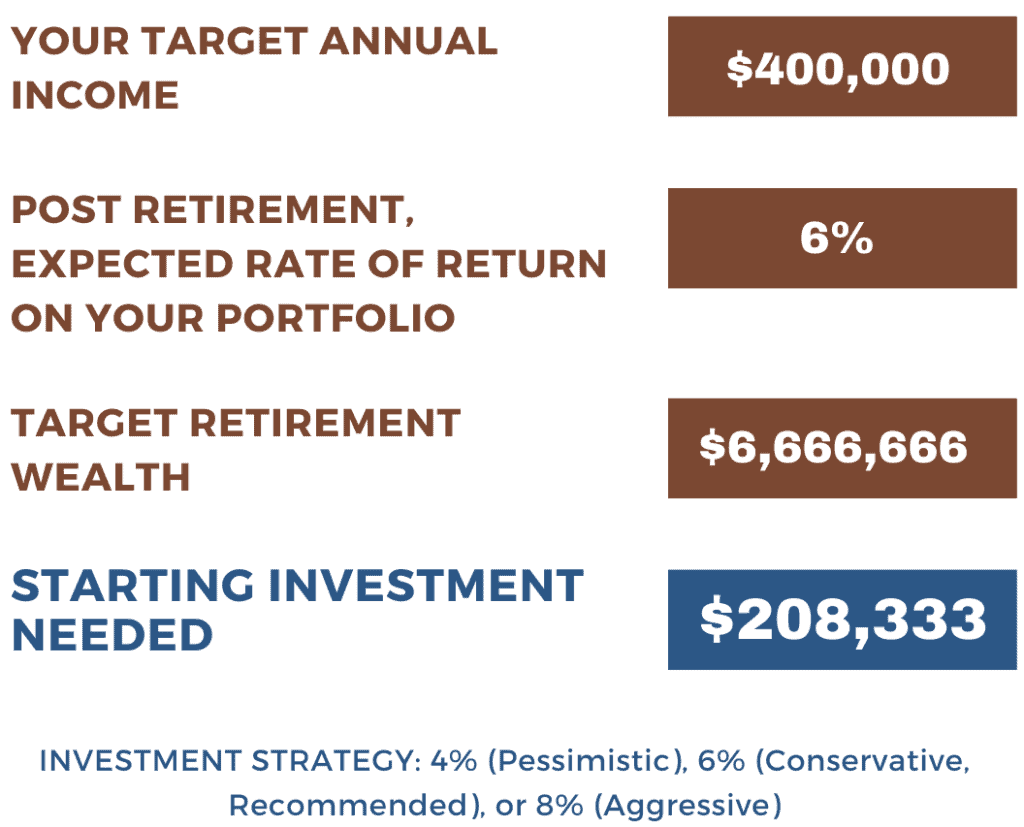

- Decide how much annual income you want to have at retirement. In the example below, we use $400,000 annual income after retirement.

- Divide this by your expected rate of return on your portfolio. (We recommend 6% to be conservative). This will give you the amount that you will need in your retirement account at the time of retirement.

- Now divide this by your expected equity multiple, 32 for 10Y, and approximately 2 for the stock market.

With 10Y you only need to invest $208,333 TODAY to RETIRE IN 10 YEARS with $400,000 of annual income! If you are investing in the stock market with a 7% annual return rather than 10Y, you will need to invest about $3.3 million total to achieve the same result.

That’s the power of compounding growth combined with time efficient capture of the high velocity portion of real estate growth.

If you’re ready to redefine what’s possible in a decade, to transform your tomorrow with strategic, informed decisions today, then the 10Y model is waiting for you. Let’s embark on this journey together – schedule a call TODAY!