Retirement planning is a critical aspect of financial stability, especially for dedicated professionals like surgeons and medical practitioners. In this blog post, we will explore a practical computation to estimate the investment needed for a comfortable retirement in just 10 years.

The Computation

1. Set Your Annual Income Goal

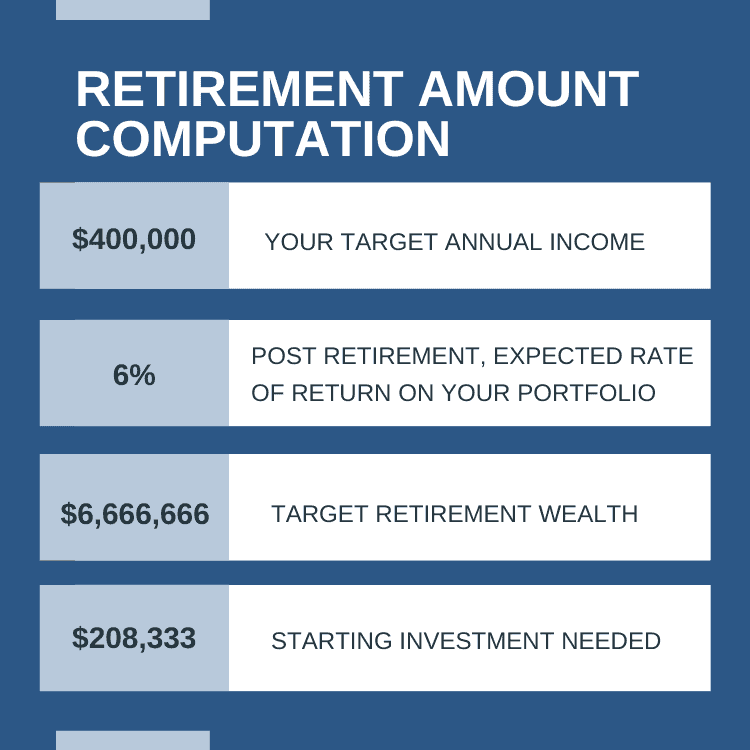

Begin by deciding your annual income goal for retirement. For this example, let’s use $400,000 as the target annual income post-retirement.

2. Determine Your Expected Rate of Return

Opt for a conservative 6% expected rate of return on your investment portfolio to navigate market fluctuations while aiming for steady growth.

3. Calculate the Required Retirement Account Amount

Divide your desired annual income by the expected rate of return. This provides the estimated amount needed in your retirement account at the time of retirement.

4. Adjust for the Investment Horizon

As we plan to retire in 10 years, adjust the calculated amount by dividing it by the expected equity multiple. Use 32 for the 10Y Fund which is a unique investment opportunity you’ll be introduced to below or approximately 2 for the stock market.

Using the provided information, let’s consider a target annual retirement income of $400,000. This computation estimates the target amount required in your retirement account after 10 years:

$400,000 ÷ 6% = $6.66M

$6.66M ÷ 32 = $208,333

INVESTMENT STRATEGY: 4% (Pessimistic), 6% (Conservative, Recommended), or 8% (Aggressive)

If the 10Y Fund hits its projected returns, you only need to invest $208,333 today to retire in 10 years with a remarkable $400,000 of annual income. This contrasts sharply with traditional stock market investments, where you would need to invest about $3.3 million to achieve the same result with a 7% annual return.

Real Estate Investment Opportunity

While traditional investment options like stocks and bonds are common, real estate presents a compelling opportunity for surgeons and medical practitioners looking to retire in 10 years. Real estate has historically provided solid returns and can act as a stable income stream during retirement.

To further enhance your retirement strategy, consider diversifying your investment portfolio with opportunities like the 10Y Exponential Wealth Multiplier Fund. This fund is designed to align with your financial goals and offer a secure path to retirement, focusing on Multifamily Assets through Value-Add and Ground-Up Construction projects. This approach provides the following advantages:

- Diversification

The fund spreads investments across multiple properties, mitigating risks associated with a single property investment. - Tax Benefits

By leveraging depreciation benefits from held properties to offset capital gains, the fund seeks to optimize tax implications, potentially resulting in reduced or tax-efficient sale proceeds in each Deal Cycle. - Impressive Returns

A $300,000 investment in the 10Y Fund is projected to yield a remarkable $9.6 million in 10-12 years, thanks to a 2x equity multiple for each of 5 cycles.

Retiring in 10 years is an ambitious but achievable goal with careful financial planning. By understanding the key components of the computation outlined above, you can take confident steps towards a financially secure retirement. While we can’t guarantee any particular outcome, five consecutive cycles doubling investor money with each cycle could potentially yield the outcome described above.

Remember, it’s never too early to start planning for the future, and the right investments can make all the difference.