Multifamily real estate is a resilient asset, especially during economic uncertainty. Despite the global financial crisis of 2008 characterized by plummeting housing prices and foreclosures, multifamily properties thrived. Let’s explore the reasons behind their enduring strength.

The Global Financial Crisis of 2008

The 2008 financial crisis was caused by the collapse of the subprime mortgage market in the US, leading to widespread job losses, bank failures, and a sharp decline in housing prices. Many homeowners were forced to foreclose, and financial markets experienced unprecedented volatility.

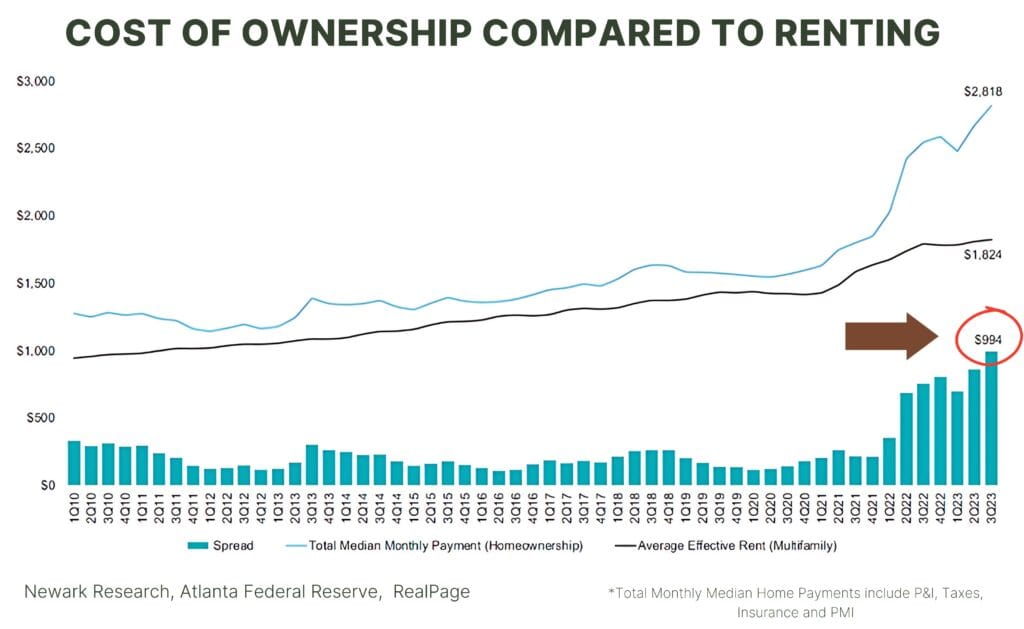

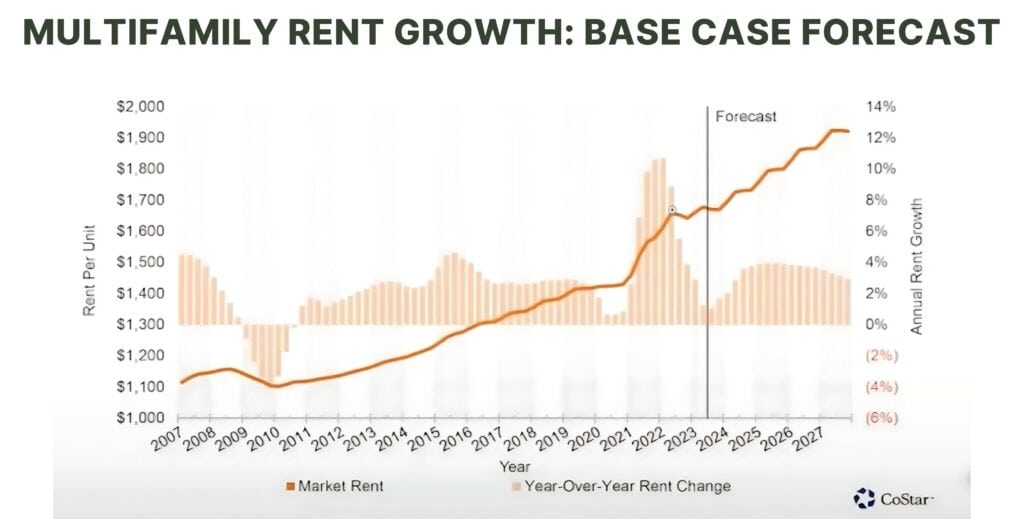

Unlike single-family homes, which experienced steep declines in value and high foreclosure rates, multifamily properties demonstrated remarkable resilience. The demand for rental housing surged as individuals, faced with job losses and financial uncertainty, opted for the flexibility and affordability of renting over homeownership. This surge in demand bolstered occupancy rates and rental incomes for multifamily properties, mitigating the impact of the broader economic downturn.

Reasons Behind Multifamily’s Resilience

- Demand for Rental Housing: Economic downturns often lead to increased demand for rental housing as individuals prioritize affordability and flexibility. Multifamily properties are well-positioned to capitalize on this demand, providing stable cash flow and occupancy levels even during challenging economic times.

- Cash Flow Predictability: Unlike other investment assets prone to volatility, such as stocks and commodities, multifamily real estate offers a steady stream of rental income. The predictable cash flow generated by rental payments provides investors with a reliable source of revenue.

- Diversification and Stability: Multifamily properties offer investors diversification benefits, with income derived from multiple rental units spread across different tenants. This diversification helps reduce risk and volatility, making multifamily real estate a resilient investment option.

- Essential Service: Housing is a fundamental human need. During economic downturns, the demand for housing remains relatively constant, ensuring that multifamily properties continue to serve a critical societal function and maintain their value as investment assets.

- Adaptive Management Strategies: Successful multifamily property owners and managers employ adaptive management strategies to optimize property performance and mitigate risk. For example, at properties like Regattain San Antonio, additional income streams include pet rental, fenced private yard, valet trash services, washer/dryer rentals, reserved parking, covered parking, bulk Internet, package lockers, and storage.

The resilience of multifamily real estate during past economic downturns, such as the global financial crisis of 2008, underscores its enduring strength as an investment asset. By providing stable cash flow, diversification benefits, and essential housing services, multifamily properties have proven to be a reliable investment option even in the face of severe economic challenges.